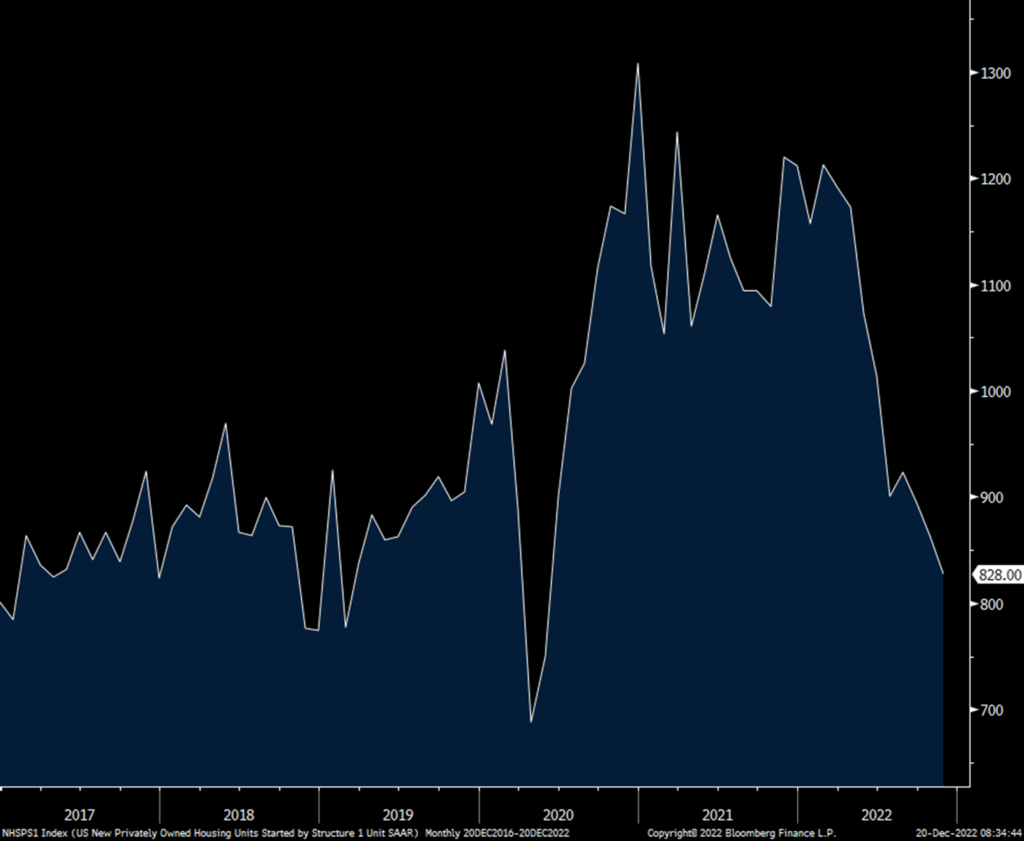

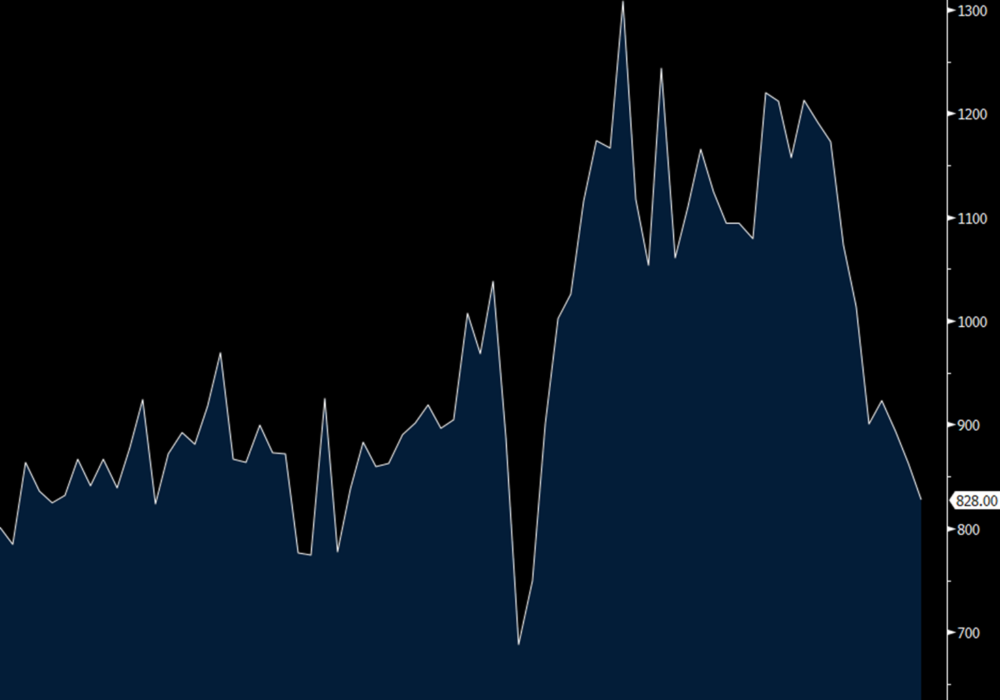

November housing starts totaled 1.427mm, just above the estimate of 1.40mm but down slightly from the 1.434mm seen in October (revised up from 1.425mm). The mix again is what we need to focus on as single family starts fell by 33k m/o/m to 828k, the lowest since May 2020. Multi family remains where the building strength is (for now, see permit figure below) as supply continues to catch up with demand. Multi family starts rose to 599k from 571k and that is the most since April.

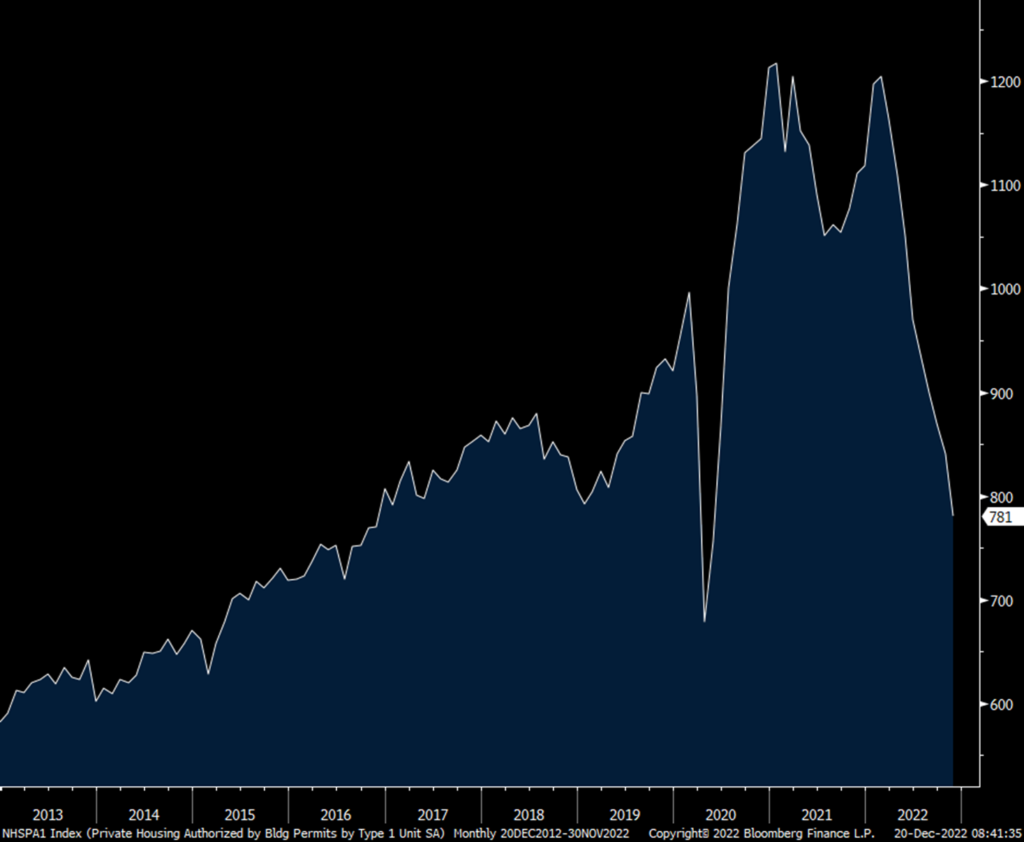

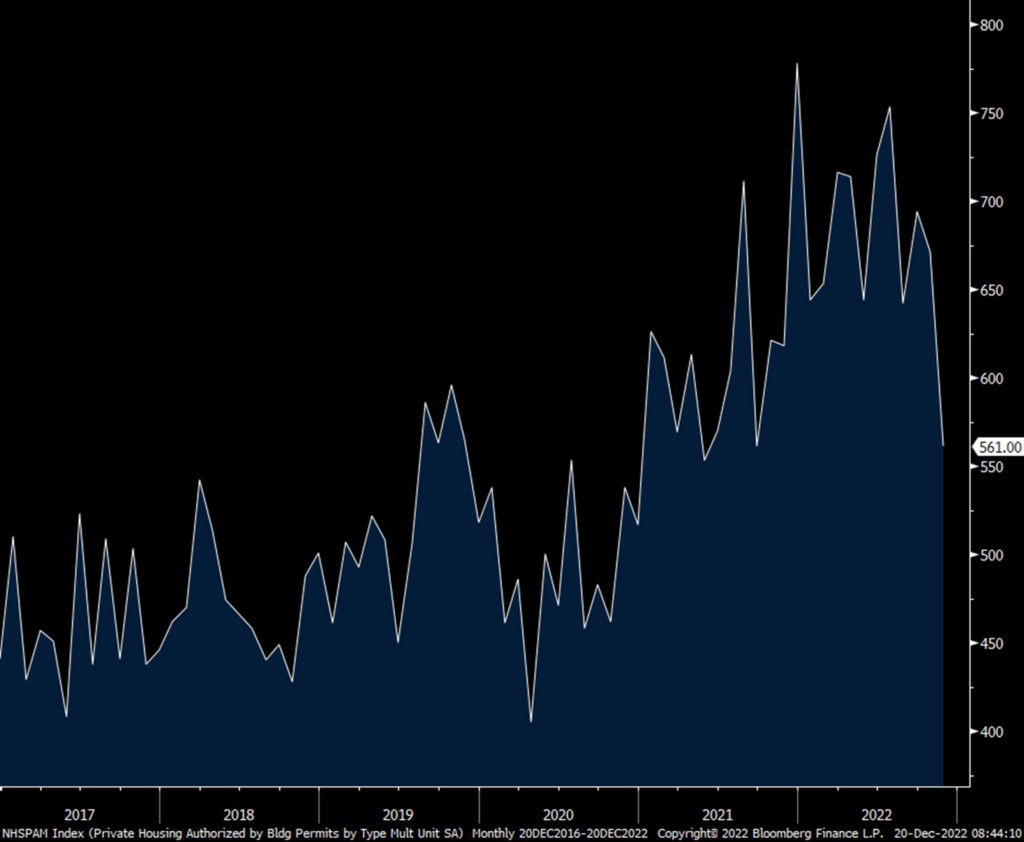

Permits are key here too as starts dropped to 781k, down 60k m/o/m. That’s the lowest since 2016 if we don’t include covid. Permits for multi family fell too, down by a large 110k to 561k and that is the least since last summer. I have been hearing anecdotal stories of multi family projects getting canceled because the numbers no longer work with the still elevated cost of construction, the sharp rise in funding rates and the slowing pace of rent growth.

Bottom line, in this VERY interest rate sensitive sector and with a very low savings rate, the cost of money is almost everything.

Single Family Starts

Single Family Permits

Multi Family Permits

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.