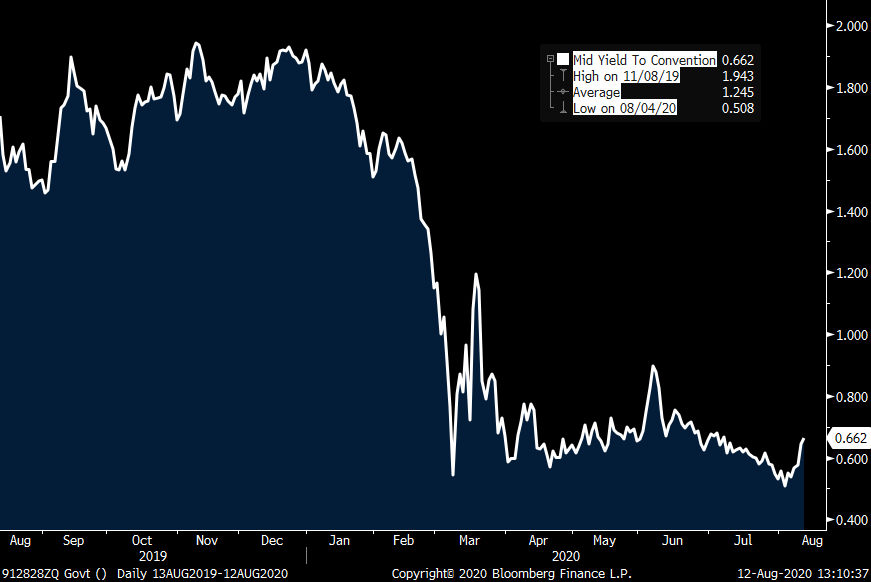

With the 10 yr note yield microscopic but at the highest level in 5 weeks, the 10 yr auction was pretty good. Positively, the yield of .677% was a hair under the when issued and direct and indirect bidders took about 80% of the auction, matching the most since April 2019. The fly though was the bid to cover of 2.41 which was slightly below the one year average of 2.45.

Bottom line, this week saw the first 6 handle on a 10 yr Treasury since July 27th and notwithstanding the hot CPI print that was enough to bring out some buyers. After touching .69% right after that CPI number hit the tape, the 10 yr yield has backed off to .66% after the auction.

The 10 yr inflation breakeven is higher by 2 bps to 1.64% after touching almost 1.67% this morning. The 5 yr breakeven is higher by 3.6 bps to 1.54% after to reaching 1.575% earlier.

If we do see continued higher inflation prints in the coming months/quarters and long rates do rise, will the Fed back off from QE because of that higher inflation or will they instead fight the rise in yields? Will be interesting quandary if it were to happen.

10 yr yield

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.