In nominal terms in August, core retail sales were unchanged m/o/m, well under the estimate of up .5%. July was revised down by 4 tenths to a .4% gain. Overall sales, which include also gasoline, auto’s and building materials, saw a .3% gain so on an inflation adjusted basis, REAL retail sales were negative in August and expect a cut to GDP estimates today for Q3, particularly due to the weakness in core retail sales. Auto sales/parts grew by 2.8% m/o/m after dropping by 2% in July and are up by 9.5% y/o/y but that’s all inflation as August CPI said new car prices were up by 10.1%. Gas station sales were down by 4.2% m/o/m but still up 30% y/o/y. Builder material sales grew both m/o/m and y/o/y.

Furniture sales were down for a 4th straight month in August and are flat m/o/m for reasons we’re well aware of. Sales of electronics were down .1% m/o/m and by 5.2% y/o/y. Sales for clothing in the important back to school month (July too for those school systems that start in August) rose .4% m/o/m after dropping by .8% in July. They are up 3.7% y/o/y. Department store sales rebounded after two months of declines. Online retail sales fell by .7% after a 1.8% rise in July that was goosed by Prime Day. They are up 12.3% y/o/y. Sales of restaurant/bars rose by 1.1% m/o/m and 10.8% y/o/y.

Bottom line, higher inflation drove the top line sales figure but volumes are obviously falling because on a real basis, sales are negative. Core retail sales being well below expectations will result in a cut to GDP estimates for Q3 as stated.

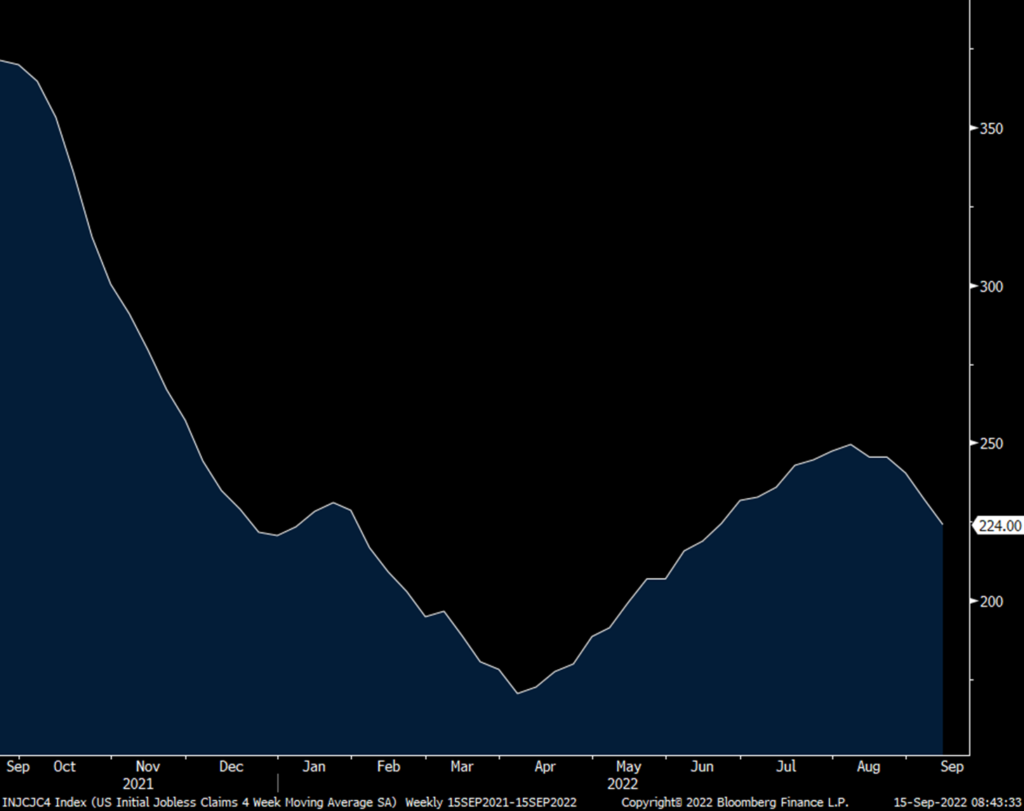

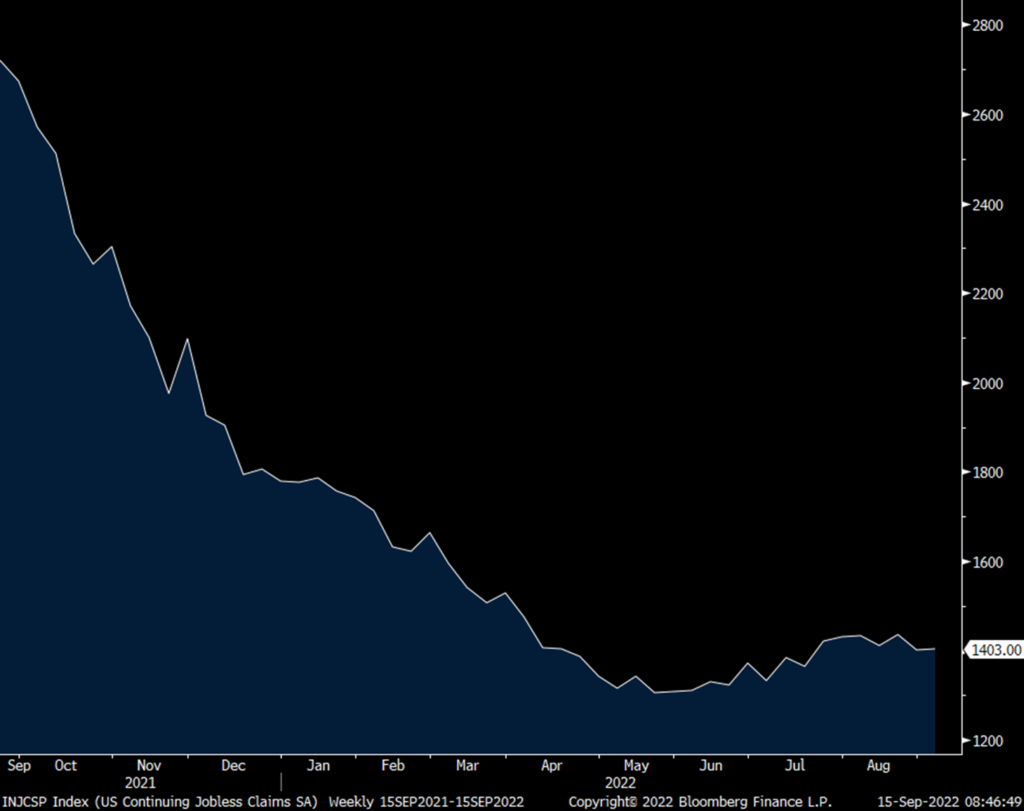

Initial jobless claims totaled 213k, 14k below expectations and vs 218k last week which was revised down by 4k. The 4k week average fell to 224k from 232k and that’s the lowest since mid June. Continuing claims were 1.403mm, well under the estimate of 75k and last week was revised down by 72k to 1.401mm. Bottom line, it’s clear that with labor shortages still apparent, the desire to hold on to tough to find workers, and laid off tech workers quickly finding new jobs, the level of claims filings still remains very low. That said, they are still off the April lows of 171k and changes in the labor force are typically lagging.

4 Week Average Initial Claims

Continuing Claims

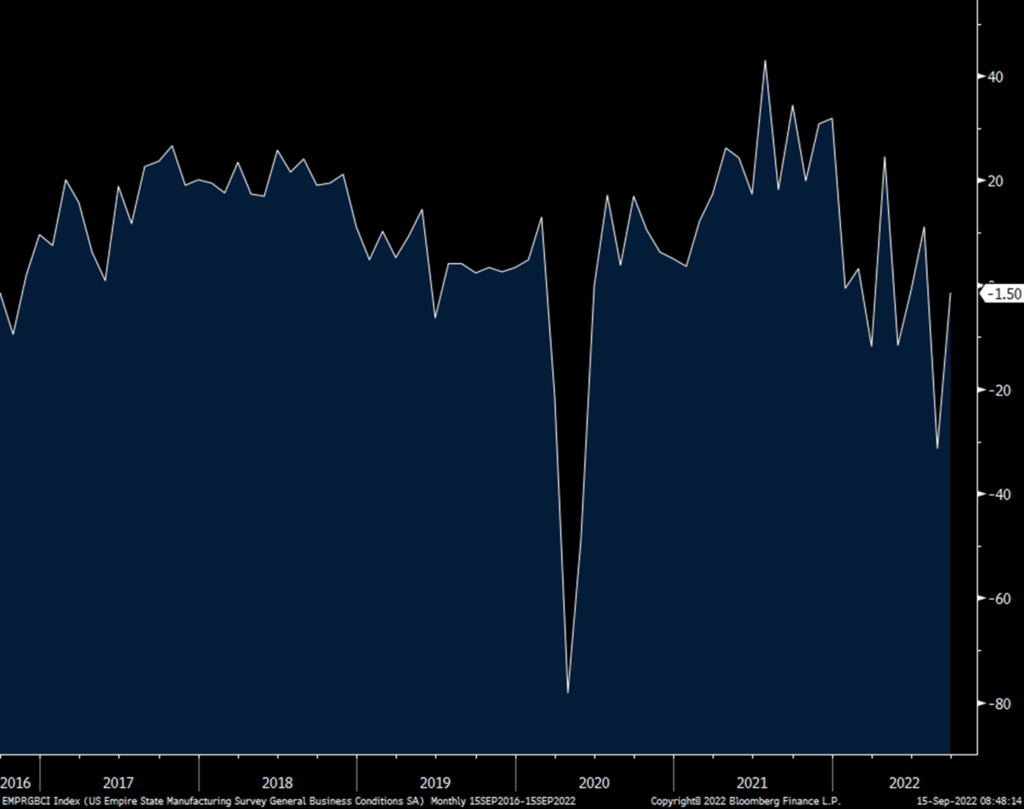

Both the NY and Philly September manufacturing surveys are in contraction. The NY figure was -1.5, after the disaster August print of -31.3, but that wasn’t as bad as the estimate of -12.9. The internals are so volatile with new orders at +3.7 after collapsing to -29.6 in August. Backlogs were below zero for a 4th straight month. Employment rose a touch after falling by more than half in August. The workweek was flat. Delivery times went back above zero but prices paid and received each fell sharply. Inventories rose but are below the 6 month average.

The 6 month business outlook was 8.2 vs 2.1 in August, -6.2 in July and +14 in June. Cap ex plans did rise after falling last month.

NY Mfr’g

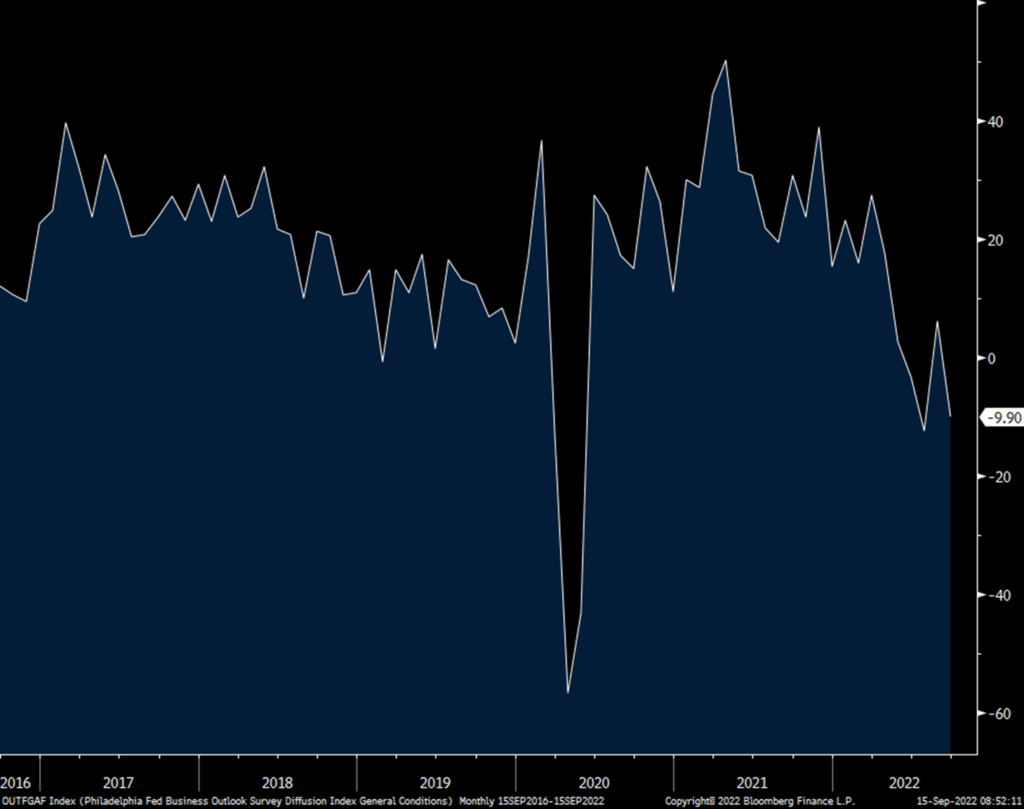

The Philly print of -9.9 is after a +6.2 read in August and that was below the estimate of +2.2. It’s negative for the 3rd month in 4. New orders were deeply negative at -17.6, below zero for a 4th month. Backlogs were also negative for a 4th month. Employment weakened and supplier deliveries dropped. Inventories went back below zero. Prices paid fell sharply but those received were higher.

The 6 month business outlook was -3.9, also negative for a 4th month. Capital spending plans fell almost 14 pts but after rising by a like amount last month.

Bottom line, if what we’re heard from Eastman Chemical, Nucor, Arconic and Alcoa and now two regional surveys reflecting contraction, on top of a negative real retail sales number for August, are we still debating whether the economy is in a recession or not? Labor data is lagging as said.

In response to the softer data, Treasuries have rallied off their early morning lows.

Philly Mfr’g

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.