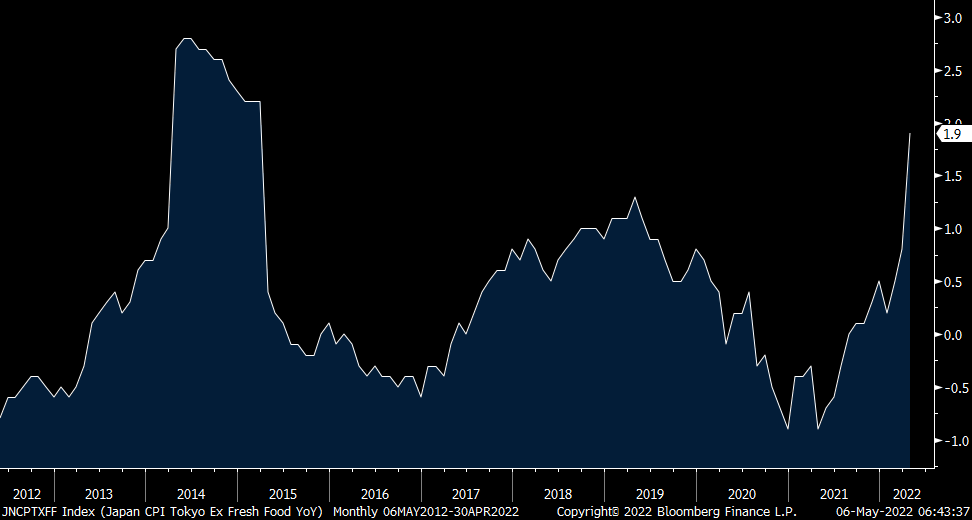

We’re about to get another test of the upper end of the BoJ yield curve control range of .25% after Tokyo said its April headline CPI rose 2.5% y/o/y, 2 tenths more than expected and up by 1.9% also ex food. Now the 2% target of the BoJ is just ex food. If we take out both energy and food, prices were up .8% y/o/y, two tenths more than forecasted. Month after month I’ve been talking about the depressing factor of a 50%ish decline in cell phone fees on CPI. Well, that has now recycled through, and this is the result. Obviously these figures are much more benign than many of us are seeing elsewhere but its the rate of change here that matters and in the context of a 10 yr yield of just .24% as of last night.

The 10 yr inflation breakeven rose 3.3 bps to 1.00%, the first time there since July 2015. The 10 yr JGB yield rose 1.3 bps to .244% and the 40 yr yield, least influenced by YCC, rose 3.3 bps to 1.12%, just off the highest since 2016. I will state again my belief that if the BoJ ends up widening its YCC band to say .50-.75%, we’ll see another round of global bond selling. As the other pressure point, and part of this debate, is the yen, it is down modestly after yesterday’s selloff.

Other Asian bond markets sold off too and it’s spilling over to Europe and the US. The German 10 yr bund yield is up by 5 bps to 1.09%, the highest since August 2014, two months after the ECB decided to cut rates below zero and something they are now realizing how difficult it is to rid themselves of it.

Tokyo CPI y/o/y ex food

Japan 10 yr Inflation Breakeven

German 10 yr Bund Yield

With the Fed now out of its quiet period, out they come today to tell us how hawkish they now are. Williams, Kashkari, Bostic, Bullard, Waller and Daly are all out on the stump in differing venues and the same people who contributed to this mess will explain how they will get us out.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.