Here are some notable quotes from two companies that had earnings conference calls yesterday which coincidentally we happen to own stock in both of them, MSC Industrial Direct and Conagra.

MSM (a great proxy for US manufacturing):

“Turning to the external environment. The picture remains similar to last quarter with sentiment readings declining and IP readings moderating. The majority of our customers are seeing stable order levels, demand and general activity. We are hearing though continued talks of softening among a portion of our customers. More recently, we experienced a higher prevalence of extended holiday shutdowns along with weather disruptions during the 2nd half of December…this resulted in a strong start to the month, but a slow finish as activity saw a sharper decline than in the last two weeks of prior year.”

“Looking forward, we continue to see new cost increases from our suppliers, although not at the fast and furious pace of last year. As a result, we anticipate taking a small pricing adjustment within the next month…the reality of the situation is that there’s still inflation. And while it is definitely moderating, there’s still inflation and there is still cost increases as evidenced by the fact that, yes, we’re still seeing suppliers coming to us with increases.”

CAG reported a 17% increase in price/mix and an 8.4% decrease in volume. “Price/mix was driven by the company’s inflation driven pricing actions that were reflected in the marketplace throughout the quarter. The volume decrease was primarily a result of the elasticity impact from inflation-driven pricing actions; however, the elasticity impact was favorable to expectations.”

“inflation has begun to moderate in certain areas, enabling our inflation justified pricing actions to catch up to the rising costs…Of course, inflation remains elevated in many areas, and we continue to closely monitor our cost, just as we have in the past. We will continue to take appropriate inflation justified pricing actions as needed…We expect gross inflation to continue, but moderate through the remainder of the fiscal year, resulting in an inflation rate of approximately 10% for fiscal ’23.

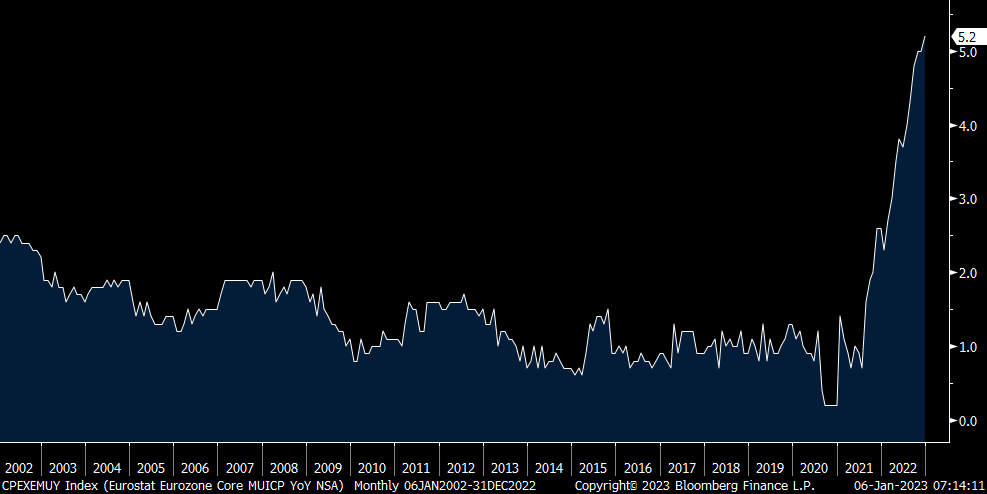

In the Eurozone, December headline CPI fell .3% m/o/m, more than the forecast of down .1%. The y/o/y gain slowed to 9.2% from 10.1%, 3 tenths below the estimate. The core rate though accelerated to 5.2% y/o/y vs 5% in November and that was one tenth more than anticipated. While energy prices are definitely falling and helping in the moderation in headline inflation, energy price caps in many European countries are helping to. That said, core inflation continues to rise.

The ECB does plan to keep on hiking and QT starts in a few months. Today Mario Centeno, an ECB governing council member, said “Interest rates will rise until the moment when we consider that the inflation profile is sufficiently robust to as quickly as possible bring inflation to 2%. We can’t hesitate on the path. In our opinion, inflation is more negative for the economy than this process of normalizing interest rates.”

The persistence in the core rate offset the headline drop in keeping the 5 yr 5 yr euro inflation swap unchanged today in response at 2.35%. Sovereign bond yields are down 1-2 bps while the euro is lower and the Euro STOXX 600 is up a hair but has started the year off nicely. Parts of Europe, particularly Germany, will be a big beneficiary of China’s reopening.

Until that full reopening though, Germany said November factory orders dropped by 5.3% m/o/m, well worse than the estimate of down .5%. The Economy Ministry said that “industry is going through a difficult winter, even though companies’ business expectations have improved recently.” Retail sales in Germany slightly missed the forecast.

Core CPI in the Eurozone

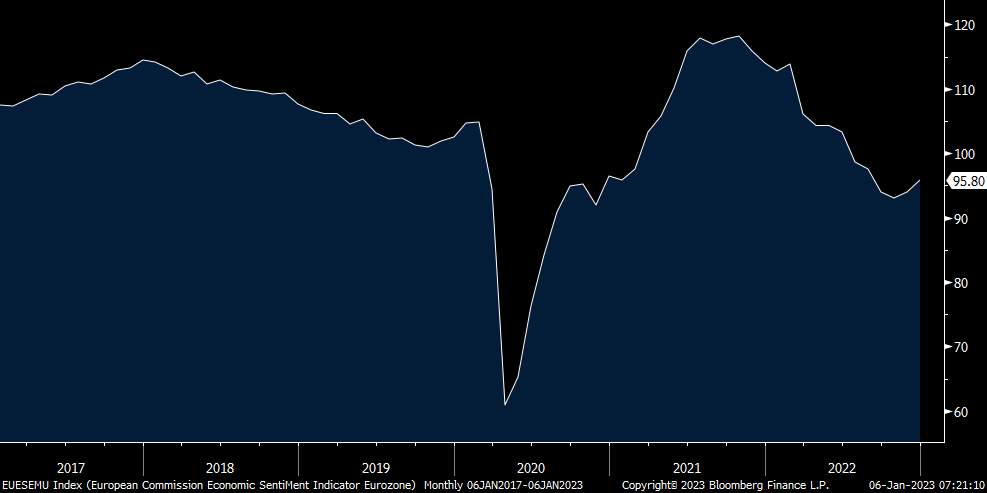

For all of the Eurozone, the December Economic Confidence index rose to 95.8 from 94 and that was 1 pt better than expected. All 5 of the internal confidence components rose m/o/m, that being manufacturing, services, consumer, retail and construction.

Economic Confidence

With respect to the BoJ who claimed that they widened yield curve control because they wanted to improve market functioning even though they ramped up QE which further damages market functioning, Bloomberg is reporting that “Bank of Japan officials see little need to rush to make another big move to improve bond market functioning, and the BoJ should assess the impact of last month’s yield adjustments for now, according to people familiar with the matter.” The yen is falling in response. The 10 yr JGB yield closed right at .50% for the first time since July 2015, up a large 7 bps, as the market continues to test the BoJ’s policy stance. The Japanese bond market is going to be a big story this year I believe with major ramifications for other bond markets.

Japan also reported modest wage gains in November at the same time inflation continues to rise, further lowering REAL earnings to -3.8%. Thankfully BoJ governor Kuroda is leaving in April but it remains to be seen whether policy will change thereafter.

JGB 10 yr Yield

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.