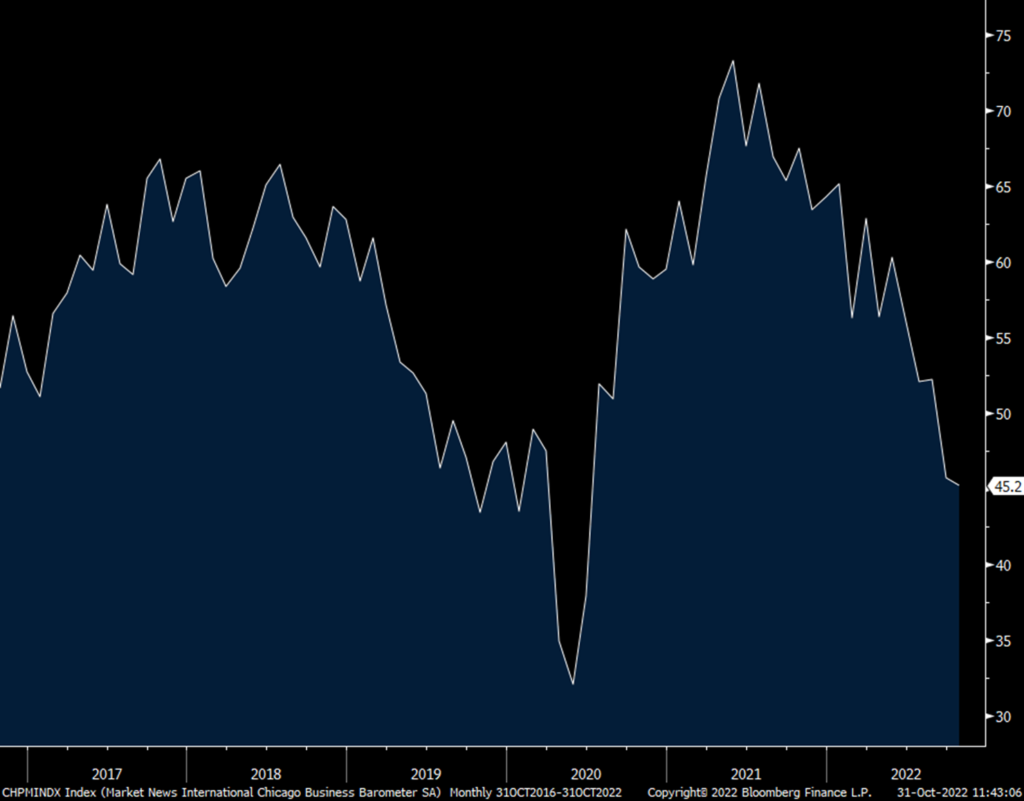

So we now have every regional manufacturing index that is in contraction with two more today, the Chicago region as well as in Dallas. The October Chicago PMI fell to 45.2 from an already below 50 read of 45.7 in September. New orders fell to just 39.2 while backlogs and employment rose but with all still under 50. MNI said “Weak economic outlooks are dragging on demand.” Inventories were up by 3.9 pts to 56.9 and “Despite remaining high, firms are moving towards normalizing levels of stock.” With respect to inflation, prices paid rose a touch but is still around 10 pts below the one yr average. “Half of firms experienced increased prices in October, compared to around 80% in the first half of the year. Falling container costs and the strong Us dollar are contributing to lower logistical costs.”

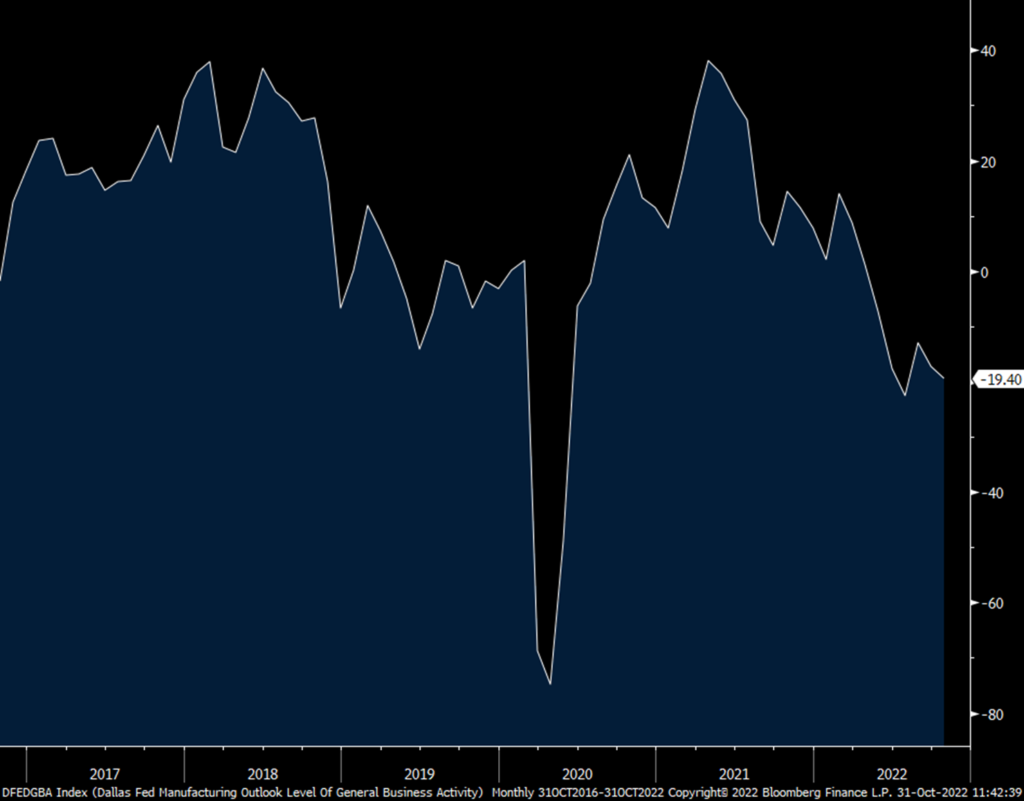

The Dallas manufacturing index dropped to -19.4 from -17.2 in September and vs the estimate of little change. New orders, backlogs and shipments all were below zero. Capital spending plans declined from September at 7.1, down about half. Inventories went negative while delivery times were little changed. Prices paid fell again but for those received it rose after the September drop. Employment was up about 2 pts while hours worked were about zero at -.1. The six month overall business outlook was -21.2, under zero for a 6th straight month.

Bottom line, manufacturing makes up about 11% of GDP that is now in contraction as measured by S&P Global and all the regional surveys. Tomorrow’s ISM is expected to be exactly 50 but with now obvious risk of something less. Treasury yields are at the lows of the day in response.

Here were some notable quotes from the Dallas region:

Food manufacturing

“Inflation in key raw materials and manufacturing expenses is expected to continue.

“The outlook has dimmed slightly. Some raw material costs have decreased, while others continue to increase or stay the same (higher level). Some customers are quietly cutting back on orders. We are in the food business, so the change is subtle.”

Textile Product Mills

“As a contract manufacturer for many different sectors, we see that home goods sales such as mattress subcomponents and comforters and pillows have consistently dropped and are half of what they were this time last year.”

Paper Manufacturing

“We have been anticipating (and experiencing) a decline in business for several months now. The rate increases are starting to go too far.”

Machinery Manufacturing

“Some raw materials are going down in cost; however, many other purchased components have had an increase in cost. Those levying surcharges have not removed those fees.”

“Business is slowing. Companies are being more deliberate in how they spend money.”

“We are still running strong and steady, however, we feel that the worsening economy will eventually catch up with us and may bring us back to reality.”

Computer and Electronic Product Manufacturing

“Inflationary pressure is reducing orders while supply chain pressure eases, so we have excess inventory for our customers.”

“We have seen a significant decrease in new orders, which is not sustainable for us.”

“We saw weakness in the personal electronics market grow in the third quarter and began to see weakness in the industrial market space. We expect most markets to weaken in the fourth quarter, though an exception may be automotive.”

Chicago PMI

Dallas Mfr’g

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.