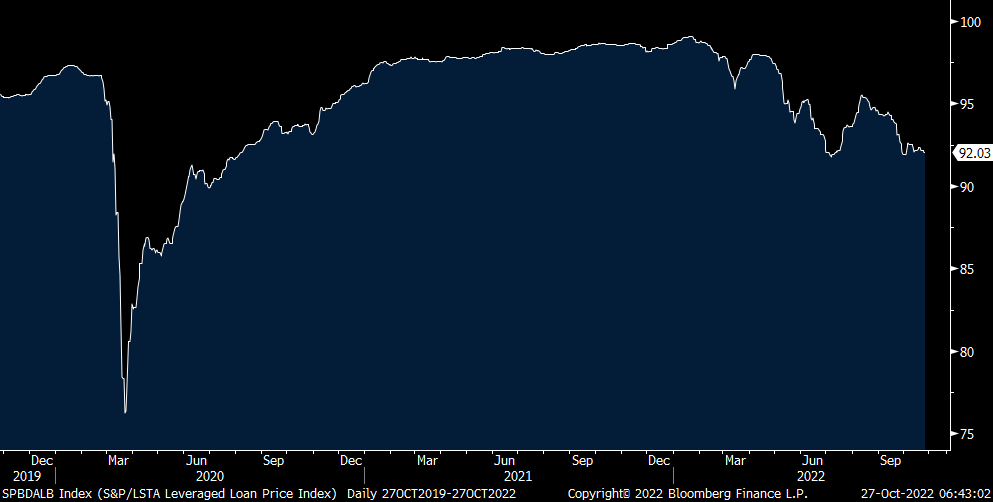

I want to talk again about floating rate debt and its Fed driven shock impact on those that have it. Yesterday the S&P/LSTA leveraged loan index (whose debt is floating), closed yesterday at 92.03 cents on the dollar, just above the lowest since July and if it breaks it, we’d have to go back to July 2020 to see a similar level. That sharply higher interest expense was likely not planned for heading into 2022.

Now with respect to real estate, I’m going to do some back of the envelope math to highlight the shock for those investors who bought property over the last few years and have debt coming due this year or next. Assume in 2020 that Company A bought a $50mm multi family property in Utopiaville. They weren’t that conservative and decided to take on a 3 yr loan with a loan to value ratio of 70% and paid a 5% gross cap rate for it. So, they put down $15mm in equity, borrowed $35mm and the property delivers gross annual rent of $2.5mm (thus not including maintenance, insurance, taxes, property management, interest expense, etc…). They probably got a mortgage rate below 3% then so let’s guess 2.75%. They’d thus be paying $962,500 per yr in interest (not including principal paydown) and their $2.5mm in rental income can handle that as they’d have $1.5mm left over for other expenses and investor distributions. That debt though comes due next year and if rates stay where they are, they’ll be refinancing into a 7%ish mortgage rate which would send their annual interest expense to $2.625mm. If they were able to raise rents by 10% in 2021 and by a similar amount in 2022, rental income would go up to about $3mm but they’d only have around $400k to cover all their expenses and leaving little, if any, left over. Property taxes in some states alone likely wipes out that $400k.

This same example goes for those who developed property in 2020, 2021 and took on construction debt at about a 3% interest expense that now needs robust rental growth when that loan is refinanced this year or next into a conventional mortgage loan to something above 7%.

Something to watch and if one paid a 4% cap rate instead and didn’t lock in long term fixed rate debt, they’ll definitely be handing back the keys to the banks.

LSTA

Not that we needed another reminder that inflation is a tax that hurts those that are most vulnerable but in Kimberly Clark’s (maker of baby diapers, tissues, and toilet paper) earnings conference call a few days ago (a stock we own), the CEO reminded us: “And then with regard to the consumer, I would say, overall, I feel like the consumer remains resilient, but we are increasingly seeing some bifurcation in demand. And I don’t know if I like that word, but it’s – I’m just trying to describe that we’re seeing two different patterns emerge. And it’s mostly along, as you would expect, socioeconomic lines. I mean, certainly – hence we do the research in a developed market like in North America, there’s a broad swath of consumer that their savings are still higher than they were three years ago. They’re employed. And while they may be curtailing some big-ticket purchases in our categories, which are essentials, we’re not seeing a discernible change in behavior there. However, there’s about 40% of the population in the US that is more living paycheck to paycheck. I grew up in one of those households and I know what it’s like. And so we are seeing some changes in the consumption patterns, whether that is buying lower count packs or trading down a bit.”

With respect to Meta, we know about their challenges both micro and macro so I just wanted to hone in on what they said about hiring ahead of claims data today and payrolls next Friday. “We are making significant changes across the board to operate more efficiently. We are holding some teams flat in terms of headcount, shrinking others and investing headcount growth only in our highest priorities. As a result, we expect headcount at the end of 2023 will be approximately in-line with third quarter 2022 levels.” So no job growth here in the coming 12+ months.

In today’s AAII data, Bears fell 10.5 pts to 45.7 and that is a 9 week low. Bulls rose 4 pts to 26.6, a 9 week high. The CNN Fear/Greed index has shifted into the ‘Greed’ category at 57. It was 40 one week ago and 17 one month ago. Yesterday’s II figures saw the Bulls rise to 36.9 from 31.3 while Bears fell to 38.5 from 40.3. Bottom line, the extreme bearish sentiment seen at the end of September is no longer and more neutral now (although AAII is obviously still pretty bearish). Thus, strictly from a sentiment standpoint, we can’t pull the contrarian lever as good reason for a bear market bounce.

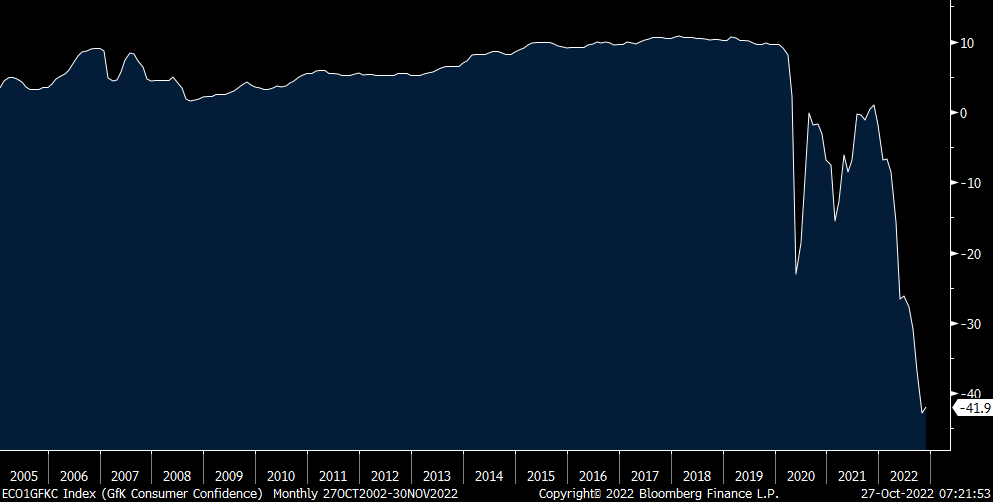

After seeing the surprising uptick in French consumer confidence for October, the German GFK consumer confidence index was up a touch to a still deeply negative -41.9 vs -42.8 last month. GFK said “It is certainly too early to speak of a trend shift at this time. The situation remains very tense for consumer sentiment. Inflation has recently risen to 10% in Germany, and concerns about the security of energy supplies continue to rise. Therefore, it remains to be seen whether the current stabilization will last or whether, considering the upcoming winter, there is reason to fear a further worsening of the situation.” The euro is lower after 5 straight days of declines but still holding that $1.00 level. Bond yields are higher across the region with stocks mostly lower.

German Consumer Confidence

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.