We know freight is slowing based on a bunch of data seen over the past few weeks and posted here and we’ve seen that also reflected in the selloff in transportation stocks. On Friday, Freightwaves said this, “In the first week of 2022’s 2nd quarter, tender volume levels continued their slide from the previous quarter – an early signal that freight demand in the spring could very well be sluggish. The Outbound Tender Volume Index (OVTI) still remains well below year ago levels, albeit against puzzling comps.” Here’s a chart and this is how CEO Craig Fuller described it on Twitter, “March 8 was the ‘cliff’ in freight demand. Its unlike anything we’ve seen before. Rapid deterioration in national freight demand. Spring is usually one of the best times.”

Notwithstanding this, I do want to make an important point that we really don’t have the answer to why such a dramatic shift just yet. We just don’t know how much of this is due to faltering US demand because inventory levels have been satisfied, this is a hangover from a lot of over ordering and consumers are buckling because of the drop in real wages OR how much of this is due to what is going on in Shanghai where the world’s largest port is disrupted because of the shutdowns. The latter will definitely have a profound effect on the world’s supply chains but I’m uncertain that it would show up so quickly as it feels like it just started. I’m thus leaning to the 1st reason, but which will be certainly exaggerated in the coming months by Shanghai’s challenges.

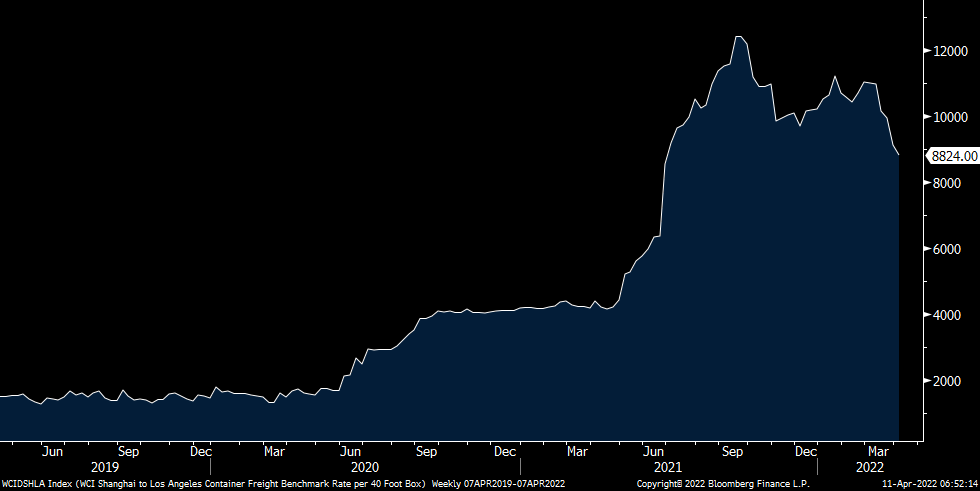

We are seeing a rather quick response however in the container shipping market where the World Container Index as of Thursday was pricing in a rate of a per 40 foot box from Shanghai to LA down to $8,824 from the recent peak of $11,197 in late January. It’s down noticeably in the past 4 weeks.

WCI Shanghai to LA per 40 ft Box

Chinese stocks by the way were down sharply overnight and we can blame another drop in oil prices to what is going on there.

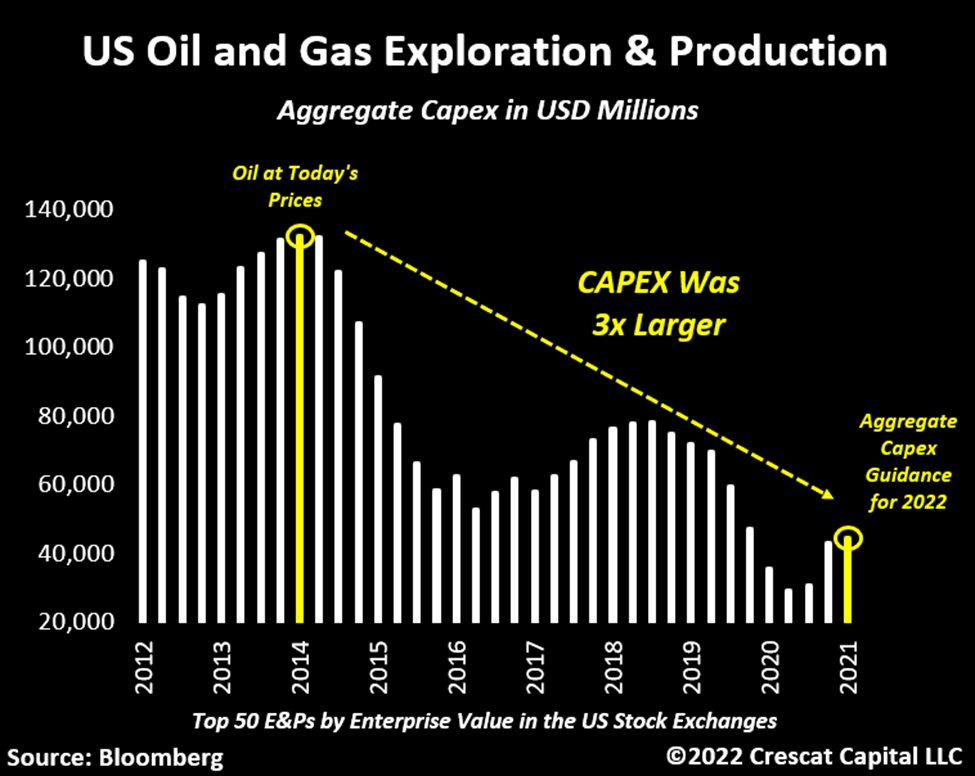

I do though remain bullish on energy stocks, something I’ve been since October 2020 and it is the lack of investment that is the big picture reason. This is a chart from my friend Tavi Costa at Crescat Capital that visualizes this case.

On Friday the CRB food price index closed at a fresh record high and just to quantify its impact, the World Bank estimates that food costs make up about 17% of consumer spending in developed economies. It gets to as much as 40% in some countries in Africa. With respect to Ukraine and what they’ve been able to plant now and thus harvest in the summer/fall, the UN Food and Agriculture Organization is currently estimating that they will plant between 70-80% of their land but not planting 20-30% is a huge amount.

CRB Food Index

Shifting to rates ahead of the US CPI tomorrow, the selloff started in Asia, spilled over to Europe and is resulting in the US 10 yr getting above 2.75%. Again, we are all in this together. The JGB market is again testing the BoJ as the 10 yr yield there closed at .24%. The South Korean 10 yr yield jumped 14 bps to 3.32%. That’s the highest since 2014. While the election news from France was positive for Macron and the European order, yields are jumping again there. The German 10 yr bund yield is up by 8 bps to .79% and that is the highest since July 2015.

The ECB by the way meets on Thursday and boy do they have a tough job ahead as Draghi left Lagarde a really tough situation but one she exacerbated by sticking to the ‘transitory’ theme.

Using TLT as the long maturity Treasury proxy, we are very oversold ahead of CPI tomorrow as measured by RSI and the single digit daily sentiment index overall for Treasuries so I wouldn’t be surprised if we saw a contra trend bounce after the number. I’m still a buyer though ONLY of short end bonds and am staying away still from duration of note.

Back to China, they did report loan data for March and after the distortion of the January/February Lunar New Yr noise, aggregate financing totaled 4.65T yuan, 1.1T above expectations with bank loans making up 3.13T of this. Money supply growth accelerated with this by 9.7% y/o/y vs the estimate of up 9.2% so officials are doing their best to cushion the slowdown. They have eased the rules on mortgage lending to households but sales are still down sharply. Bottom line, the Chinese economy, while maintaining its covid approach for now, is going to slow sharply this year with only the extent in question. They’ll tell us 4-5% but in reality I’ll take the under as long as they don’t change their covid rules.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.