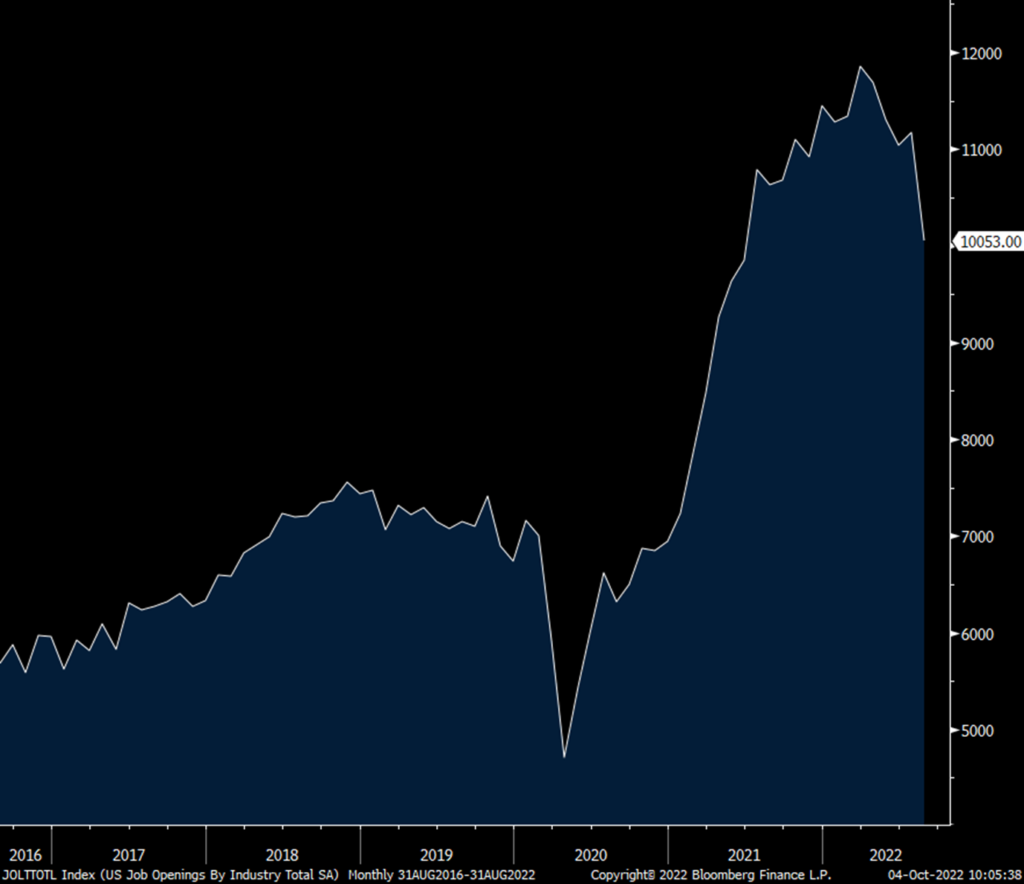

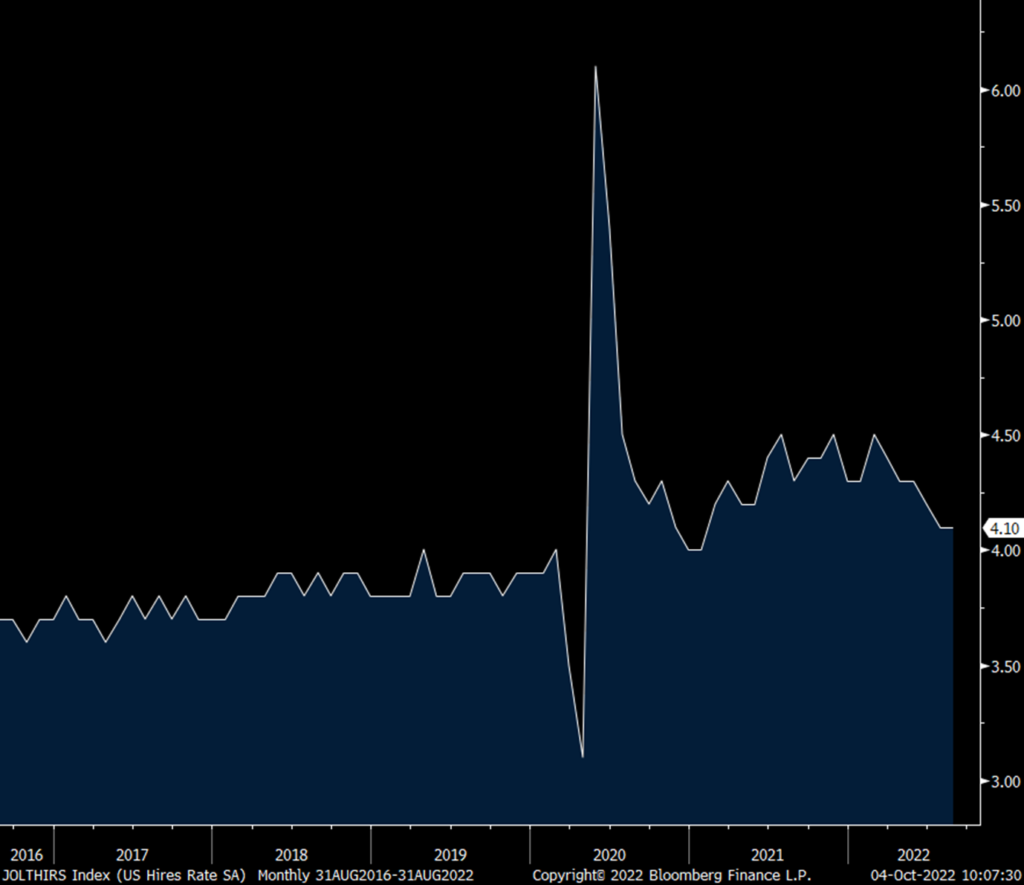

The number of job openings in August shrunk by more than 1mm to 10.05mm from a revised 11.17mm in July. That is the least amount since June 2021. The hiring rate held at 4.1% but that is the lowest since January 2021. The quit rate was also unchanged m/o/m at 2.7% and which matches the lowest since May 2021.

Job openings in the manufacturing sector slipped to the lowest since February 2022. In retail, the number of job openings are the smallest since December 2020. Job openings for leisure and hospitality fell too as they did for professional business, information and financial services. Construction interestingly is where job openings grew.

Bottom line, while there are still plenty of job openings around 10mm and as we continue to hear stories about the difficulty in finding workers in certain industries, it’s become clear that the first thing companies do when the macro environment becomes more challenging is to slow the pace of hiring’s. This data today is of course for August and Friday’s BLS September consensus estimate is for a job gain of 265k and that would be the least since April 2021.

Job Openings

Hiring Rate

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.