Ahead of Thursday’s CPI report, Manheim reported its used car wholesale index yesterday for December. Seasonally adjusted it rose by .8% but is still lower by 15% y/o/y. And, non-seasonally adjusted saw a drop of 1.9% m/o/m. They also estimated used car sales in December by looking at data from Dealertrack and “we initially estimate that used retail sales declined 7% in December from November and that used retail sales were down 10% y/o/y, which was the same as November’s performance.”

While not nearly as big in terms of dollars, there are similarities to what is going on with autos right now and what happened with homes in 2007-2009. Because of the extraordinary prices many paid for used cars over the past few years, there are a lot of debt on these cars that far exceed the value of them. That is leading to a rise in repossessions. And, we know what’s happened to the used car vendors who paid very high prices for inventory over the past few years that are now worth much less.

It was last week that the NY AG announced that along with the US Consumer Financial Protection Bureau, they are suing Credit Acceptance Corp, the large auto lender “claiming it tricked low-income borrowers into high cost loans that exceed interest rate caps, resulting in a debt spiral for borrowers. Notably, the complaint also claimed the company engaged in fraudulent practices and misleading investors in about $7.4b worth of its subprime auto loans packaged into ABS deals from 2015 to 2021” according to the WSJ. Something important to watch this year for the entire industry.

Speaking of housing, yesterday too Fannie Mae released its monthly Home Purchase Sentiment Index and it rose 3.7 pts m/o/m to 61 in December “but the index remains only slightly above its all time low set in October.” Of the survey’s 6 components, 3 rose, that being home buying conditions, mortgage rate outlook and job security.” Because of a still challenging affordability situation, just 21% said it’s a good time to buy.” So, in 2023 we’re still going to have the faltering demand side because of high prices and costly funding and on the supply side people that don’t want to give up their low mortgage rate.

Also out yesterday was the December NY Fed’s Consumer Expectations Survey. Inflation expectations moderated by .2% m/o/m to 5% and that is the least since July 2021 while 3 yr expectations were unchanged at 3% and 5 yr rose one tenth to 2.4%. Expectations for gas, food, rent and education prices all slipped but rose slightly for medical care. To highlight again the earnings calls I heard last week from Conagra and MSC Industrial Direct, price pressures are slowing but they still remain glaring and while by yr end we might print a below 2% inflation rate y/o/y, I still believe in 2024 it settles out at 3-4% rather than the 1-2% pace seen pre Covid.

Home price expectations did rise but they remain near zero at 1.3%. On the labor market front, there were some conflicting stats. Unemployment expectations fell but “the mean perceived probability of losing one’s job in the next 12 months increased by .9 percentage point to 12.6%, its highest reading since November 2021. Earnings expectations rose slightly as did access to credit but on the former, “the share of households reporting it is harder to obtain credit than one year ago remains near its series high.”

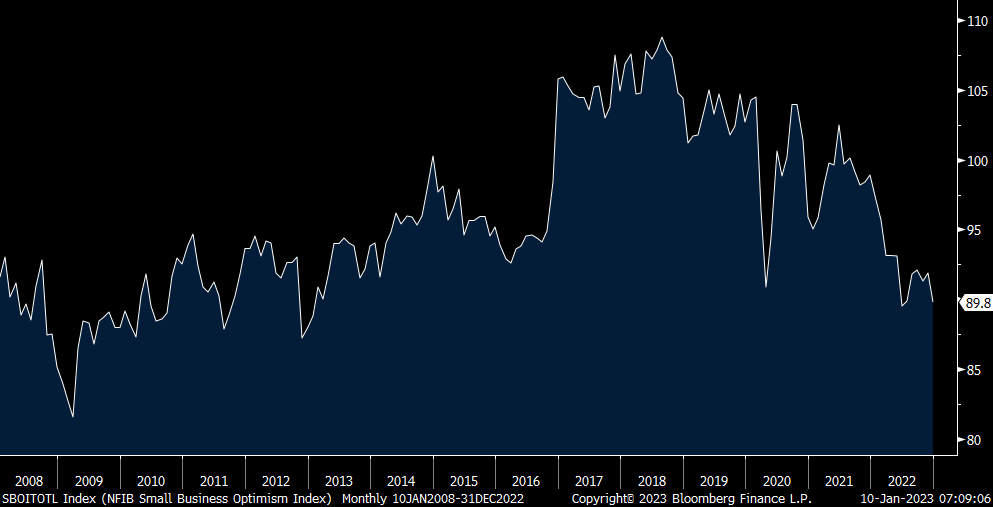

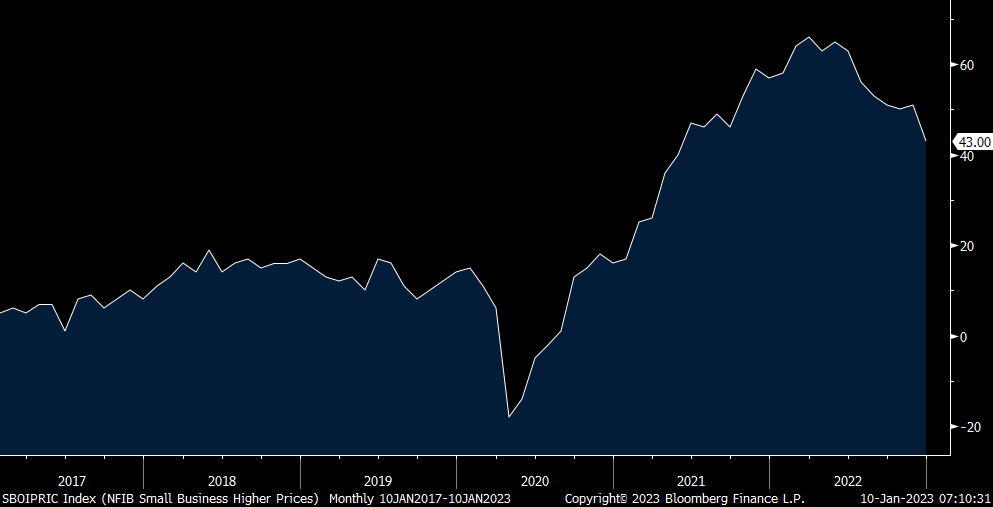

The NFIB December small business optimism index dropped to 89.8 from 91.9 and that is the lowest since June 2022 and a hair from the weakest since 2013. Plans to Hire fell 1 pt and those implementing Higher Selling Prices was down a notable 8 pts to 43%, the lowest since May 2021 but still is historically high. Job openings were down by 3 pts but current compensation plans rose 4 pts after falling by a like amount in November. Future comp plans were down by 1 pt. Of note, those that Expect a Better Economy was down by 8 pts to the weakest in 5 months and near a record low. Those that said it’s a Good Time to Expand and those that are Expecting Higher Sales also declined. Capital spending plans were unchanged at below zero at -4%. Tighter credit conditions were seen here to the greatest extent since January 2013. Finally and ahead of the flood of earnings reports, the earnings outlook softened by 8 pts after rising by 8 pts last month.

The NFIB chief economist said “Overall, small business owners are not optimistic about 2023 as sales and business conditions are expected to deteriorate. Owners are managing several economic uncertainties and persistent inflation and they continue to make business and operational changes to compensate.”

More on inflation and the stickiness of it, notwithstanding the slowing trend, “Owners continue to call inflation their top business problem, lamenting the cost increases for their inputs (inventory, supplies, labor, energy, etc.) which compel them to raise their selling prices to cover the costs.”

NFIB

Higher Selling Prices

Prices keep rising in Japan as measured by the Tokyo December CPI (a precursor to the national report) as headline inflation rose 4% y/o/y as expected and by the same amount ex food which was 2 tenths above the estimate. Taking out both food and energy saw prices up 2.7% as forecasted but that is the biggest increase since 1992 if we take out the influence of VAT hikes. The headline rise is the most in 40 years.

I’ll highlight again my concern that what happens with BoJ policy when Kuroda leaves and the direction of the JGB market will have major spillover effects to other global bond markets this year. The 10 yr JGB yield is now approaching .51% and the 40 yr JGB yield traded higher by almost 6 bps to 1.96%, the highest since 2013. European and US bonds are trading off in sympathy.

Tokyo CPI y/o/y

40 yr JGB Yield

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.