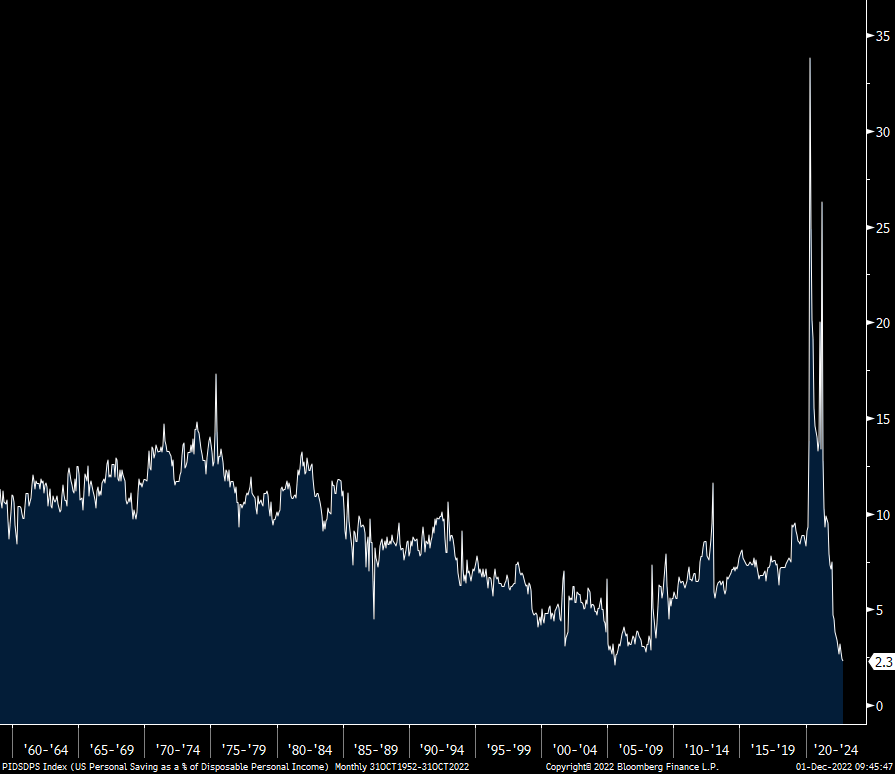

A very important stat I forgot to mention on the 8:30am data was the US personal savings rate which is now down to just 2.3%. The last time I saw something less was 2.1% in July 2005 in data going back to 1959.

The bottom line is easy but unfortunate here, the savings well is running dry and why credit card usage, as mentioned by a few retailers over the past few weeks, is picking up. And this gets to my whole repeated point that it is almost impossible to avoid a recession when the cost of credit goes higher. Just as we need food to live, the US economy for the past 20+ years has needed cheap capital to grow and without a large pool of savings, that was ever more so. Now that savings is depleting and interest rates go higher, how do we not have a recession?

Savings Rate

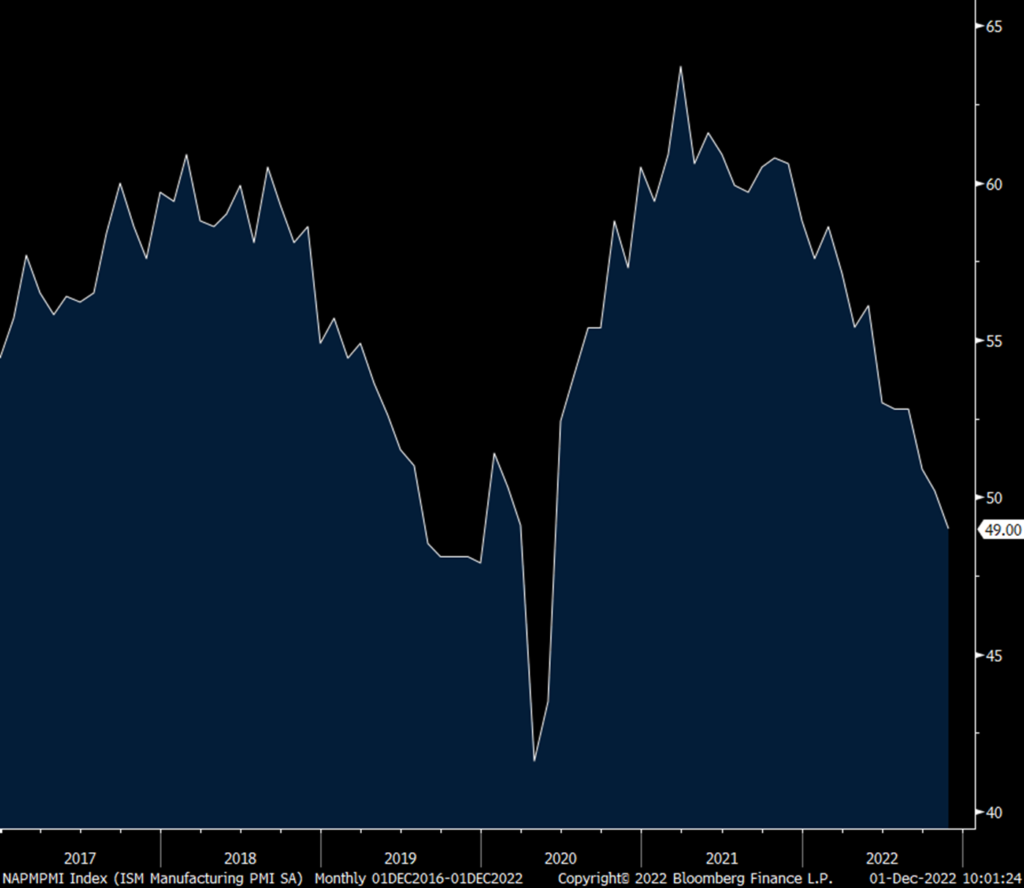

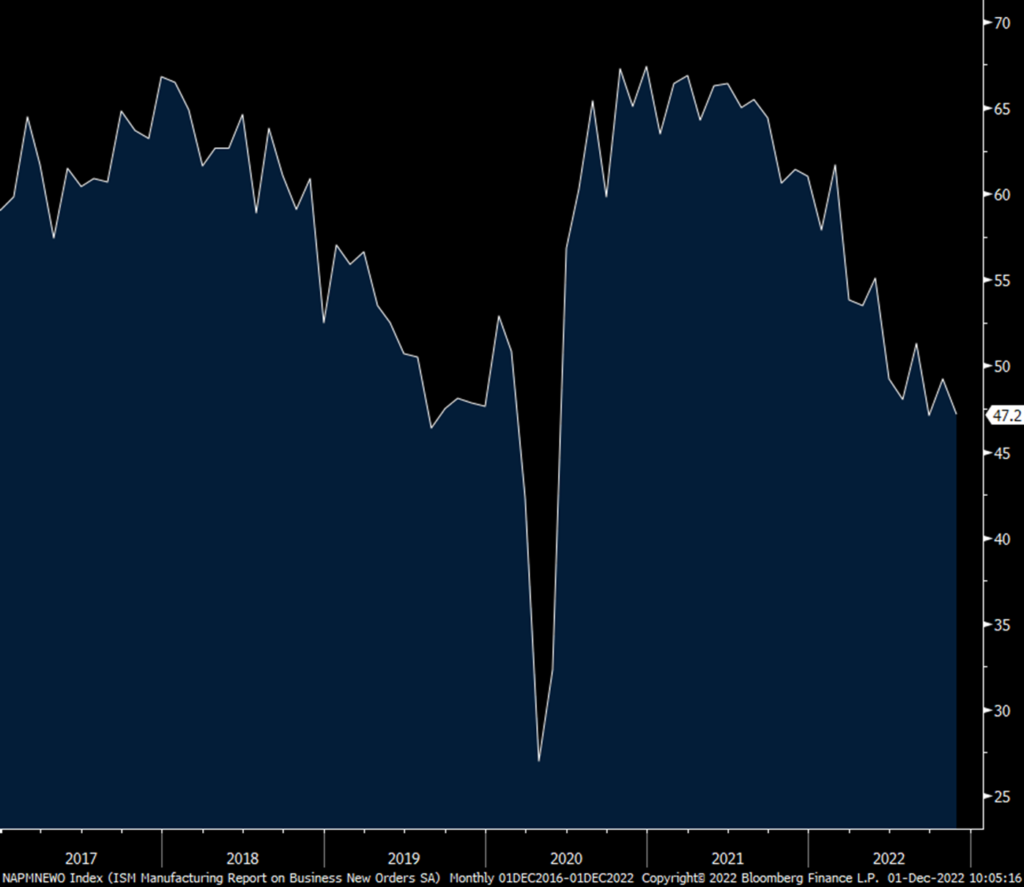

The November ISM manufacturing index fell into contraction at 49 vs 50.2 in October and below the estimate of 49.7. This is the first time this number has printed below 50 since May 2020. New orders fell 2 pts to 47.2 and that is below 50 for the 3rd straight month. Backlogs dropped all the way down to 40 from 45.3 in October and 50.9 in September. Inventories fell 1.6 pts to 50.9 but jumped at the customer level to 48.7 and that is the most since April 2020 and thus a precursor to slower production. Export orders were below 50 for the 4th straight month but less so at 48.4 vs 46.5 last month. Following the sharp drop in jobs in the ADP report, the employment component fell 1.6 pts to back below 50 at 48.4. Supplier deliveries stayed below 50 for a 2nd month but up a touch m/o/m at 47.2. Prices paid fell another 3.6 pts to 43, the least since May 2020.

Of the 18 industries surveyed, only 6 saw growth vs 8 in the month before and 9 the month before that. Those seeing a contraction totaled 12 industries vs 10 in October. Chemicals in particular, a key building block to just about everything that is produced, contracted for a 4th straight month.

The ISM said this on hiring, “Labor management sentiment continued to shift, with a number of panelists’ companies reducing employment levels through hiring freezes, attrition, and now layoffs. In November, layoffs were mentioned in 14% of employment comments, up from 6% in October.”

Bottom line, I’ll repeat again what I said yesterday, add the manufacturing sector to the recession side of the economic ledger.

Here were some business quotes:

Computer & Electronic Products,

“Customer demand is softening, yet suppliers are maintaining high prices and record profits. Pushing for cost reductions based on market evidence has been surprisingly successful.”

Chemical Products,

“Future volumes are on a downward trend for the next 60 days.”

Transportation Equipment

“Orders for transportation equipment remain strong. Supply chain issues persist, with minimal direct effect on output.” I’ll add, this sector is playing catch up to the dearth of trucks last year and the truck stocks have done amazing.

Food, Beverage & Tobacco,

“Consumer goods are slowing down in several of our markets, although the US economy seems decent. Cannot say the same for the European economy.”

Machinery,

“General economic uncertainty has created a slowdown in orders as we approach the end of the year, and many of our key customers are reducing their capital expenditures spend.”

Electrical Equipment, Appliances & Components,

“Overall, things are worsening. Housing starts are down.”

Plastics & Rubber Products,

“Looking into December and the first quarter of 2023, business is softening as uncertain economic conditions lie ahead.”

ISM Mfr’g

New Orders

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.