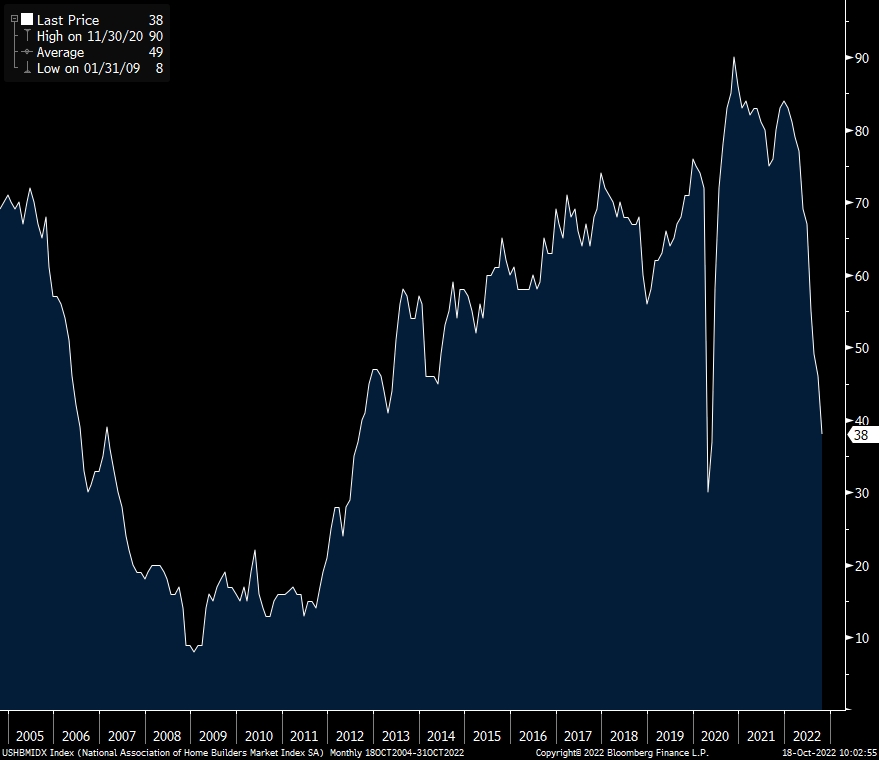

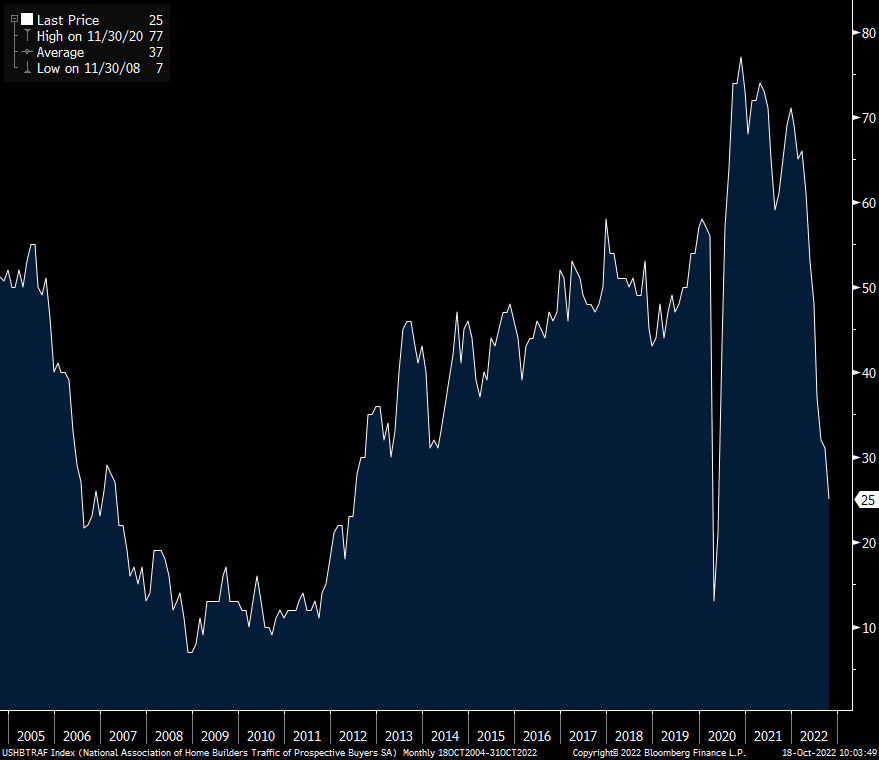

The NAHB home builder index for October plunged further to 38. That’s down from 46 in September and 5 pts below expectations with 50 the breakeven between expansion and contraction. The Present situation dropped 9 pts to under 50 at 45 while the Future outlook component was down by 11 pts m/o/m to 35. Prospective Buyers Traffic is now down to just 25 from 31 last month. It was last above 50 in May.

With this index now down for 10 straight months and at the lowest since August 2012, we are clear on why. The NAHB stated, “High mortgage rates approaching 7% have significantly weakened demand, particularly for first time and first generation prospective home buyers. This situation is unhealthy and unsustainable.” They added, “This will be the first year since 2011 to see a decline for single family starts. And given expectations for ongoing elevated interest rates due to actions by the Fed, 2023 is forecasted to see additional single family building declines as the housing contraction continues.” As a result, we’ll see a further drop in the homeownership rate “as higher interest rates and ongoing construction costs continue to price out a large number of prospective buyers.” Nothing more to add other than to say again, the only question is to what extent do home prices fall from here because the supply of existing homes will still remain tight as many stay in their 3%ish type mortgages.

NAHB

Prospective Buyers Traffic

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.