Over the past two days on CNBC we’ve heard from the CEO’s of Marriott, Hyatt, Hilton and Loews. The tone was very positive from all, particularly with regards to leisure travel. The Marriott CEO yesterday on Squawk Box said “if there are any questions about the resilience of travel, those have been answered over the last couple of years…It’s across every segment and every part of the world.” He did say though specifically with luxury that the strong rate trends of 2022 have moderated a bit this year. The Hyatt CEO this morning said that leisure travel is trending about 30% above 2019 levels, that group travel is looking good for the summer but business travel, while still improving, is more uncertain as it trends still below 2019 levels. He said that small and medium sized business employees are back on the road more so than those from large companies.

Sara Eisen interviewed the CEO of Hilton Chris Nassetta also yesterday and who said he’s “not so far” seeing any signs of a travel slowdown. He said leisure, business (also being led by small and medium sized business employees he said and where revenue is just above 2019 levels) and meetings/events (pent up demand with planning seen for 2024 and 2025) are all strong notwithstanding signs of slowing economic growth he pointed out. He was optimistic about international travel which is still lagging the recovery (inbound to the US just 60% of pre-Covid levels), particularly out of China (outbound is just 10% of pre-Covid).

Nassetta also pointed out something really important and something I coincidentally read about yesterday from Reuters but having been watching for signs of this post SVB. He mentioned the lack of development that will limit the amount of supply of hotels in the coming years. Here was the title of the article from Reuters, “US Hotel Developers Run Out of Cash as Construction Lending Dries Up.” The article said “Hotel developers, private equity firms, and general contractors told Reuters the financial stress on regional banks – the largest lenders to hotels and other CRE markets – has forced developers to postpone projects or find other creative ways to raise capital.”

The piece highlighted that post SVB’s failure a California developer paused construction on a 21 story hotel and casino in Vegas as they were trying to “secure more funding.” Notably, “Since March, 59 of the 98 total US hotel projects that broke ground or were in the pre-construction phase this year have been paused, according to previously unreported data shared with Reuters by Build Central Inc, a subscription based research and analytics firm used by some large hotel brands to gauge market opportunities by location.” I bolded the comment.

From the CIO of MCR Hotels, the 3rd largest US owner-operator of hotel brands, including Hilton, “The regional banks that used to be active for us 9 to 12 months ago are not showing up to finance hotels for us today.”

Yes, private equity is trying to step into the breach but offering 9-10% interest rates does not get a project done vs 4% a few years ago.

Bottom line, the bank credit crunch has only just begun. //www.reuters.com/business/finance/us-hotel-developers-run-out-cash-construction-lending-dries-up-2023-06-05/

Black Knight had a story yesterday on residential real estate titled “Tightening Credit Availability Adds to Affordability Struggles as Rates Remain Elevated, Inventory Shortages Worsen and Home Prices Strengthen.” Their data “showed home sales volumes fell in April, as a lack of both affordability and inventory continue to create major market headwinds.” On inventory, “for-sale inventory is now at its lowest level since April 2022, with inventory deteriorating in 95% of major markets since the start of 2023.” Home prices rose again in April as a result m/o/m, up for a 4th month but are now flat y/o/y which is the first time they haven’t been higher “since the market began to recover in the wake of the GFC.”

We know the home builders are trying to fill the inventory gap but affordability challenges exist there too and why they are still employing incentives.

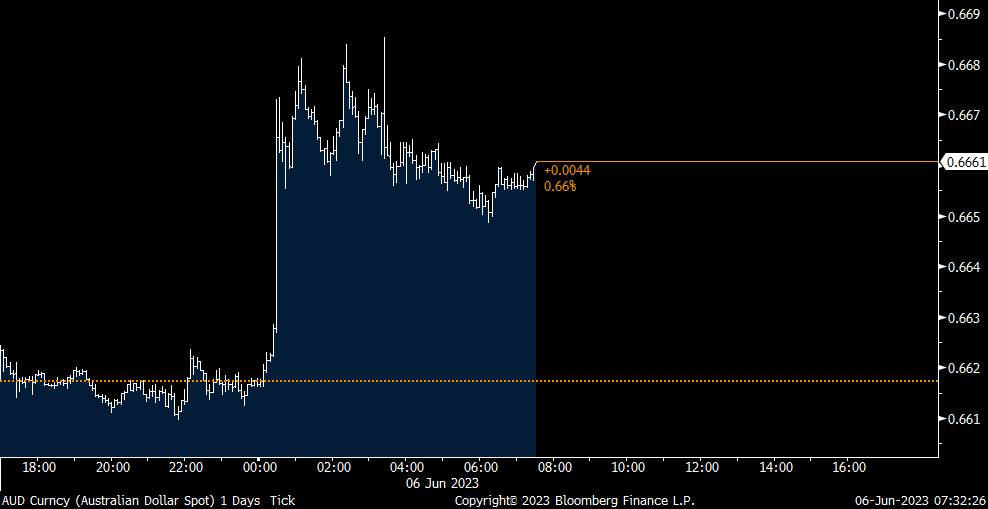

The Reserve Bank of Australia surprised everyone with a 25 bps rate hike to 4.10%. Governor Lowe left open the door for more, “Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable time frame, but that will depend upon how the economy and inflation evolve.” He seemed to be honing in on rising labor costs as the impetus for the hike with labor productivity little changed, “unit labor costs are also rising briskly, with productivity growth remaining subdued…The Board remains alert to the risk that expectations of ongoing high inflation contribute to larger increases in both prices and wages, especially given the limited spare capacity in the economy and the still very low rate of unemployment.” The Aussie$ is rallying by .6% to a 3 week high and yields are higher too. The ASX fell 1.2%.

Intraday Aussie$ move

Base pay did improve in Japan in April, rising by 1.1% y/o/y, a 4 month best but still running well below the rate of inflation which is around 4%. The BoJ is closing in again on some very tough decision making as they try to balance inflation rising twice their target at the same time the Japanese government needs continued low rates to finance their huge financing needs.

Singapore’s May PMI fell to 54.5 from 55.3 and vs 52.6 in March. S&P Global said “Underpinning the latest private sector expansion was a sustained improvement in new orders. Demand for Singaporean goods and services continued the streak of growth that began since the start of 2023, further rising at the fastest rate since last November on the back of better underlying demand and increased consumer spending.” The caveat, “Business confidence across the private sector remained relatively subdued, however, reflecting historically sharp cost pressures.” We remain bullish and long Singaporean stocks.

Germany factory orders fell .4% m/o/m in April, well below the estimate of up 2.8%. They are lower by 10% y/o/y. Foreign orders and those to the rest of the Eurozone fell but did rise domestically after the sharp drop in March. The world is in a manufacturing recession and that is felt most acutely in Germany.

END

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.