Japan said consumer prices in March in Tokyo rose .3% y/o/y ex food and fuel. That was up from .2% in February and one tenth more than expected. March saw on and off restrictions in Tokyo and ran up against a 7 tenths increase comp from one year ago. As price gains remain benign but with higher energy prices soon to be lifting the topline back into positive territory, inflation breakevens were unchanged. The yen is weaker for a 3rd day but it’s the only major currency the dollar is higher against today and that lower yen helped the Nikkei to rally by 1.6%.

Speaking of the dollar, the DXY closed just above its 200 day moving average yesterday (which trended above the 50 day MA back last July) and thus is at a key technical level. The bearish sentiment on the dollar a few months ago got extreme for sure and we’ve had this bounce but I think the secular trend remains down, especially with the ever persistent budget and trade deficits the US has in place.

DXY

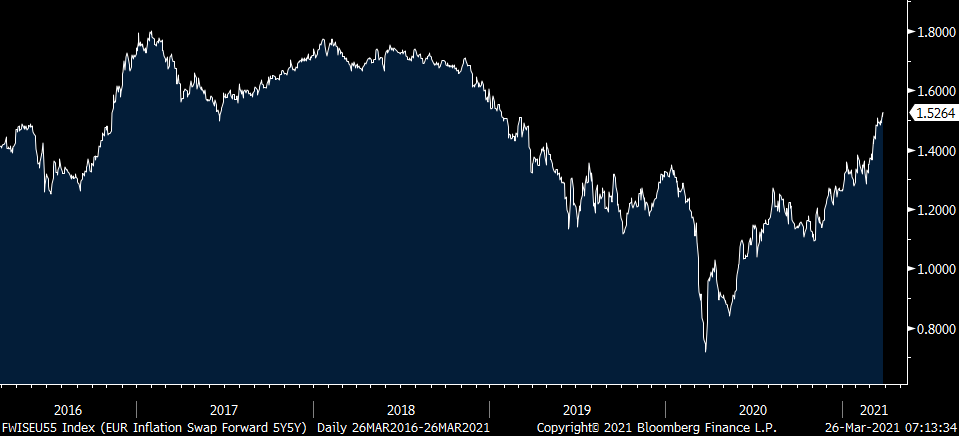

The euro is rising after declines in 8 out of the last 10 days after the March German IFO business confidence index rose 3.9 pts m/o/m to 96.6 and which was 3.4 pts better than expected. The Expectations component rose 5.4 pts and the Current Assessment was up by 2.4 pts. The IFO said succinctly “Despite the rising rate of infections, the German economy is entering the spring with confidence.” We saw the same yesterday with French business confidence. Bond yields in Europe are rising after 5 days in a row of declines. The German 10 yr bund yield in particular is up by 3.3 bps to .35%. We talk a lot here about when and how the Fed will eventually end their emergency policy even though we are far away from the emergency but when the time comes in Europe, that would be even more profound for what it will mean for their bond markets considering NIRP. The 5 yr 5 yr euro inflation swap is at a fresh 2 yr high up 2 bps to 1.53%.

GERMAN IFO

5 yr 5 yr Euro Inflation Swap

Business confidence in Italy in March rose .6 pts m/o/m to the highest in a year with the strength in manufacturing and construction while services and retail fell due to the lockdowns. We’ll see what magic Draghi can spin for the Italian economy in the quarters to come.

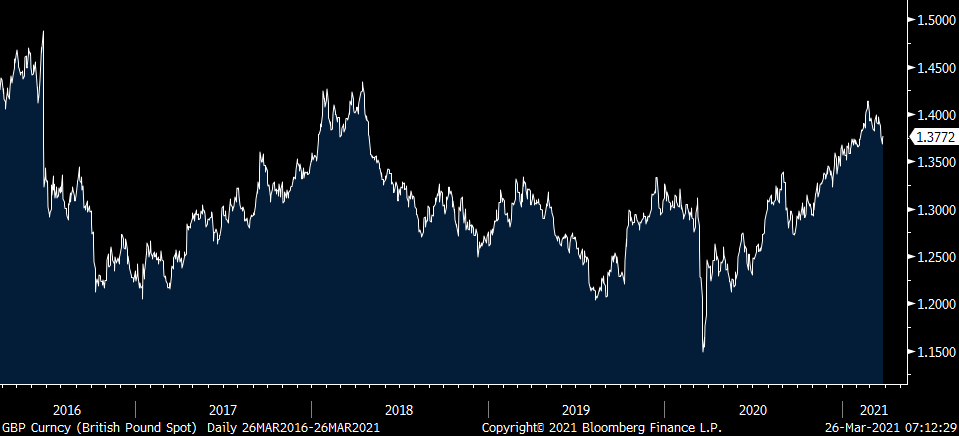

Capturing the stop and start shutdowns, UK retail sales did rebound in February by 2.4% m/o/m but only after an 8.7% drop in January. They still fell y/o/y but this is all old news as the UK has done a great job with giving out vaccines and the coming months should get much better with their economy. About 45% of the UK population has at least one shot. The pound is up for a 2nd day and I still believe the pound is headed back to $1.45-$1.50 which where it stood pre Brexit vote vs $1.377 today.

BRITISH POUND

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.