The European bond market selloff is continuing today. The Italian 2 yr is up another 12 bps and by 52 bps on the week. The 10 yr yield is higher by 19 bps after the 30 bps jump yesterday and also up by 52 bps this week. German yields are up by 25-30 bps this week to 14 year highs. The 10 yr spread between the two is wider by another 9 bps and by 27 bps this week. So Mario Draghi blew an epic bond bubble via negative rate policy and Lagarde is now popping it. US yields are higher in sympathy.

Many are pretty confident on where the US 10 yr yield is going from here based on their US growth and inflation forecasts but I remain highly uncertain because of the influence of European, Japanese bond markets and how the US market handles not just this but the massive supply coming to finance what will be huge budget deficits at the same time the market continues to lose buyers. I’m much more certain that the 2 yr Treasury and short term TIPS are buys.

I again want to highlight the need to watch the S&P LSTA leveraged loan index because of its floating rate borrower constituency. Also, I saw a stat from UBS that 75% of companies in this index have no higher than a B credit rating with many CCC’s too, the bottom ends of the high yield grouping. This index yesterday closed just off the lowest level in 5 weeks and hasn’t really bounced much off its July lows.

I’ll add this point again too, there is so much debate on what level of the fed funds rate will be enough to get inflation much lower without understanding that just keeping it higher for longer is itself a form of tightening because any debt coming due in the next year or two will price much higher than when it was initially taken on. And, for those with floating rate debt, the shock rise in interest expense will see no relief anytime soon.

LSTA

We know a home buyer, particularly the first time one, is facing an affordability sticker shock but so are car buyers. Edmonds yesterday gave its end of year lay of the auto land and outlook for 2023. They highlighted that while the average transaction price (ATP) in November 2022 hit a record high of $47,681 (which is not much different than the median income in the US btw), “this was also the first time since July 2021 that the ATP came in below the average MSRP.” That’s a good thing but…

The challenges though are twofold, one for those leasing and the other that want to buy and that’s the all in cost. With leasing, “once a popular option for American consumers, has grown increasingly more expensive as inventory is slow to recover and interest rates remain high. Edmunds data reveals that the average monthly lease payment climbed to $583 in November 2022 compared to $471 in November 2019.” I’ll add, that comes to a 24% increase.

For those wanting to buy, where cheap money and long loan terms helped “Americans buy the bigger, feature heavy vehicles that they love over the past decade…that trend is reversing and consumers are paying more than they ever have to finance new and used vehicles.” Said Edmonds data “from November 2022, the average interest paid over the life of a new car loan climbed to an all time record of $8,436, and the average interest paid over the life of a used car loan climbed to an all time record high of $10,204.”

Combine US housing and auto sectors and we’re talking about 20% of the US economy directly and quickly impacted by the sharp rise in interest rates.

Ahead of the S&P Global US PMI at 9:45am est, we saw some from overseas. Japan’s December composite index rebounded back to exactly 50 from 48.9 led by a rise in services that rose to 51.7 from 50.3 while manufacturing softened a touch and remains below 50. Tourism helped the service side while “manufacturing firms continued to struggle in the face of subdued demand conditions and severe inflationary pressures.” Inflation pressures though did ease.

Australia’s PMI fell to 47.3 from 48 with manufacturing remaining above 50 but services falling further below.

The Eurozone December PMI rose 1 pt to a still below 50 read of 48.8 with both components higher but still under 50. Manufacturing improved slightly led by German “and linked to a combination of improving supply conditions and reduced fears of energy constraints.” With services, the “malaise has also calmed, in part driven by signs of reduced fears over the cost of living squeeze and, in the financial service sector, reduced concerns over the tightening of financial conditions.” On that last point, this was of course taken before yesterday’s ECB move and the subsequent jump in interest rates. Also helping, “the outlook for inflation is especially encouraging, with supply chains now improving for the first time since the pandemic began and firms’ costs growing at a sharply reduced rate, feeding through to lower rates of increase for prices charged for both goods and services.”

The UK PMI rose to 49 from 48.2 with services getting back to 50 offsetting a continued drop in manufacturing to 44.7. This is the 5th month in a row of below 50 prints. “Anecdotal evidence indicated that a weaker overall economic climate and a sustained squeeze on client budgets amid the cost of living crisis and tighter financial conditions had dampened output.”

So these recessionary figures in Europe are coming as their central banks keep tightening monetary policy, the same mix we face here. Fun times.

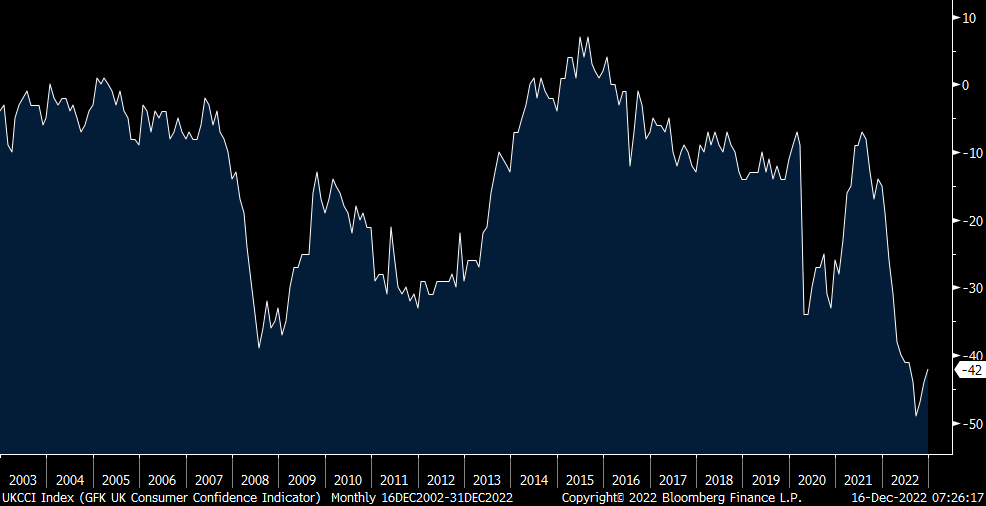

Also in the UK, December consumer confidence improved slightly to a still deeply negative -42 vs -44 in November. The estimate was -43. Retail sales ex fuel oil in November was a bit less than expected if we include the October revision. The cost of living challenges the average UK consumer faces is acute.

UK Consumer Confidence

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.