Thanks Led Zeppelin for the subject line in today’s note and replace ‘levee’ with ‘yield curve control.’

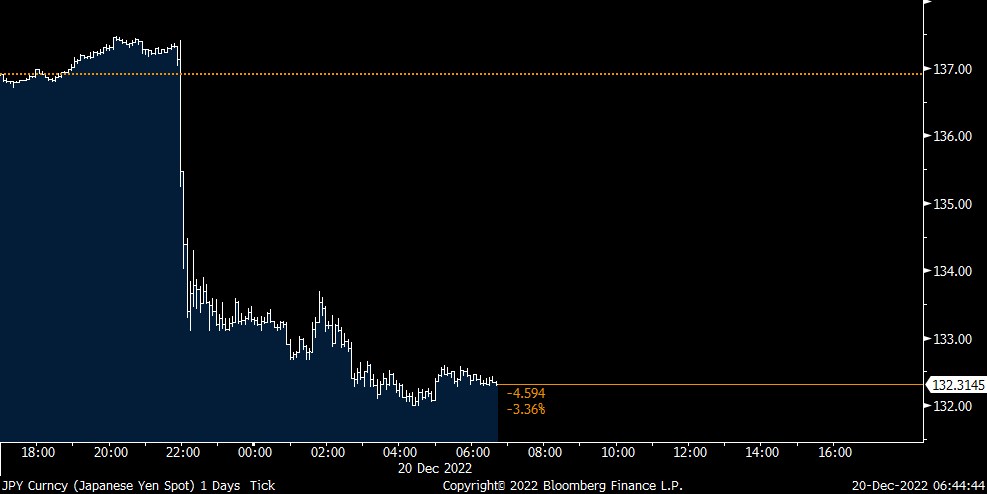

Not one economist I saw in polling expected Kuroda and the BoJ to decide to take some of themselves off the beach ball they’ve been trying so hard to suppress under water last night. Next year seemed it was inevitable after Kuroda left in March but not last night and hence the sharp move in everything there. The 10 yr JGB yield went straight up to .41% bps, higher by 15 bps and to a 7 yr high. This response reflects how badly broken the JGB market has become and it was the BoJ that hammered it. The 40 yr yield, the most market oriented part of their yield curve, was up 4 bps to 1.80% and just 10 bps from being back at a 9 yr high. I also include below the intraday yen chart to visualize the 3%+ rally response.

Bond yields are rising globally in response as you’ve heard me say COUNTLESS times that what happens with the JGB and European sovereign bond markets from here, the epicenter of the epic bond bubble, will have major implications for bond markets around the world, including in the US. The Australian 10 yr yield jumped 20 bps, yields are higher by 5-8 bps in Europe and the US 10 yr yield is up 6 bps after yesterday’s 10 bps rise. Keep in mind too that as other bond markets become more attractive in terms of yield, the US Treasury market becomes less so. Japan is the biggest foreign owner of US Treasuries but have been consistently selling this year and assume they will keep on selling.

The next thing to watch is if the 10 yr JGB yield gets to .50% and the pressure builds all over again. I do want to point out that one of the reasons why it didn’t go straight there overnight was the BoJ also said they are increasing the pace of QT to try to mitigate the upward yield adjustment. Kuroda also cited the problems his policy was creating logistically for markets, “While we have kept the 10 yr bond yield from exceeding the .25% cap, this has caused some distortions in the shape of the yield curve. We, therefore, decided that now was the appropriate timing to correct such distortions and enhance market functions…Today’s step is aimed at improving market functions, thereby helping enhance the effect of our monetary easing. It’s therefore not an interest rate hike.” He might think that but the market has raised rates for him in response to his move. He also said they will continue on with YCC, “It’s absolutely not a review that will lead to an abandonment of YCC or an exit.”

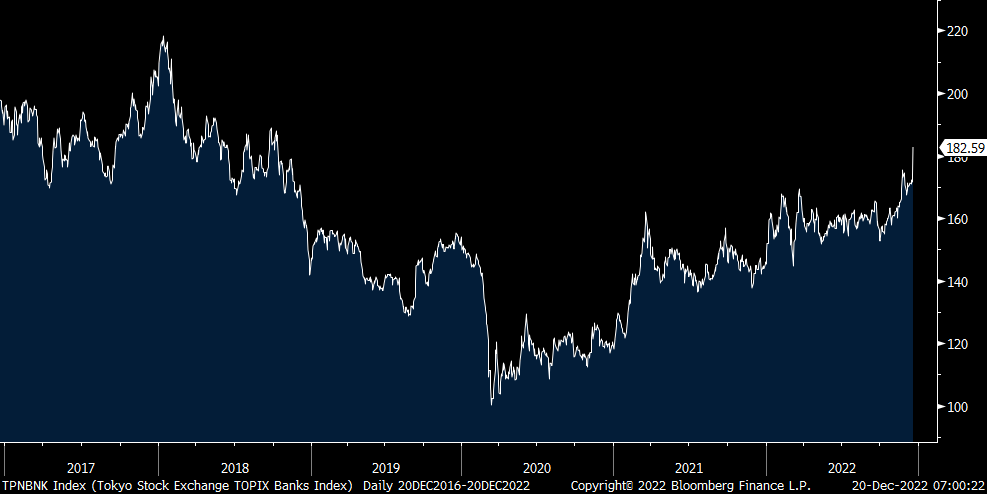

While the Nikkei fell 2.5% in part because of the yen strength, the TOPIX bank stock index rallied by 5.1% as the financial sector now has a profit lifeline. We are long Mitsubishi UFJ and it was up 6% to the highest since February 2018 and it remains cheap, trading well below book value. Mizuho Financial, which we do not own, was higher by 4%. Sumitomo Mitsui Financial, also not a holding, rallied by 5.4%.

With the US dollar weakness, gold is back above $1,800 and silver is rallying to just off its best level since April. We remain bullish.

10 yr JGB Yield

Yen

TOPIX Bank Stock Index

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.