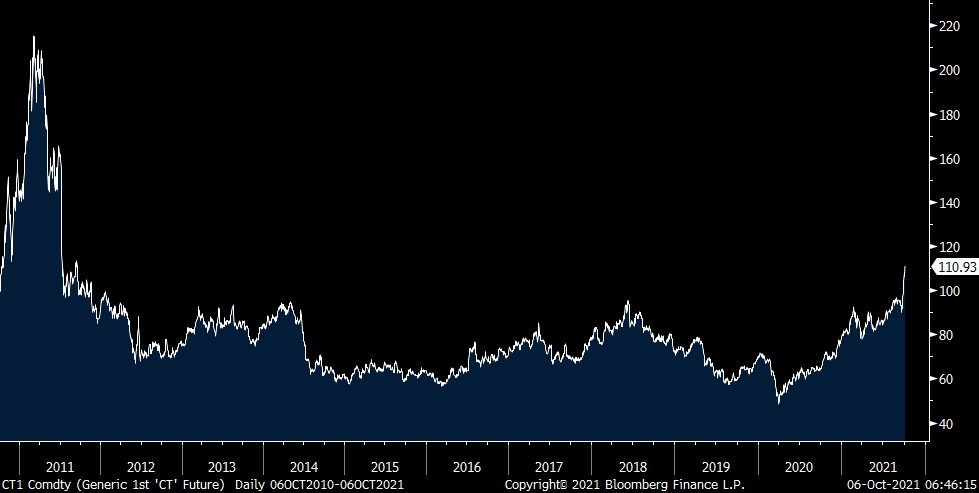

That 2.3% Atlanta Fed GDPNow forecast as of Friday that I mentioned yesterday morning, down from 6% two months ago was downgraded further on Tuesday to 1.3%. Inflation and the lack of supply of so many things are written all over this. And now we can throw in the rising cost of energy and power with the prices of both going parabolic. Here again are charts of US natural gas, European natural gas and a new chart, that of German power prices. By the way, have you seen what the price of cotton has done? It’s up 74% since October 2019 to a 10 yr high.

US NATURAL GAS

DUTCH NATURAL GAS

GERMAN BASELOAD ELECTRICITY FORWARD PRICES

COTTON

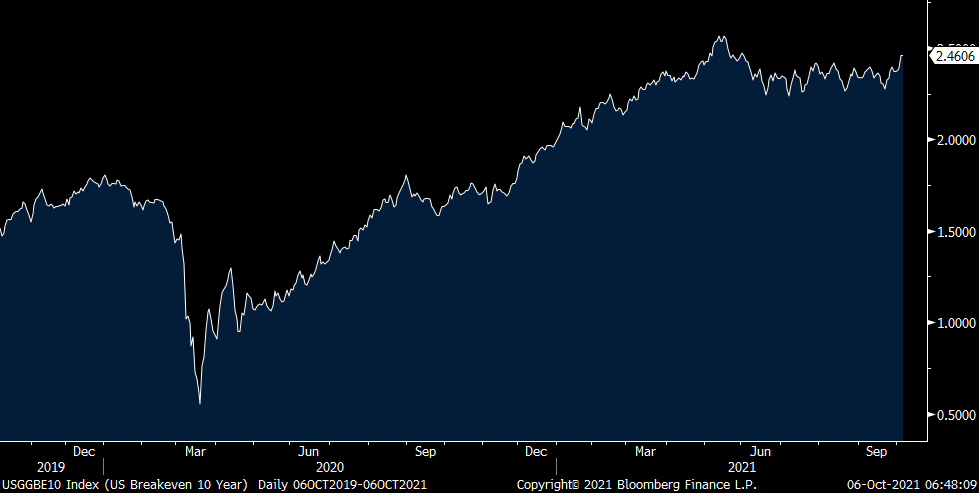

After consolidating for the past 4 months, the 10 yr US inflation breakeven is back to a 4 month high as of yesterday’s close thanks to the rise in energy prices. And they are rising to a fresh 6 yr high in Europe where European sovereign nominal yields are higher across the board.

I’ll say this again, central banks have essentially left the world’s bond markets naked in yield defenses against a period of higher inflation. Higher inflation that of course these same central banks have been rooting for. If negative rates didn’t exist, if the fed funds rate was 3% and the US 10 yr at 4% for example, there would be a nice cushion against inflation. But of course, we have none of that now. And don’t get me started on the Fed’s relatively new policy of inflation symmetry and tolerating a period of higher inflation to offset one that is lower. They should try to explain that one to lower income people and if only someone in Congress fully understood it.

US 10 yr INFLATION BREAKEVEN

The Reserve Bank of New Zealand raised interest rates by 25 bps to .50% as expected and laid the groundwork for more, “it is appropriate to continue reducing the level of monetary stimulus so as to maintain low inflation and support maximum sustainable employment.” Notice how they said ‘low inflation’ first as that is what is necessary to ‘support maximum sustainable employment.’ You’ll never have the latter without first the former. The Fed has forgotten that and why they still have not started the taper yet and rates will still be at zero for at least another year.

The Bank of Korea, which raised interest rates a few weeks ago, will likely do so again soon after September CPI rose .5% m/o/m after a .6% rise in August. That was one tenth more than expected and up 2.5% y/o/y. The core rate was higher by 1.9% y/o/y.

The September Hong Kong PMI fell to 51.7 from 53.3. Blame the strict Covid restrictions but also the supply chain constraints. On pricing, “Although firms continued to share these cost burdens with clients, overall input price inflation continued to exceed that of output charges, indicating pressure on the margins.”

While it’s an August number and thus somewhat dated, German factory orders fell by 7.7% which was well worse than the forecast of a drop of 2.2% and was only slightly offset by a 150 bps upward revision to July. We know what we can blame here. The 10 yr German inflation breakeven is at a fresh 8+ yr high.

GERMAN 10 yr INFLATION BREAKEVEN

Lastly, with another tick up in the average 30 yr mortgage rate to 3.14%, the highest since early July but still so historically low, mortgage apps fell by 7%. Purchases were down by 1.7% w/o/w and 12.6% y/o/y while refi’s were lower by 9.6% w/o/w and 16% y/o/y. There is growing evidence that the very sharp rise in home prices is beginning to moderate because buyers are calling a timeout. The demand is still there but again, just not as much at current prices.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.