Again, the question with CPI today is to what extent does further acceleration in services inflation due mostly to rents offset a likely further slowing in the rate of gains with goods prices. While the BLS calculation of rents will show more increases, Realtor.com released a report yesterday titled “September Rental Report: Rent Growth Continues to Cool.” Rents are still rising sharply don’t get me wrong and twice the pace of pre-Covid but the rate of changes between reality and the BLS are moving in opposite directions. Realtor said “September 2022 marks the 2nd month in a row where rent growth has slowed to a single digit for 0-2 bedroom properties (7.8%).” //www.realtor.com/research/september-2022-rent/

With respect to the goods component of CPI, we’ll be watching closely the prices for both new and used cars. Yesterday Kelley Blue Book had an article titled “Average New Car Price Falls for First Time in 5 Months.” Kelley said “The average new car in America sold for $48,094 in September. That’s $146 less than the average in August. It’s a modest drop. But it’s the first time in five months that prices haven’t set a new record high.” Prices are still up 6.1% y/o/y however and they are still going above MSRP. They also said “Interest rates and average monthly payments were up in September, which means affordability worsened. With prices still well above MSRP and incentives from automakers still low, sales in September continued to struggle as consumers weighed their vehicle buying options.” Interestingly, “Incentive made up just 2.1% of the average sale in September, the lowest figure we’ve ever recorded. One year ago, that same figure was 5.2%.” //www.kbb.com/car-news/average-new-car-price-falls-for-first-time-in-5-months/

Delta said this in today’s earnings release: “Domestic passenger revenue was 2% higher and international passenger revenue was 97% recovered compared to the September quarter 2019. International unit revenue growth outpaced domestic for the first time since the pandemic. Transatlantic demand was driven by leisure destinations such as Italy, Spain and Greece and improving business demand, with Transatlantic revenue up 12% compared to 2019.”

On the business side, “Corporate sales increased after Labor Day and are at the strongest recovery rates since the start of the pandemic, exiting the quarter at 80% of 2019 levels…and recent corporate survey results show positive expectations for business travel, with nearly 90% of accounts indicating their travel will stay the same or increase in the December quarter compared to the September quarter.”

Fastenal also reported and they are a great proxy on the industrial side of the US economy. They said “We experienced higher unit sales in the third quarter of 2022 that contributed to the increase in net sales in the period. This was due to good underlying demand in markets tied to industrial capital goods and commodities, which more than offset softer markets tied to consumer goods and relatively lower growth in construction.” We can assume housing impacted the latter.

Pricing added 550 to 580 basis points to net sales. “The increase is from actions taken over the past 12 months intended to mitigate the impact of marketplace inflation for our products, particularly fasteners, and transportation services.” Interestingly, “We did not take any broad pricing actions in the third quarter of 2022, and price levels in the market remained stable.” They also said, “Spot prices in the marketplace for many inputs, particularly fuel, transportation services, and steel, began to decline during the period. Due to our long supply chain for fasteners and certain non-fastener products, however, it is likely to take several quarters before this is reflected in our cost of goods.”

Shifting to Pepsi’s earnings call yesterday where they showed strong pricing and a slight dip in volumes, the CEO gave a very simple explanation, “our categories seem to be growing faster than food and food is growing faster than non-food. I don’t think that’s going to change. We’ve seen, I think, affordable treats and small moments of pleasure continue to be a key need state, I think, consumer today and our categories play in that space. So that I think we should assume that will continue in spite of all the ups and downs, potentially economically around the world.” I certainly agree that a bag of Doritos is a small, but notable, moment of pleasure.

Yesterday’s late day rally in Gilts is continuing today with the 10 yr yield down by 17 bps to 4.27% which is almost back to last Friday’s close of 4.24%. The 30 yr yield is lower by 23 bps to 4.59% which compares with Friday’s closing yield of 4.39%. The 2 yr yield is down 12 bps to 3.89% and that is the lowest in 3 weeks. In turn to the calm in the UK bond market today, the pound is higher and the FTSE 250 is up by .9%. The pound sensitive FTSE 100 is flat.

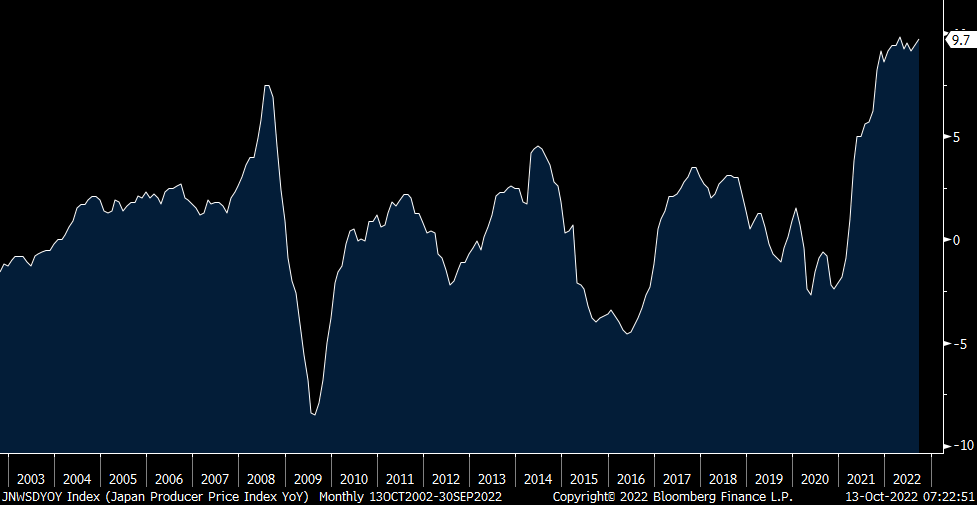

As BoJ Governor Kuroda, who I’m amazed still has his job but I guess his bosses within the government want him to keep borrowing rates at near zero, keeps on with policy, Japan today said that PPI in September rose 9.7% y/o/y, well above the estimate of up 8.9% as the weak yen continues to make it really expensive to import energy. Prices jumped by .7% in the month from August. The forecast was up .3%. There wasn’t much of a market move in response as JGB yields and breakevens are little changed. The yen is slightly higher after 6 days of losses to near 32 yr lows.

Japan PPI y/o/y

Stock market sentiment is still very sour. Yesterday Investors Intelligence said Bulls fell to 25 from 25.4 while Bears rose to 44.1 from 41.8. The Bull/Bear spread of -19.1 is now the widest since 2009. AAII today said Bulls fell 3.5 pts to 20.4 after rising by 3.9 pts last week. Bears rose 1.1 pts to 55.9 after last week’s 6 pt drop from the 60+ level which was last seen in February 2009. The CNN Fear/Greed index at 19 compares with 18 on Tuesday and 28 one week ago. This is in the ‘Extreme Fear’ range. Bottom line, strictly looking at these figures points to the contrarian set up for a notable market rally but from what level is the question.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.