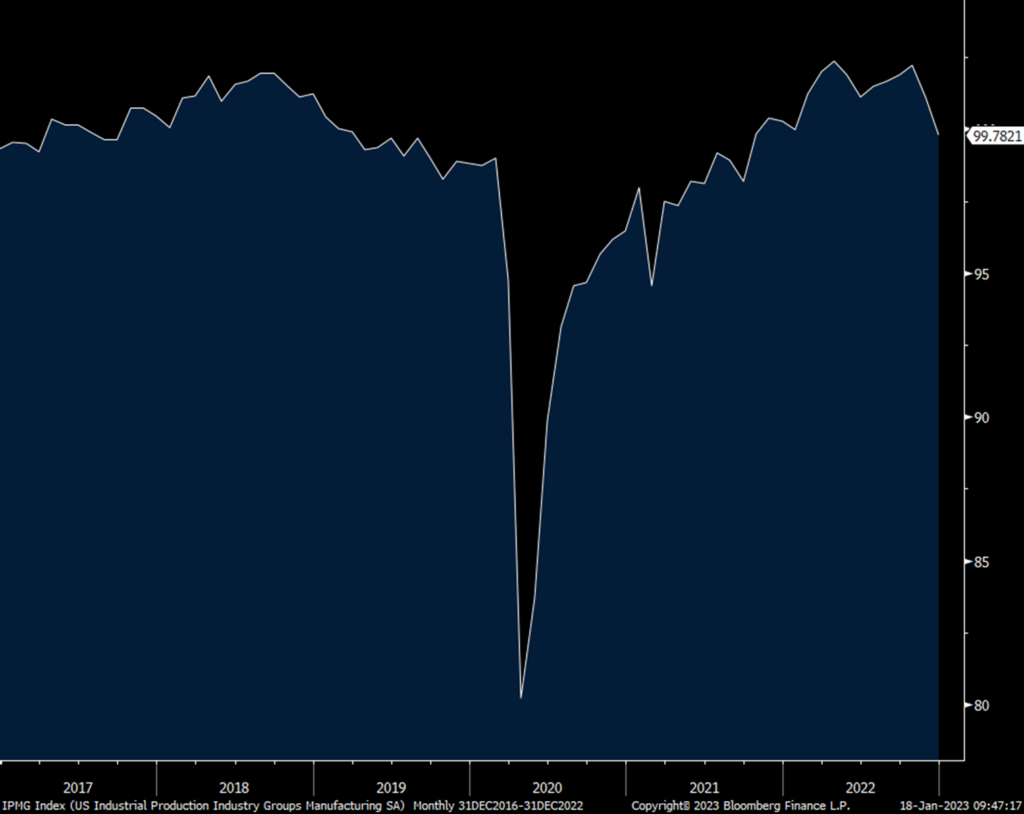

The string of disappointing US data points (ISM mfr’g, services, NY mfr’g, retail sales, housing, autos and NFIB) continued with a 7 tenths m/o/m drop in December for industrial production and November was revised down by 4 tenths. Manufacturing softness led the way (confirming the weakness in other mfr’g data) with a 1.3% m/o/m drop, well worse than the expected down .2%. November was revised lower by 5 tenths. The weakness in manufacturing production was across the board and the index itself fell to the lowest level since September 2021. The only thing keeping IP from coming in worse was the 3.8% increase in utility output in the month. Mining production fell for a 2nd month.

With respect to capacity utilization, it fell to the lowest since December 2021 and the manufacturing component saw this stat at the weakest since September 2021.

Manufacturing IP

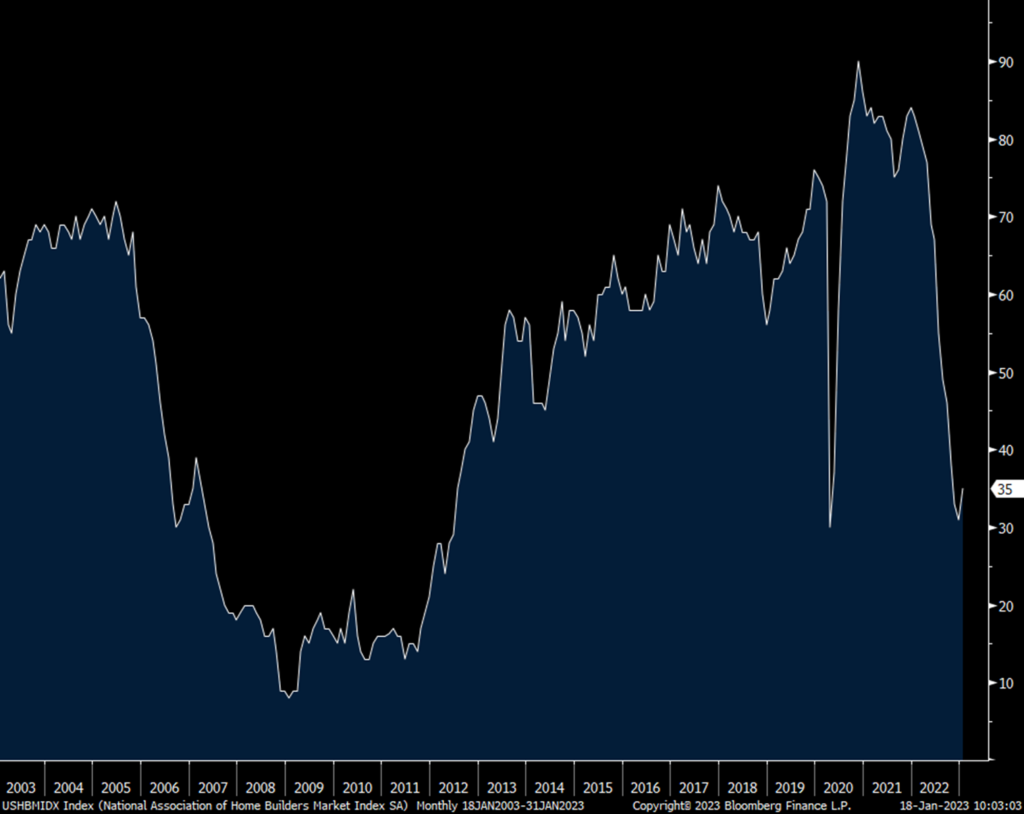

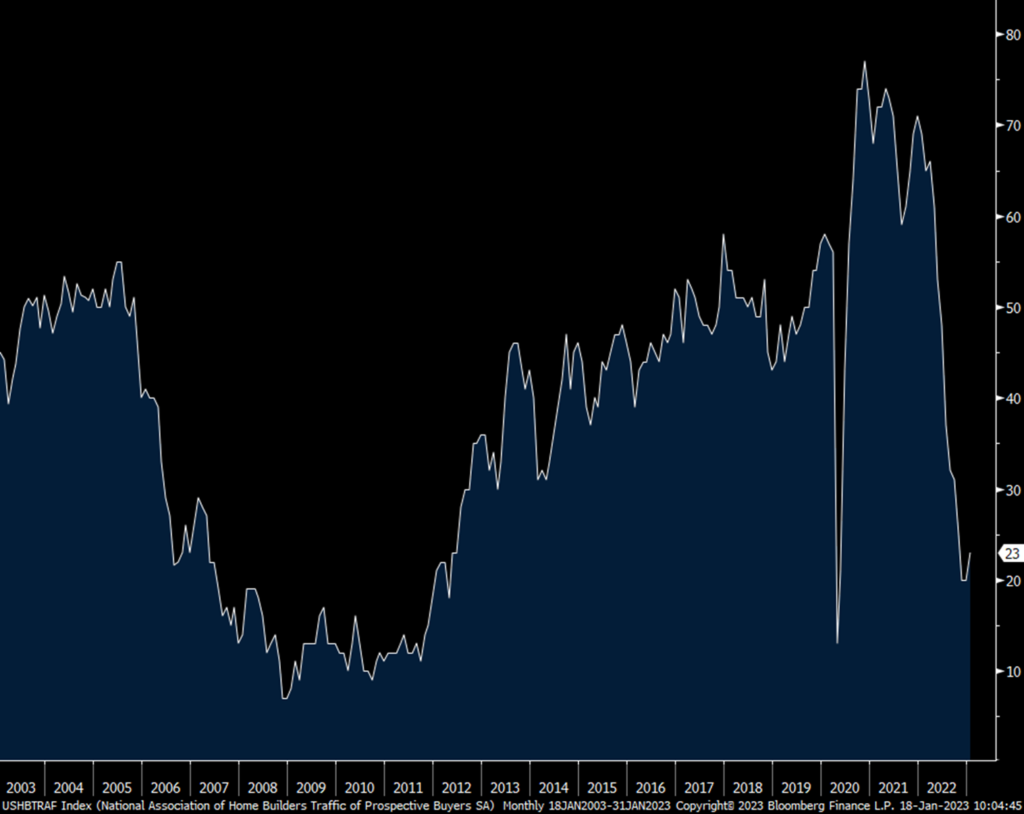

After falling in all 12 months of 2022 by a total of 53 pts to 31, the NAHB home builder sentiment survey rose 4 pts in January to 35, thus remaining well below the 50 breakeven between expansion and contraction. Present conditions rose by 4 pts while the outlook was up by 2 pts. Prospective Buyers Traffic remained very low but a bit less so at 23 vs 20 in December.

The bottom line according to the NAHB, notwithstanding the modest uptick in January, is that “sentiment remains in bearish territory as builders continue to grapple with elevated construction costs, building material supply chain disruptions and challenging affordability conditions.” In order to move product, “many builders continue to use a variety of incentives, including price reductions, to bolster sales.” Hopes are also apparent that mortgage rates have peaked and if the case, sales should stabilize but at current much softer levels. The key for 2023 remains to what extent do home prices fall in order to bring back more buyers, particularly the first time buyers who are struggling the most with affordability.

NAHB

Prospective Buyers Traffic

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.