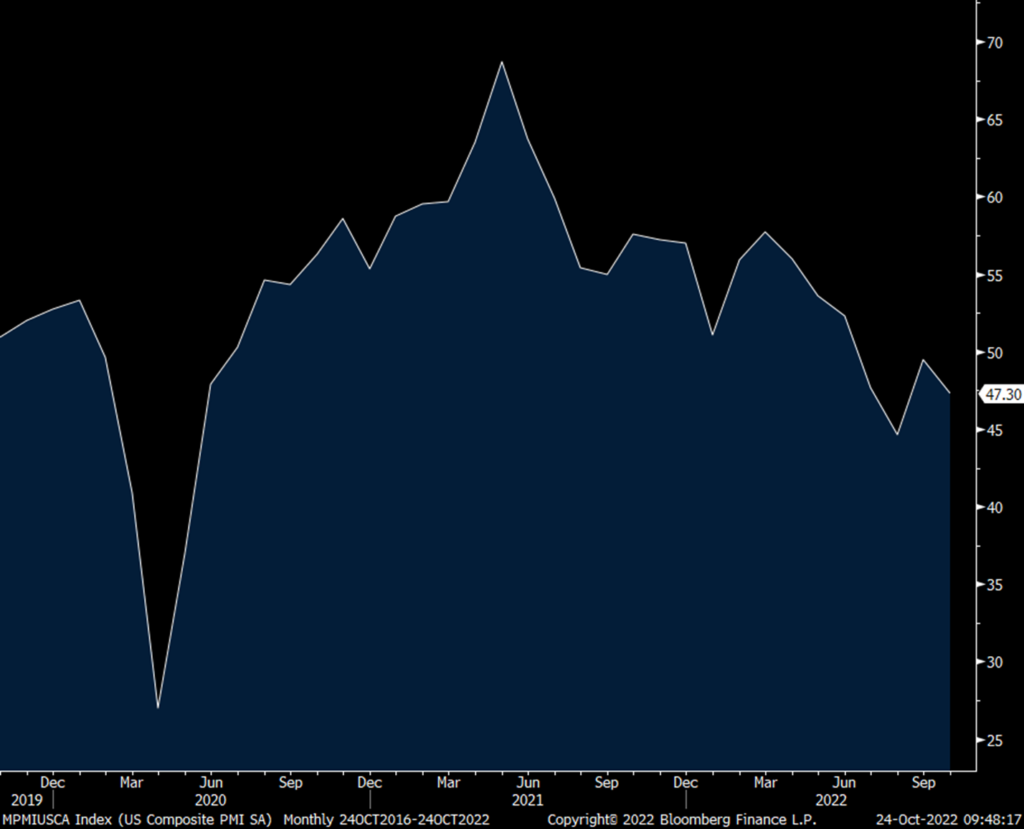

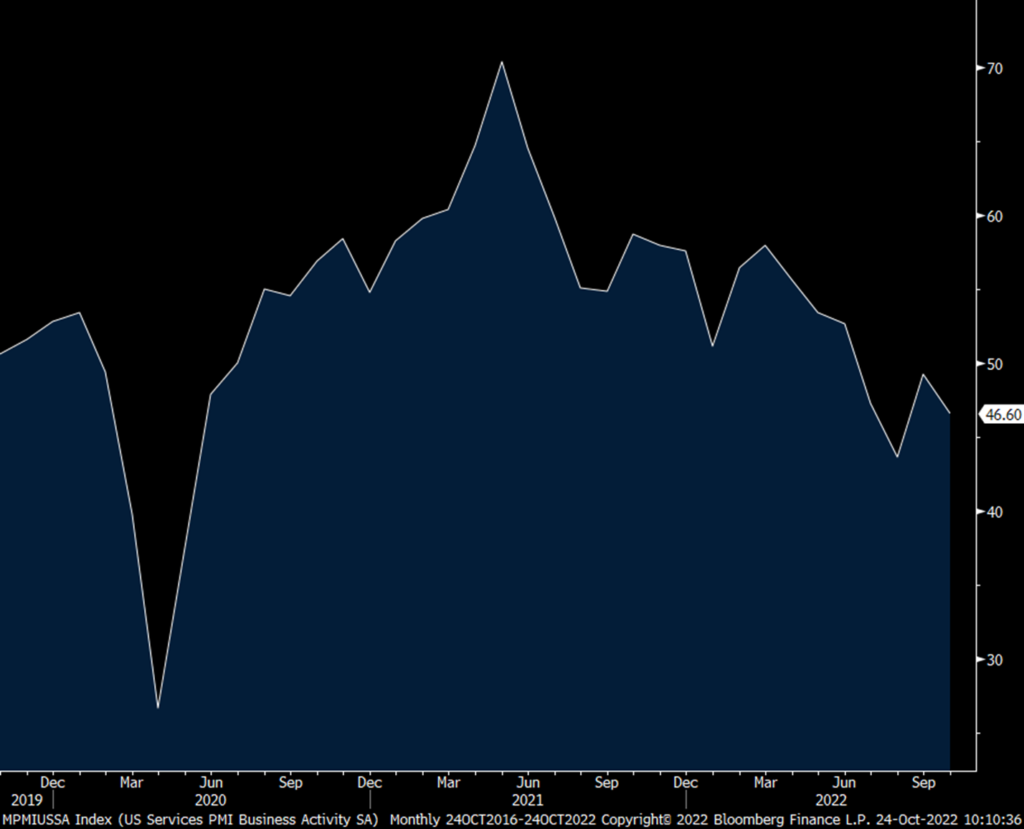

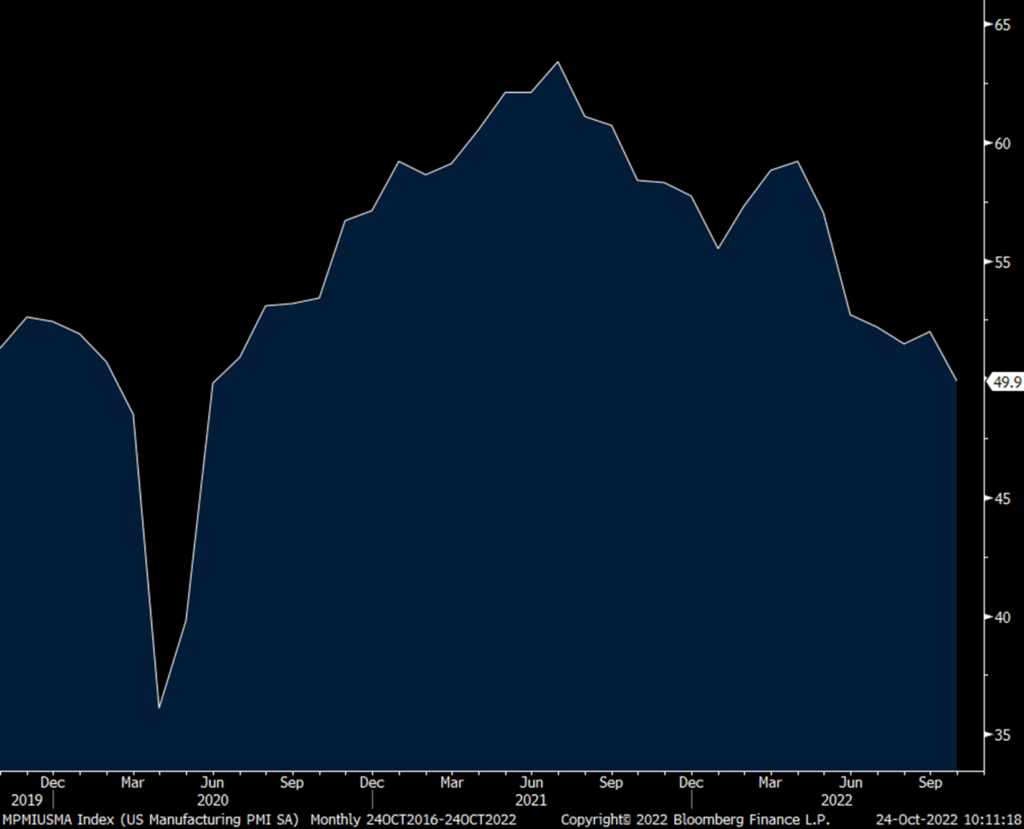

The S&P Global October US PMI remained below 50 for a 4th straight month at 47.3 from 49.5 in September and vs 44.6 in August and 47.7 in July. Services dropped to 46.6 from 49.3 and manufacturing declined a hair under 50 at 49.9.

With services, S&P Global said “Firms linked the decrease to weak client demand and the impact of inflation and higher interest rates.” New orders fell back below 50 and “Weighing on total new sales was a drop in foreign client demand. New export orders declined at a solid pace due to inflationary pressure in key export markets.” On pricing in the US, prices paid ticked up but is still well below its highs. As for those received, “Companies partially passed on higher cost burdens to their customers, as the pace of charge inflation picked up slightly.” Employment fell below 50 for the first time since June 2020 and “Companies noted the non-replacement of voluntary leavers, alongside some reports of lay-offs.” As for the business outlook in services, it fell to the “weakest since September 2020, as higher operating costs and client hesitancy weighed on optimism.”

On manufacturing, call it “broadly unchanged operating conditions on the month.” Production did rise slightly above 50 “as firms noted easing supply chain pressures and the delivery of some key inputs.” But, new orders fell back below 50 to the weakest since May 2020 as “alongside domestic inflationary pressures, total new orders were dampened by challenging economic conditions in key export destinations and dollar strength, as new export orders fell steeply.” Supply constraints eased to the least since July 2020 “as firms noted less marked extensions to input delivery times.” Both prices paid and received declined further. Employment stayed above 50 but less so m/o/m. With regards to the future, “output expectations regarding the year ahead outlook at manufacturing firms slipped to the lowest in almost 2 ½ years. Muted customer demand and inflation concerns reportedly dampened confidence.”

The bottom line from S&P Global, “The US economic downturn gathered significant momentum in October, while confidence in the outlook also deteriorated sharply. The decline was led by a downward lurch in services activity, fueled by the rising cost of living and tightening financial conditions. While output in manufacturing remains more resilient for now, October saw a steep drop in demand for goods, meaning current output is only being maintained by firms eating into backlogs of previously placed orders.”

My bottom line, on Thursday we’re possibly going to see a 2%+ GDP figure for Q3 after the two prior quarters of declines. But when combining all three quarters, you’ll see no growth thru September year to date. And if this S&P Global business survey has any validity, the US economy is now seeing declining activity for 4 straight months (measuring direction, not degree).

S&P Global US PMI

Services

Manufacturing

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.