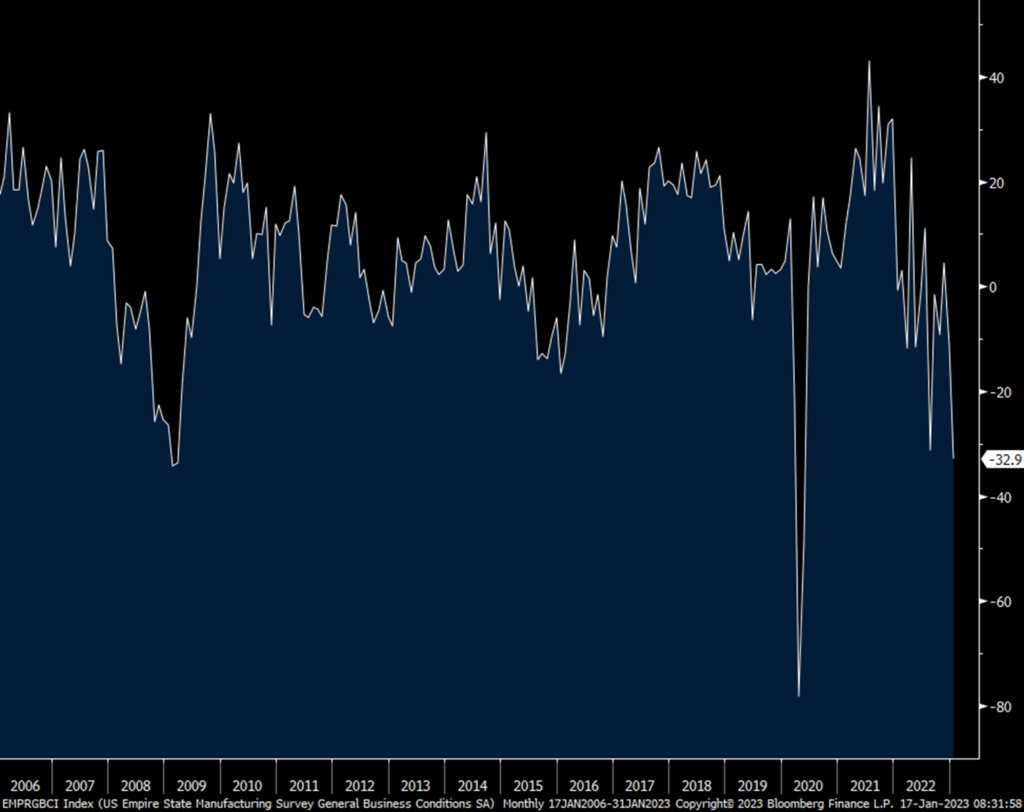

After two months in a row to end 2022 seeing contraction in US manufacturing as measured by ISM, the January NY manufacturing index, the first January industrial figure to be reported, plunged to -32.9 from -11.2 and that was well worse than the estimate of -8.6. If you take out covid, this is the worst print since March 2009.

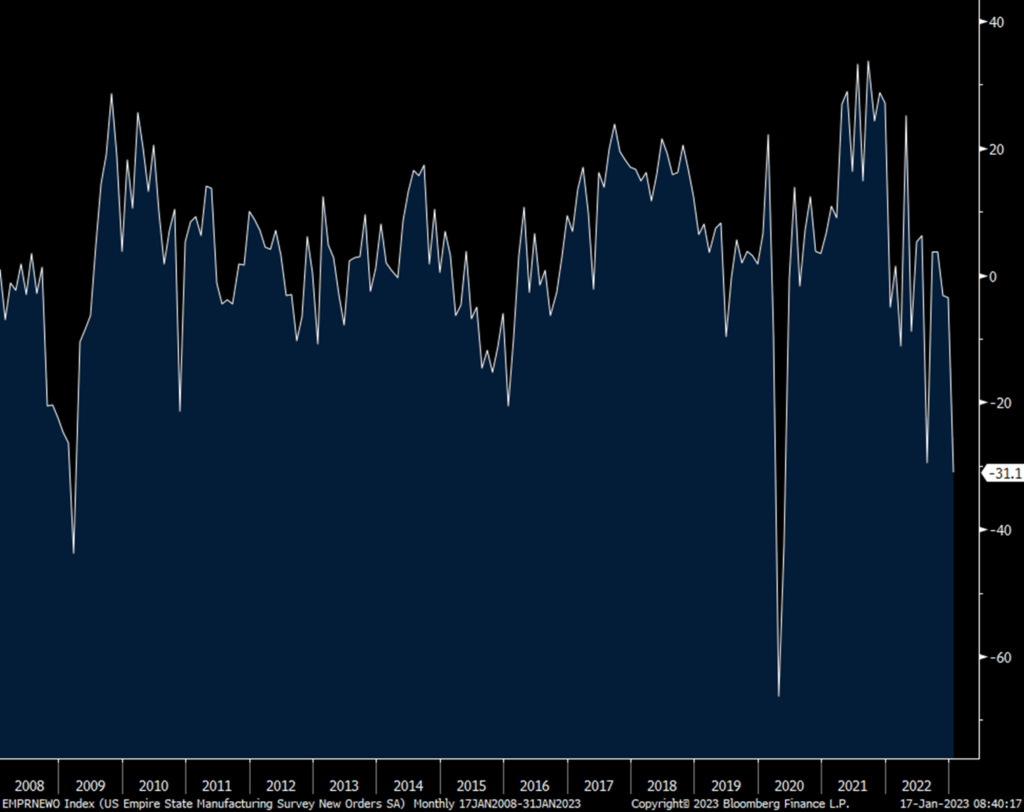

New orders (forward looking) went from -3.6 to -31.1 while shipments (backward looking) dropped to -22.4 from +5.3. Backlogs fell to -14.3 and are in contraction for an 8th straight month. Inventories rose slightly. Employment dropped 11 pts to the lowest since September 2020 and the workweek fell further below zero at -10.4. Delivery times fell 1 pt and prices paid fell a sharp 17 pts to 33.

The 6 month outlook rose 1.7 pts to 8, so assumes some improvement over this time frame from what was seen in January but not much. Capital spending plans fell a touch but did rise for tech spending by 5 pts to the best since last June.

I want to make clear here that these diffusion indices measure the direction of change, not degree but an overwhelming number of respondents saw the pace of business contract in the NY region in January.

Notwithstanding the bad report, Treasury yields are at the high of the morning as they are too in Europe and as we await what the BoJ will do this week, if anything.

NY Mfr’g

New Orders

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.