There are 5 more Fed speakers today and the discussion is shifting to not how many more hikes they have (4-4.5% is where they seem to want to get) but to how long they will stay there in 2023. Bostic, non voting, said yesterday “Ideally, I would like to reach a point where policy is moderately restrictive, between 4% and 4.5% by the end of this year, and then hold at that level and see how the economy and prices react.” When asked about the fed funds futures next year pricing in some rate cuts in the back half of the year, Mary Daly, also non voting, said “I don’t see that happening at all.” As for markets, ending the rate hikes will be an immediate celebration but the reality of them staying elevated thereafter will be something we’re not used to when compared to the prior times when the Fed hiked us into a recession and then quickly slashed and burned rates lower. That said, they very well might slash and burn again in the future if their attention shifts to employment from inflation, as they’ve done in the past.

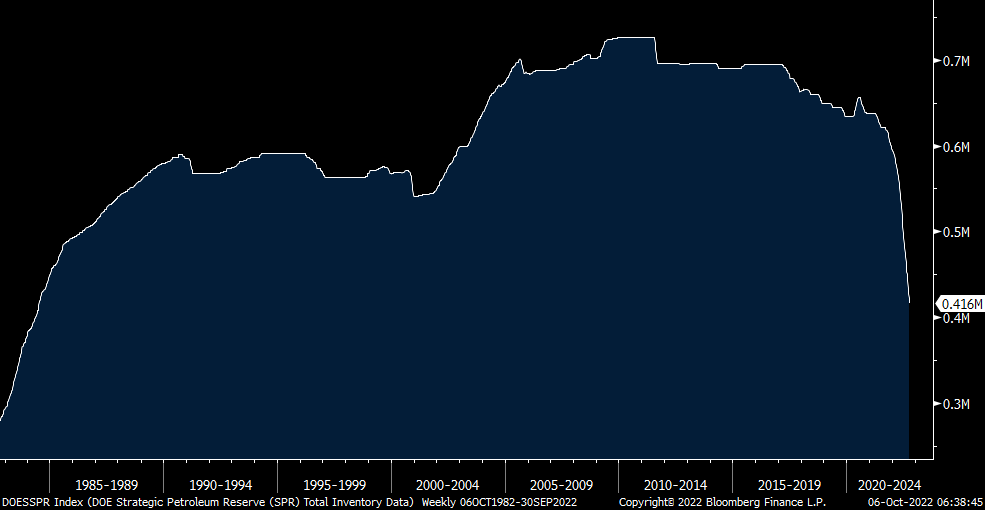

With OPEC+ cutting production and the administration wanting to continue to release barrels from the SPR for another month, let’s look again at what’s left of the SPR in the chart below. At 416mm barrels left, it stands at the lowest since 1984 in nominal terms and falling at about 1mm barrels per day.

SPR Inventories

On Tuesday the September Logistics Managers Index came out and it rose to 61.4 from 59.7. The storage of goods is strong but the actual movement of them continues to slow. LMI said “Transportation continues its slump, while warehousing is chugging along at the same breakneck pace we have observed for much of this post-pandemic recovery period. Much of this confusion can be attributed to the high levels of inventory that continue to permeate global supply chains.” Now be sure that part of the inventory build is due to companies pulling forward their preparations for the holidays so as not to repeat the shortages seen in the past few years.

Also out Tuesday was the KPMG Global CEO survey “which asked more than 1,300 CEOs at the world’s largest businesses about their strategies and outlook.” The results reflected “More than 8 out of 10 anticipate a recession over the next 12 months, with more than half expecting it to be mild and short….14% of senior executives identify a recession among the most pressing concerns today, up slightly from early 2022 (9%), while pandemic fatigue tops the list (15%). In anticipation of a recession, “76% have already taken precautionary steps.”

What does this mean for the labor market? “With continued economic turmoil, there are signs the Great Resignation could be cooling down, with 39% of CEOs having already implemented a hiring freeze and 46% considering downsizing their workforce over the next 6 months. However, the three yr view is more optimistic with only 9% expecting a further reduced headcount.”

Hong Kong’s September PMI fell back below 50 at 48 from 51.2. While the SAR is trying to distance itself from covid, “Covid disruptions were reportedly the primary factor weighing on overall sector performance, with firms signaling that limitations on meeting up and a general hesitancy among some customers impacted demand and activity. Firms therefore registered renewed contractions in order book volumes and output,” according to S&P Global. There is hope though that the move away from strict covid limits will improve the economic situation, “with the Covid situation improving towards the end of September and quarantine measures for international travelers having eased, we could hope to see Hong Kong SAR’s private sector rebound in the months ahead.” Let’s hope too that mainland China after the party Congress starts to ease restrictions.

Germany factory orders in August dropped by 2.4% m/o/m, more than the estimate of down .7% but July was revised sharply higher to a 1.9% gain from the initial print of down 1.1%. The reason for the large upward revision had to do with large aerospace orders that showed up late in the data collection. Overall, the Federal Statistics Office said this, “Enterprises still have difficulties completing their orders as supply chains are interrupted because of the war in Ukraine and distortions persist that have been caused by the Covid crisis.” To the latter point, maybe they are referring to China at this point since that is Germany’s largest trading partner.

The euro is little changed today while bund yields are up and it’s been quite the volatile week again for bunds. On Monday yields fell 19 bps for the 10 yr and another 5 bps on Tuesday and the yesterday and today they are higher by 18 bps. The all important Italian 10 yr/German 10 yr yield spread stands at 241 bps. It got as wide as 253 bps recently in late September.

With respect to stock market sentiment, yesterday II said Bulls were unchanged at just 25.4% but Bears jumped to 41.8% from 34.3% and that is just below the mid June high of 44.1% and above the March 2020 peak of 41.7%. Today AAII said Bulls rose 3.9 pts to 23.9. It got as low as 17.7 a few weeks ago. Bears fell 6 pts after being above 60 for two straight weeks and which was the highest since March 2009. The CNN Fear/Greed index at 30 is in the ‘Fear’ camp but one week ago, before the sharp October rally, was at just 14. Bottom line, the extreme sentiment reads over the past week was a good set up for the rally we’ve seen and while we’ve come a bit off the extreme, sentiment is still pretty dour.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.