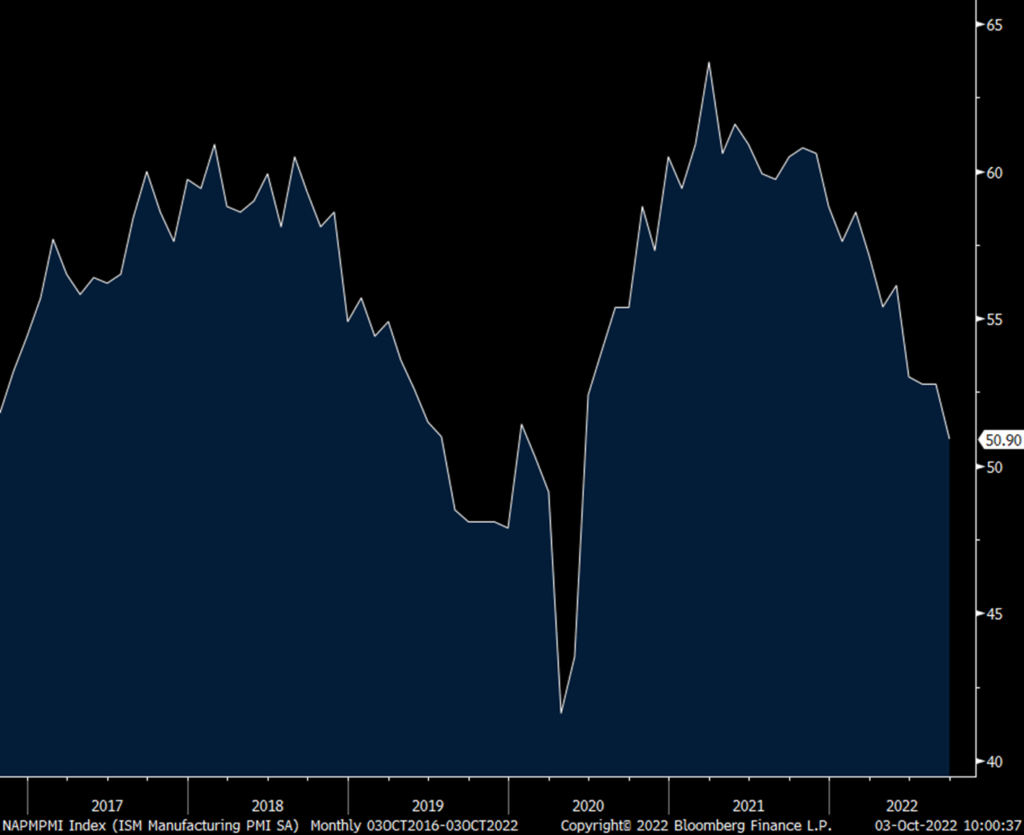

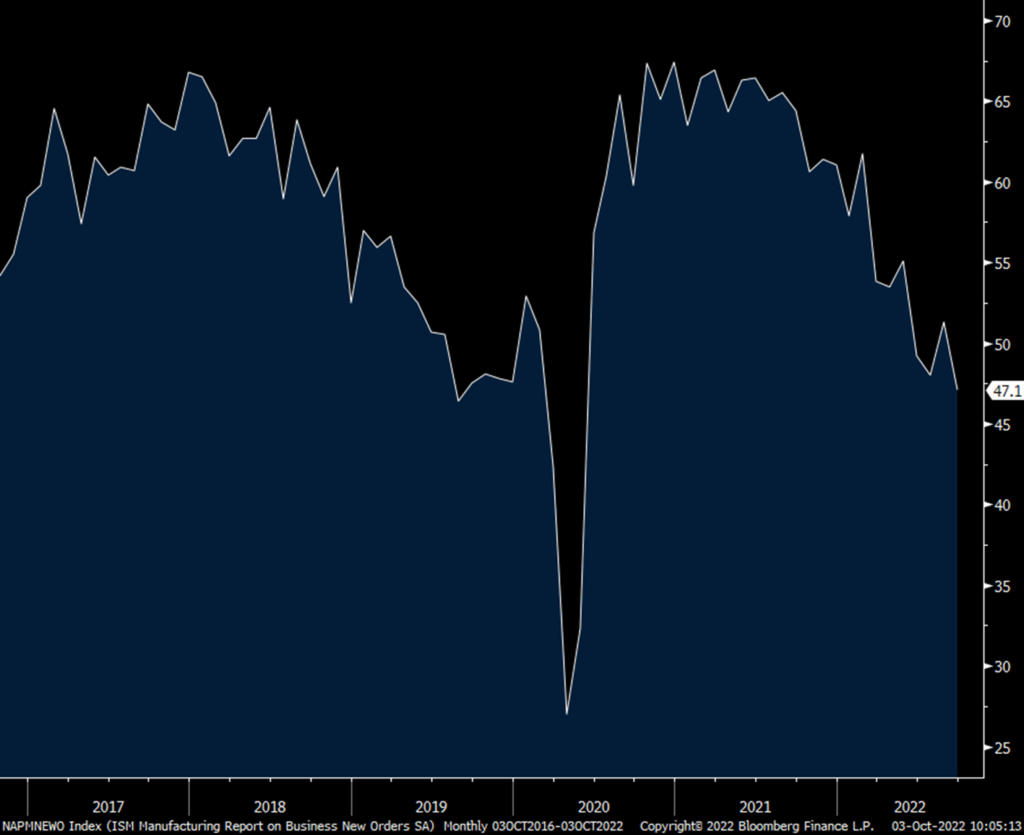

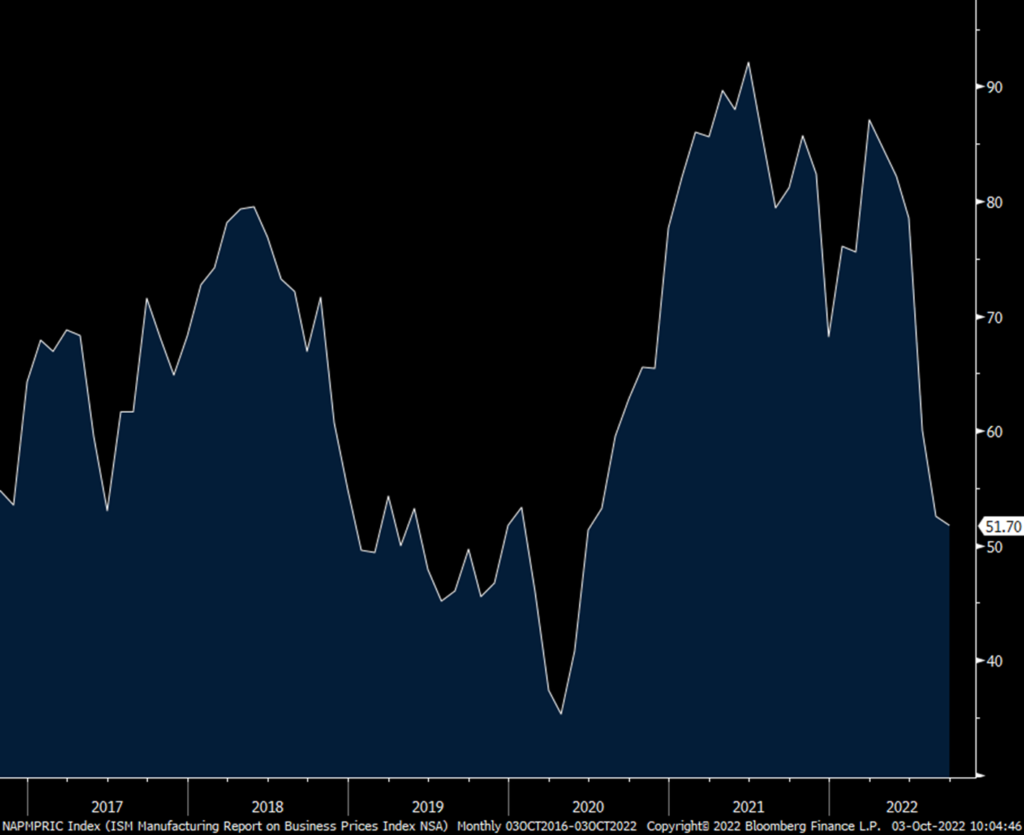

The September ISM manufacturing index fell to 50.9 from 52.8 and that was 1.1 pts below expectations. That’s the lowest since May 2020. New orders fell below 50 at 47.1 and is less than 50 for the 3rd month in the past 4. Backlogs slipped by 2.1 pts to 50.9. Inventories at manufacturers rose 2.4 pts after falling by 4 last month but of note, Customer Inventories rose 2.7 pts to 41.6. That is still well below 50 but the highest since June 2020. Export orders fell further below 50 at 47.8 from 49.4 in August and vs 54.4 in July. Imports were little changed. Employment dropped by 5.5 pts to 48.7 and is the 4th month in 5 below 50. Supplier deliveries eased again, down by 2.7 pts to 52.4 while prices paid fell .8 pts to 51.7, the lowest since May 2020.

In terms of breadth, 9 saw growth and 7 contracted with the balance seeing no growth. That compares with 10 reporting growth and 7 seeing a contraction in August with one experiencing no change.

Bottom line, the positive is the easing in supply pressures and the drop in prices paid, although it’s still a challenge broadly. The negative is that it’s coming because demand is very mixed domestically and faltering abroad. With respect to the labor market, which we know has really hung in there up until now, the ISM said this on the below 50 print, “Labor management sentiment shifted in September, with a higher number of panelists’ companies pausing hiring through hiring freezes and allowing attrition to reduce employment levels.” On the inventory situation, “Panelists’ companies continue to aggressively manage total supply chain inventories through a pausing of order placement in response to slowing in new order rates.”

The reaction to the upside in global bonds and drop in yields, and more so after this ISM figure, is at least for today, a shift towards the economic damage being done via higher interest rates, the spike in energy prices in Europe and the Chinese economic growth challenges. Also, the hope that Brainard’s Friday comments is the first step to a shift to a 50 bps rate hike from the previous run of 75 is likely helping. The dollar is selling off, gold is rallying with silver in particular sharply higher.

Some notable quotables:

“Supply chain issues for all electronic components and custom build-to-print materials are in short supply due to capacity and skilled labor shortages. Energy cost continues to negatively impact freight cost.” [Computer & Electronic Products]

“Concerns of global economic slowdown are growing, and (we are) experiencing some customers pulling back orders.” [Chemical Products]

“Production is steady, allowing reduction of backlog amidst slightly softened demand.” [Transportation Equipment]

“Almost all suppliers are experiencing lead times growth. It seems no one wants to keep inventory on hand anymore.” [Food, Beverage & Tobacco Products]

“Supply chain constraints on many items are still an issue; staffing on the production side continues to be a significant problem. In contrast, we have more stock than needed on some key items, specifically imports, and have begun reducing open purchase orders and decreasing extended forecasts on those items in order to bleed down inventory. [Machinery]

“Business continues to be strong. Some commodities within the supply chain are starting to stabilize, while others are still causing disruption for production. Electrical and wiring components continue to cause significant issues. We cannot run as consistently as we would like.” [Electrical Equipment, Appliances & Components]

“Quotes and orders still strong; however, we are not able to accept any new orders for shipment for the rest of 2022 due to motor and electronic component shortages. [Misc Mfr’g]

ISM Mfr’g

New Orders

Prices Paid

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.