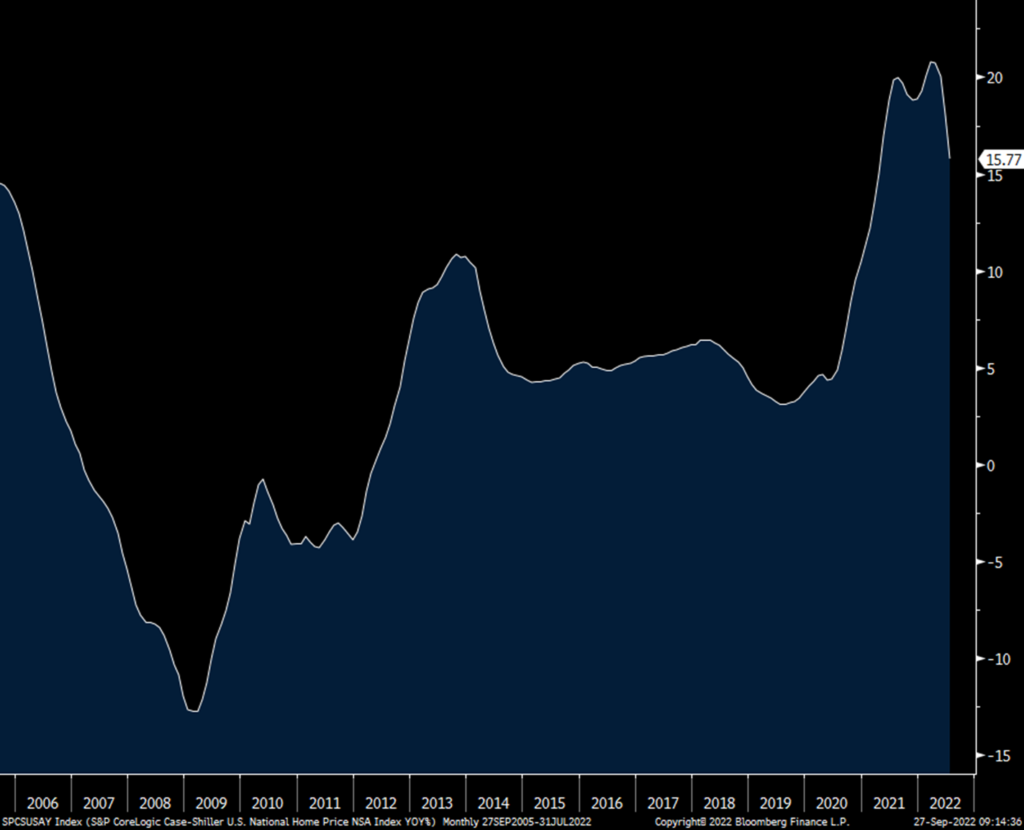

Home prices in July according to S&P CoreLogic moderated to a 15.8% y/o/y pace in July from 18.1% in June. That is the slowest rate of gain since April 2021 and assume this slowdown will only continue. The gains were still led by the sunbelt cities, Tampa, Miami, Dallas, Charlotte and Atlanta. Phoenix home prices slowed to a 22.4% y/o/y pace from over 30% just a few months prior. Home price gains were below 10% in Minneapolis and in DC and just above that in San Francisco.

Bottom line, to say again, the only question from here is to what extent do prices come down in some markets and slow the pace of increases in others. For the sake of the first time buyer, that would be a good thing in order to offset the pain of higher mortgage rates.

S&P CoreLogic Home Prices y/o/y

Core durable goods orders in August rose 1.3% m/o/m, well above the estimate of up .2% and July was revised up by 4 tenths. From July, orders rose for vehicles/parts, computers/electronics, electrical equipment, machinery and primary metals. They fell for fabricated metals. Shipments of core goods, plugged into GDP, was in line with its .3% m/o/m gain and July was revised up by one tenth.

Bottom line, there are so many cross currents here. We have the slowing economy, we have a complete upheaval in the timing of both orders and shipments as companies pulled forward activity as to not to get caught short ahead of the holidays, we’ve had excessive inventories in some areas of the goods market in things people bought too much of the last few years, we’ve had stop and start manufacturing activity out of China where many goods and parts are shipped here and we still have logistical challenges in terms of ports even as overall transportation costs have fallen. Lastly, these are nominal numbers and thus can be clipped by inflation. Thus, I can’t state here any firm conclusion.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.