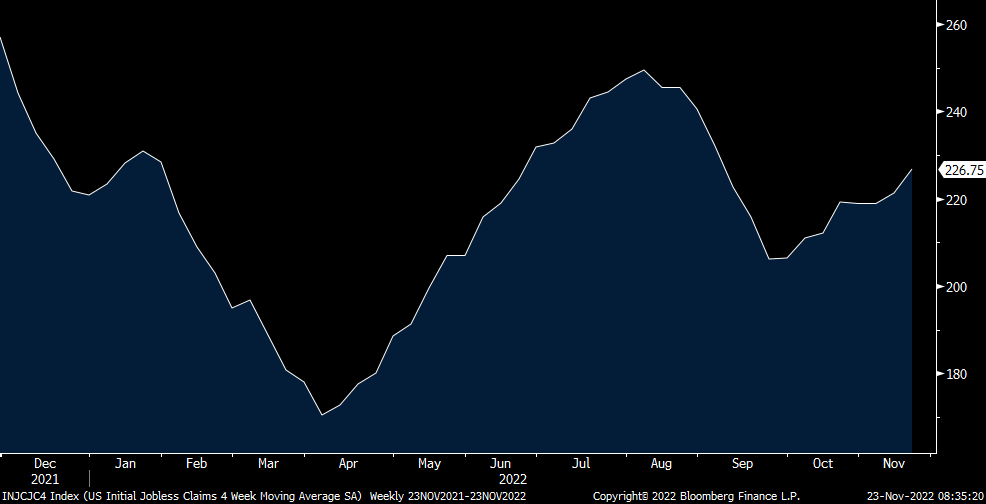

Initial jobless claims jumped to 240k, 15k more than expected and the highest print since mid August. This is up from 223k last week and brings the 4 week average to 227k from 221k and that is the most since early September. Continuing claims rose to 1.551mm and that is the most since early March and up 48k w/o/w.

Bottom line, while most the reported job cuts have come in tech, we of course have to watch to see if there is spread beyond this sector and today’s higher than expected figure is worth noting if it continues. Also, continuing claims have now risen for the 6th straight week and while some sectors in services such as those tied to leisure, travel, hospitality and healthcare need more people, this increase in those still collecting claims is also now worth keeping a close eye on too. It is inevitable that a slowing economy will bring higher unemployment and it’s now just a matter of months before the U3 unemployment rate has a 4 handle I believe.

4 Week Avg Initial Claims

Continuing Claims

Core durable goods orders for October rose .7% m/o/m which was better than the expected forecast of no change but partly offset by a 4 tenths downward revision to September to a drop of .8%. Shipments of previously ordered goods were better than expected and will lead to an increase in Q4 GDP estimates but it is orders that is forward looking. Auto/parts orders and machinery led the way with the former catching up with needed inventory and the latter benefiting from still high commodity prices. After sharp declines in September, orders for computers/electronics and electrical equipment each bounced by .4% m/o/m. Orders for metals, both primary and fabricated, were little changed after declines in the month before.

To try to parse out the influence of inflation, headline durable goods orders over the past 6 months are up 4.5% while core PPI finished goods prices are up by 3.1%. Thus, inflation is making up most of the gains.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.