According to S&P CoreLogic, home prices rose 13% y/o/y in August, a downshift from the 15.6% pace seen in July. It’s the 5th straight month of deceleration and AGAIN, the only question is to what extent does this continue. Because of what will still be limited supply of existing homes (in contrast to new ones) with many wanting to hold on to their 3%ish type mortgage, it will be the number of transactions and everything associated with a move in/out that suffer the most in this housing recession. The plus side here is the slow down and possible price declines in some markets can help to mitigate the 7% sticker shock mortgage for many first time buyers.

The sunbelt cities continue to drive the price gains with Miami, Tampa, Charlotte, Dallas and Atlanta leading the way. The price gain laggards were San Francisco, DC, Minneapolis, Portland and Detroit.

Home Price Gains y/o/y

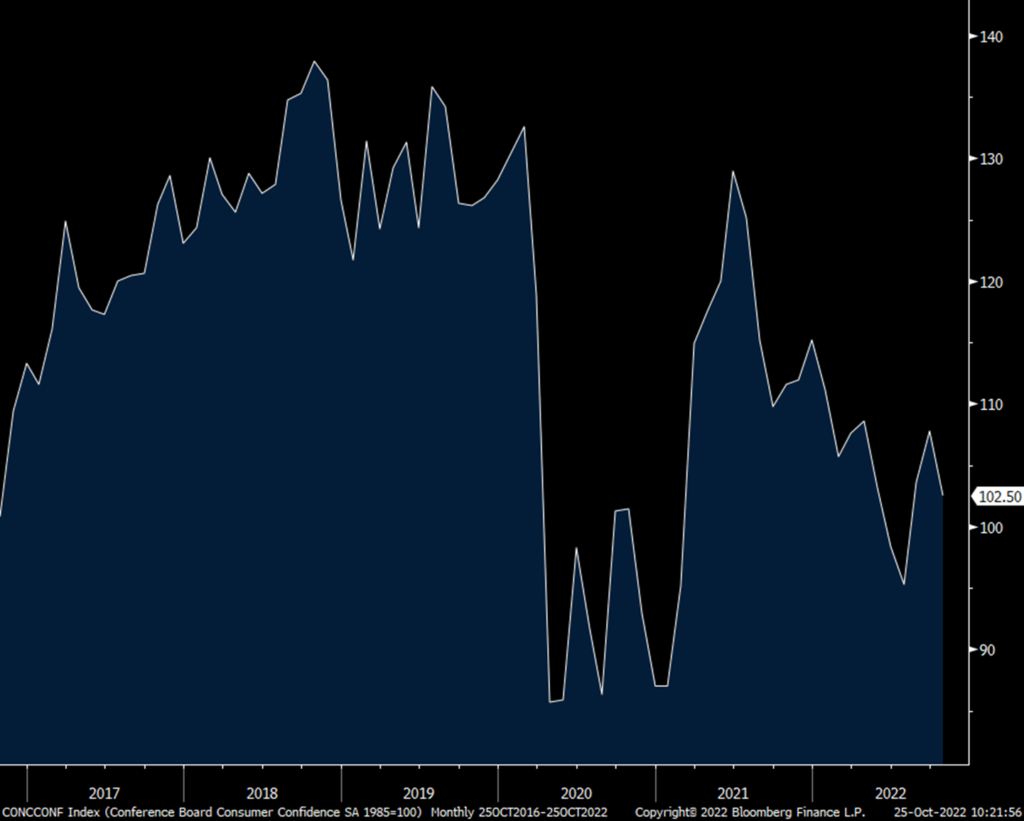

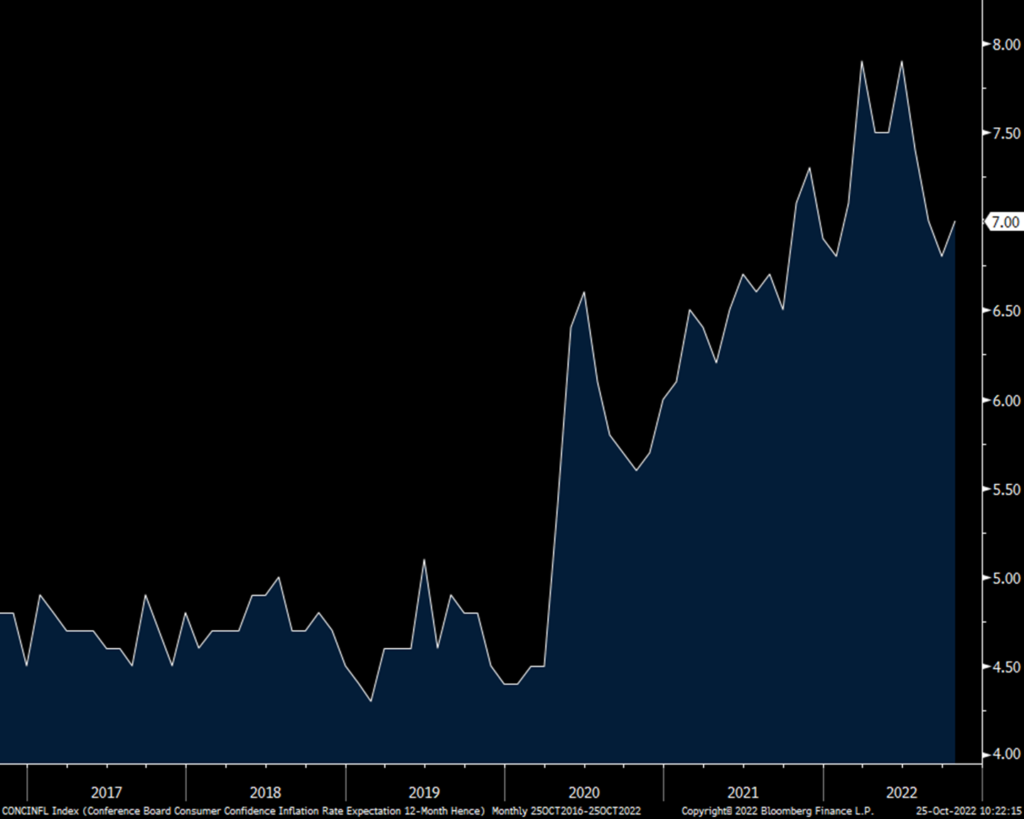

The October Conference Board’s consumer confidence index fell to 102.5 from 107.8 and that was below the estimate of 105.9. Most of the decline was in the Present Situation but Expectations slipped too. One yr inflation expectations rose 2 tenths to 7% after falling by 2 tenths in September with the price of gasoline and food being the major influences. The 20 yr average with inflation expectations is 5.3%.

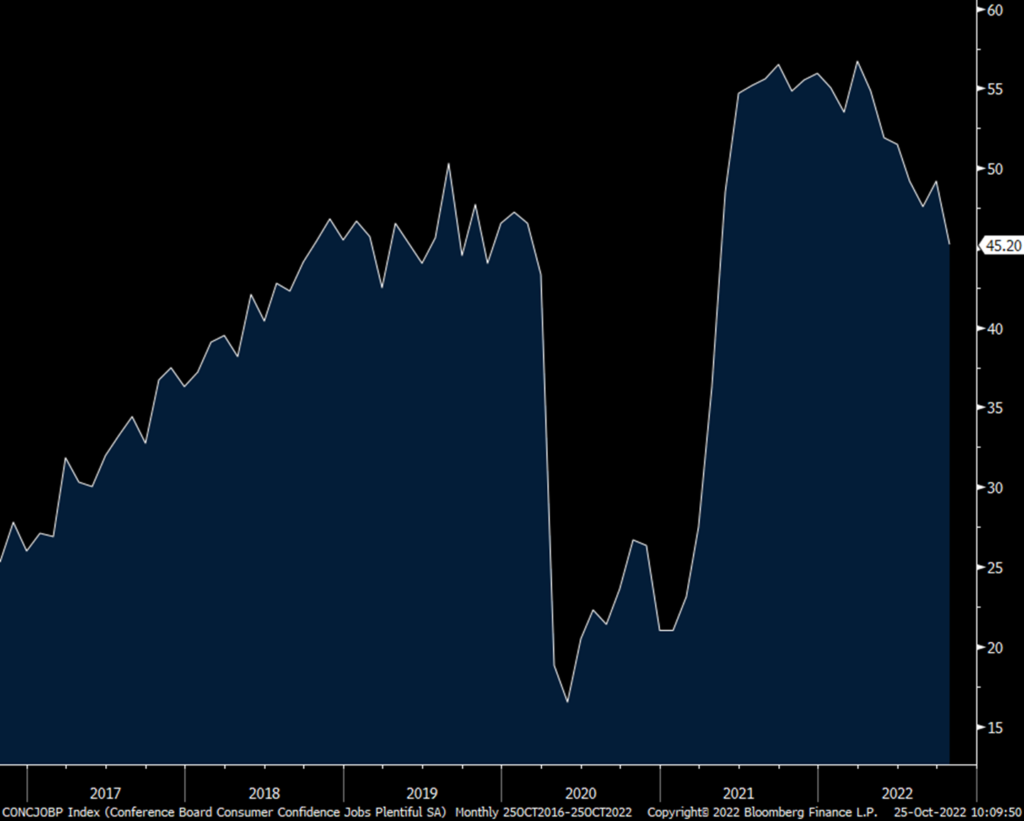

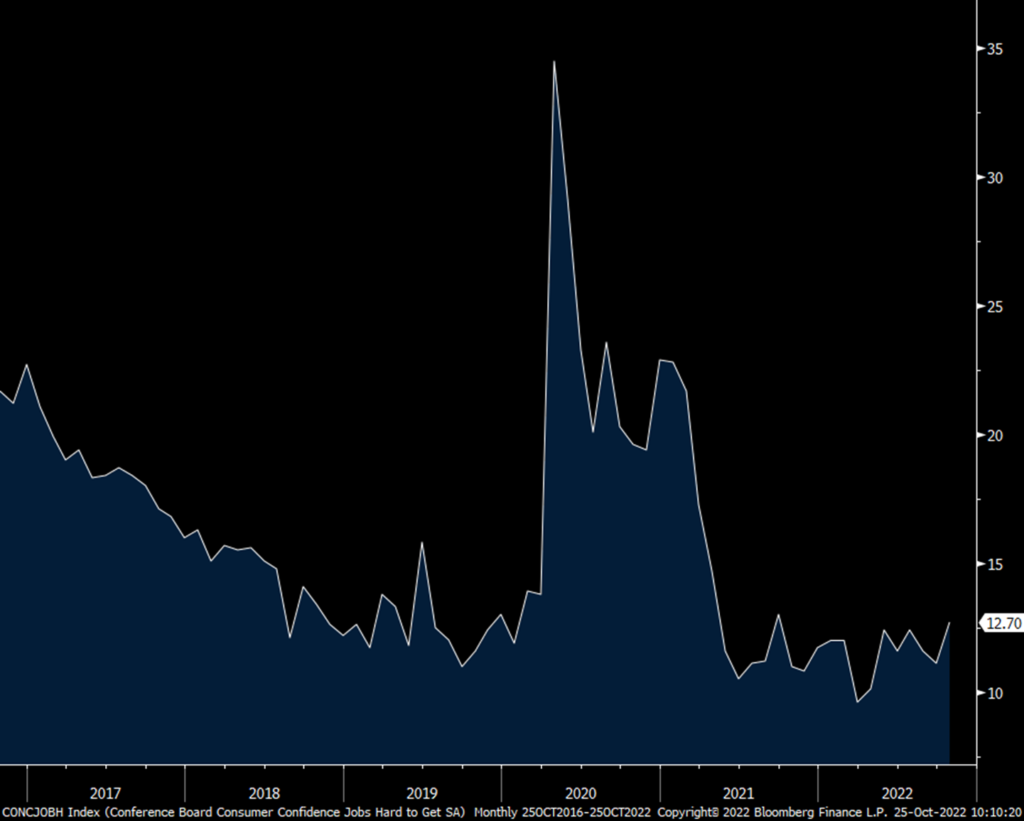

Notable was the answers to the current situation jobs questions where some deteriorated. Those that said jobs were Plentiful fell 4 pts to the lowest since April 2021. Those that said they were Hard to Get rose to the most since September 2021. Expectations on jobs and income were more mixed. Expectations for ‘More Jobs’ did improve to the best since January 2022 and expectations for an ‘Increase in Income’ was the highest since fall 2021. This for both was mitigated by a rise in expectations for ‘Fewer Jobs’ and a ‘Decrease in Income.’ Those that thought they would stay the ‘Same’ is from where the shift took place.

Interestingly, spending intentions improved for autos, homes, and major appliances but they did slip for vacation intentions. There was a definite income differential in the stats where those making between $25-$125k all saw consumer confidence fall but it rose for those making more and maybe the latter drove those spending intentions.

This was the bottom line from the Conference Board, they referred to consumer view of the short term outlook as “dismal” and said that an Expectations reading under 80 is a “level associated with recession.” As what will happen from here, “inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers.” For perspective, the 102.5 print compares with 132.6 seen in February 2020 and the Covid low of 85.7 in April 2020. I’ll also add, keep note of the growing clouds building in the labor market figures here ahead of claims Thursday and the October jobs data next week.

Consumer Confidence

One yr Inflation Expectations

Jobs Plentiful

Jobs Hard to Get

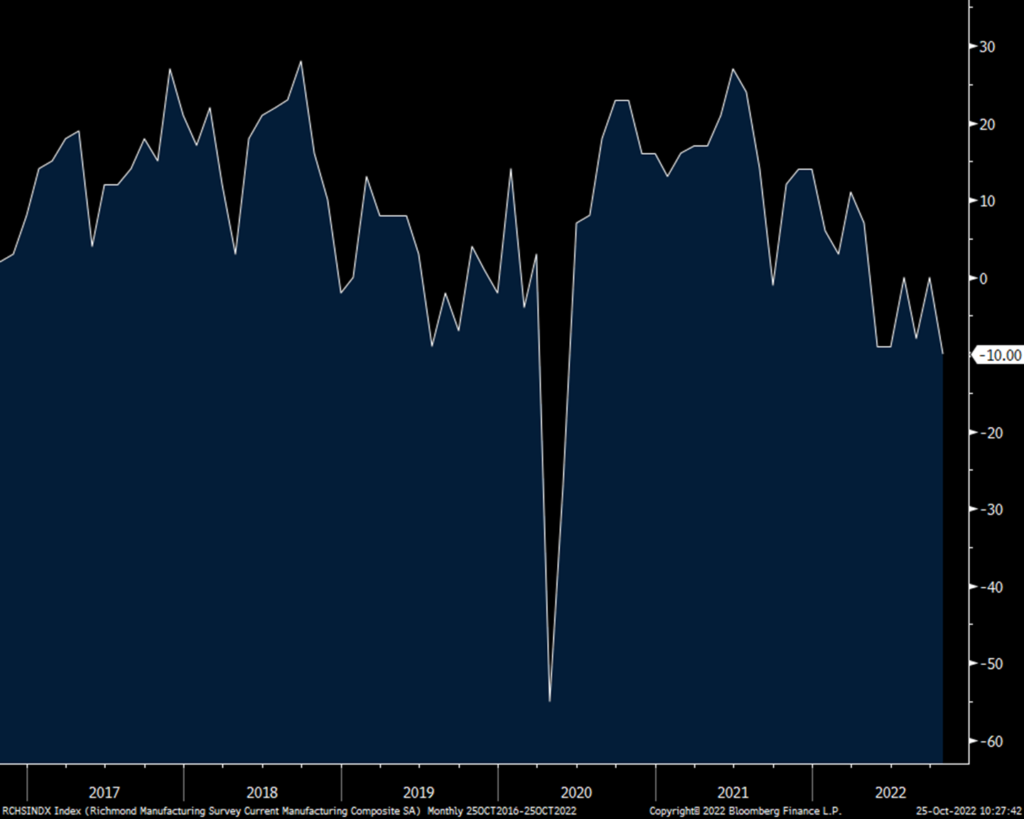

We now have three October regional manufacturing indices that are below zero with the Richmond Fed today saying its index fell to -10 from zero. The estimate was -5. New orders and backlogs were deeply negative and capital spending plans moderated as did six month expectations for them. Employment was zero for a 2nd month and wages fell but after jumping last month. The outlook for each fell. Prices paid and received rebounded after the recent declines as did the expectations for them.

Bottom line, the US manufacturing sector is now in a recession.

Richmond Mfr’g

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.