On what should now be the most important focus with respect to the Fed, that being higher for longer rather than do they have 50 or 75 bps left of hikes, regional presidents Mary Daly and Loretta Mester on Friday gave some color on how long rates will stay at whatever peak it ends up at (they like 5%ish). Daly defined it as 11 months or longer. Mester said “My own outlook is that we will have to keep the funds rate up above 5% next year, until we get inflation moving back down on that consistent basis and then we can move into the next phase.”

The fork in the road the Fed could hit next year is a 3%-4% inflation rate while we also have 5% unemployment. What to do then?

Darden on their earnings call Friday gave some good anecdotes. They saw 8.5% hourly wage inflation in the quarter. And in terms of food costs, “chicken, dairy and grains continued to be categories experiencing the highest levels of inflation. Produce, especially lettuce, was much higher than expected due to poor growing conditions and weather related events in the quarter.” They offset higher costs though via “improved productivity, reduced marketing, and other cost savings initiatives.”

For fiscal 2023 they see “total inflation of approximately 7%” with commodity inflation “between 8% and 9%.” On the consumer, “our data indicates that the higher end consumer hasn’t seen the same impact as consumers at the lower end of the spectrum…sales at Thanksgiving were a record for Fine Dining (they own Capital Grille and Eddie Vs) and Seasons 52, and bookings for this holiday season are encouraging. So seems like the higher-end consumer is doing pretty well.” With respect to those making under $50,000 in income, “we’ve seen a little softness in that consumer over the last six months. But the mix of the $50,000 households and under is still above pre-Covid levels for us…And I would say, keep in mind that a lot of our consumers below $50,000 are single or retirees or living in multi-generational households. So maybe $50,000 goes a little bit farther for that consumer.”

Shifting overseas, not only is China finally off its dynamic zero Covid approach, they are acknowledging the importance of their private sector again after bashing big tech over the past few years. At the annual Central Economic Work Conference, a statement said “We will encourage and support the growth of private economy and private enterprises both with policy and in terms of social consensus. Officials at all levels should concretely help private companies deal with difficulties.” Refreshing to hear but with private sector employment making up more than 80% of the workforce, they must embrace the private sector. Chinese stocks were weak though as they have to get through all the disruptions in the coming months as covid flares throughout the populace. China’s full reopen in 2023 will be a major economic story.

The Bank of Japan meets tonight and Reuters has a story titled “Japan to consider revising Abe-era deflation fighting mandate – sources.” It said “The government could initiate the revision after a new BoJ governor is appointed in April, they said, a move that may heighten the chance of a tweak to incumbent governor Haruhiko Kuroda’s ultra-loose monetary policy.” Now while we might have to wait until Q2 to get this tweak, this could be the first trial balloon that policy needs to start tightening in the only country in the world where it hasn’t yet.

I’ve highlighted many times the potential bond market disruptions that could come when they do. While the 10 yr yield remained stuck at .25% overnight, the 40 yr yield jumped 7 bps to 1.76% and the yen is stronger but off its highs. Of note, the 5 yr JGB yield rose to .143%, the highest in 7 years, up 1.4 bps overnight. Maybe the weakness today in European bonds and US Treasuries are following this.

5 yr JGB Yield

40 yr JGB Yield

Over to Europe, the December German IFO business confidence index rose to 88.6 from 86.4 and that was 1 pt above the estimate with both the Current Assessment and Expectation components higher. The IFO said succinctly, “German business is entering the holiday season with a sense of hope.” Lower energy prices and a Chinese reopening are likely the reasons. On the better number the euro is higher as are bund yields and the DAX. On the lower energy prices than initially feared, today the Bundesbank said “Economic output in Germany is likely to decline in the fourth quarter, albeit a little less sharply than previously expected.”

German IFO

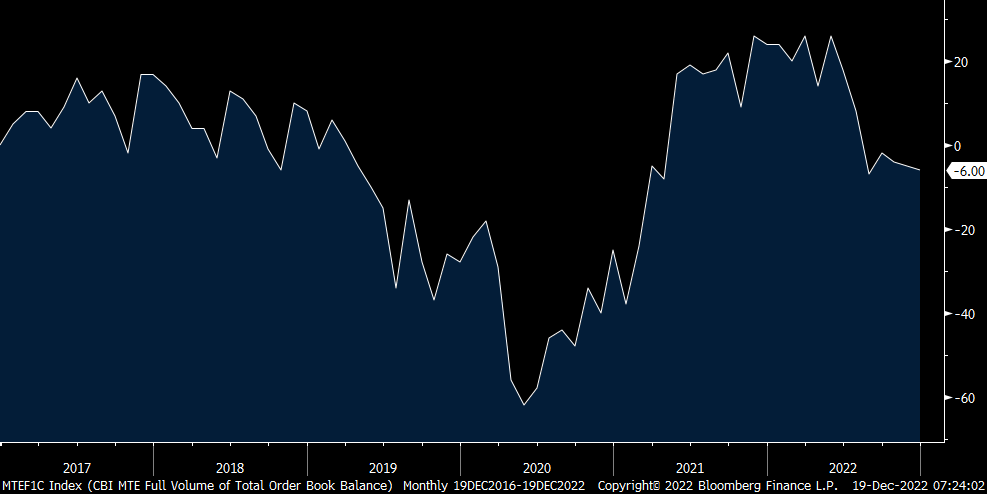

The UK CBI industrial orders index for December was little changed at -6 vs -5 in November and vs the estimate of -9. The CBI said “The corrosive effect of higher inflation on demand is increasingly clear, as manufacturing output contracting at the fastest pace in two years over the last quarter. While some global price pressures have eased in recent months, cost and price inflation will likely remain very high in the near term, with rising energy bills a key concern for manufacturers.” The government subsidizing energy costs has certainly helped in preventing things from being worse, for both businesses and households but at a costly price and for how much longer will they do it?

UK CBI

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.