The noteworthy news out of the ECB was that QT will start in March with details to come in February, but they are saying it will total 15b euros per month in Q2. While this should not be a complete surprise and it’s really a snail’s pace of balance sheet shrinkage, the reality that it’s coming sent European sovereign yields much higher. The Italian 10 yr yield in particular, home to the most indebted European nation in terms of absolute euros (Greece has higher ratios but well termed out debt), is jumping by 24 bps and its spread to the German 10 yr bund yield is wider by 14 bps. Also, the ECB implied that the QT pace will pick up in Q3. As for ECB rate hikes from here, they will continue as they said they “still have to rise significantly.”

The euro is still down vs the US dollar but is off its lows of the morning.

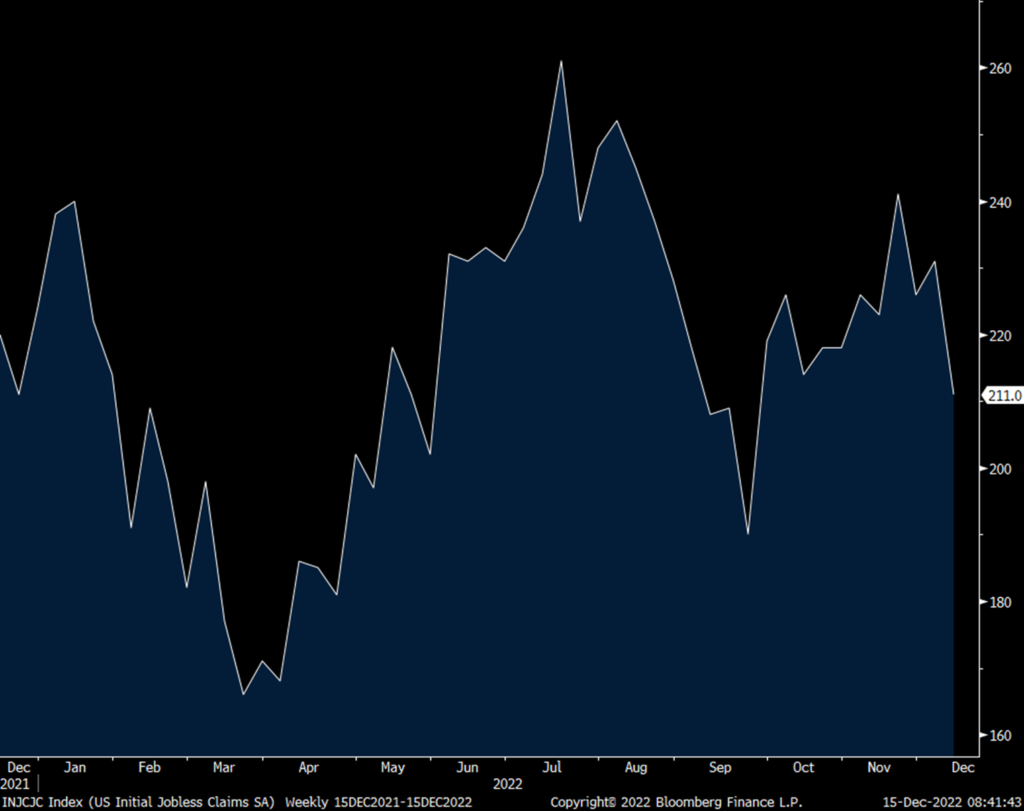

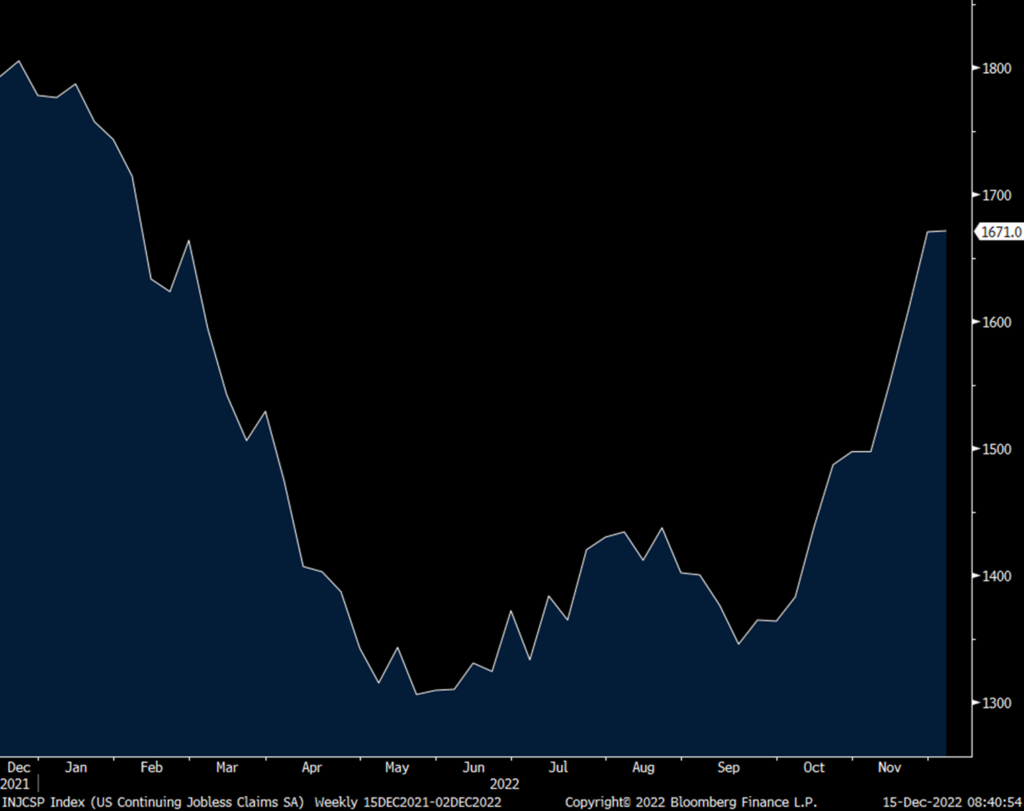

Initial jobless claims fell by 20k w/o/w to 211k and that was 21k below expectations. Smoothing out the week to week puts the 4 week average at 227k vs 230k last week. Continuing claims remained at the highest level since February at 1.67mm.

Bottom line, employers won’t let their hard to come by employees go while those losing jobs in tech are either getting severance and/or finding new jobs soon after. That said, the 10 month high in continuing claims points to the slowdown in the pace of hirings.

Initial Claims

Continuing Claims

Core retail sales in November missed estimates with a .2% fall m/o/m vs the expectations of up .1%. Also, October was revised down by 2 tenths. The breadth of sales was pretty weak as they fell for auto’s, furniture, electronics, building materials, clothing, sporting goods, department stores and even online retailing. The only areas seeing a gain from October was for bars/restaurants (still crowded as I saw first hand last night), health/personal care and food/beverages.

These are nominal figures and will lead to a cut in Q4 GDP estimates. The consumer spending party is getting tougher to sustain with the 2nd lowest savings rate going back to 1959 and the growing usage of credit needed to continue on.

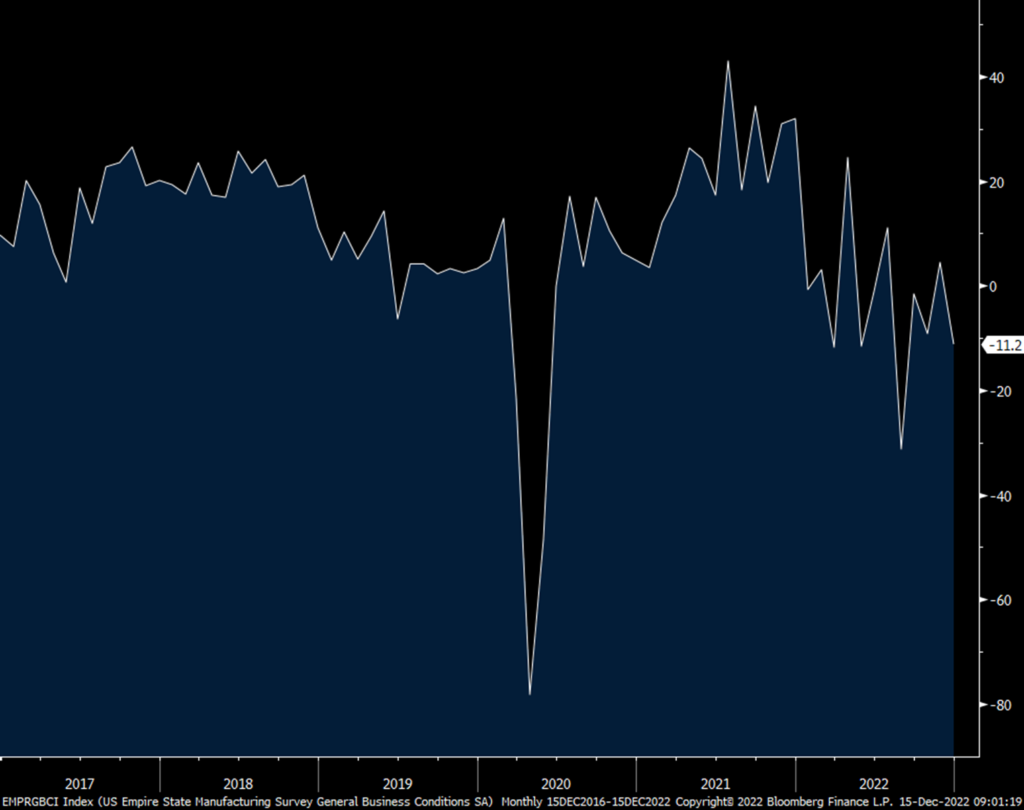

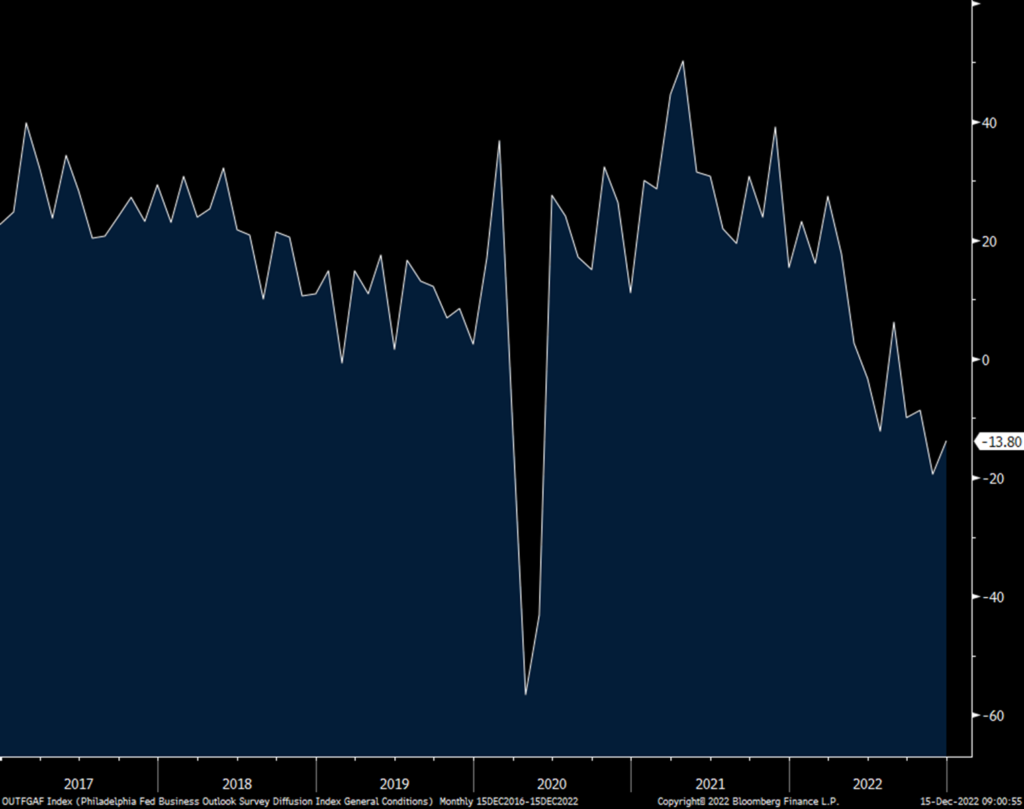

Both the NY and Philly December manufacturing indexes were in contraction and more than expected with mixed internals. With NY, the 6 month outlook did bounce back to +6.3 from -6.1 and there were improvements in capital spending plans but jumps in expectations for prices paid and received. Business expectations in the coming 6 months also did rise in the Philly report after 6 months of below zero prints. Capital spending plans here rose too as did forecasts for prices paid and received.

Bottom line, at least for the first 2 December industrial figures, US manufacturing in these regions are in contraction.

NY Mfr’g

Philly Mfr’g

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.