The February CPI rose .4% m/o/m headline as expected while the core rate was up by .5% m/o/m, one tenth above what was expected. The y/o/y gains are 6% and 5.5% respectively vs 6.4% and 5.6% in the month before.

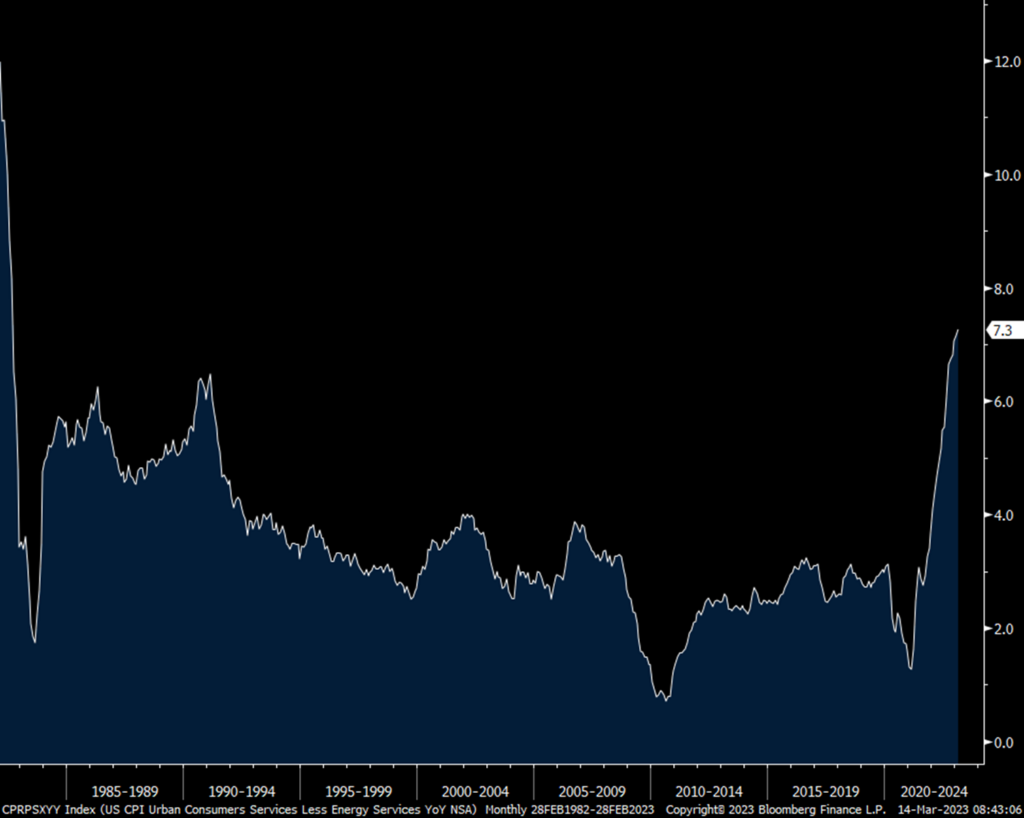

With respect to services, prices ex energy rose .6% m/o/m and 7.3% y/o/y with the latter at a fresh 41 yr high. Rental growth is still playing catch up and is also old news but heavily influencing this data. Owners’ Equivalent Rent was up .7% m/o/m and 8% y/o/y. Rent of Primary Residence was up by .8% m/o/m and 8.8% y/o/y. Based on real world data points, rent growth is now running at less than half this for new leases and renewals. Medical care costs fell .5% m/o/m while up 2.3% y/o/y because of lower health insurance prices (for the methodology quirk I’ve talked about each month over the past 6) which were down by 4.1% m/o/m. After some robust price increases, the price of motor vehicle maintenance was up .2% m/o/m and still up 12.5% y/o/y. Car insurance prices jumped another .9% m/o/m after a 1.4% jump in January and are up 14.5% y/o/y. Airline fares grew by 6.4% in the month and by 26.5% y/o/y.

On the goods side, core prices were unchanged and no longer falling for a 2nd month and are up 1% y/o/y, the slowest since August 2020. Used car prices at retail fell 2.8% m/o/m (should reverse up again as wholesale prices are inflecting higher) and down by 13.6% y/o/y. New car prices continued to rise, by .2% in the month and by 5.8% vs last year. Apparel prices jumped by .8% for a 2nd month, and by 3.3% y/o/y. Prices related to the home are still rising briskly, up by .8% m/o/m and by 6.3% y/o/y.

Bottom line, we have again a further acceleration in service prices that is offsetting the continued moderation in goods prices. That said, we know rental growth is being way overstated but should still growth 3-4% sustainably after the current supply increase gets absorbed as the demand is still very solid. Goods prices on the other hand have likely bottomed on the downside of the spike. The combination is still going to lead to slower but sustainable inflation and why the Fed is going to hike rates by 25 bps next week but likely pause thereafter. The call for a rate cut next week by a particular bank makes no sense to me as the Fed would look so weak in doing so and would make all the vocal hawks look silly.

I want to also say this, this will be the first rate hiking cycle in 40 yrs where the Fed’s ability to pivot aggressively with rate cuts thereafter in reacting to an economic downturn is going to be extremely limited as long as inflation remains so much above its 2% target. Those looking for the Fed to save them in the coming recession will have to temper their expectations I believe.

In response to the persistent inflation report, the 5 yr inflation breakeven is getting back what it lost yesterday and rising by 8 bps to 2.42%, though still down from the near 2.80% it saw two weeks ago before some banks blew up. The 2 yr yield was up about where it was right before the report. The odds of a 25 bps rate hike next week is 84%.

Services Inflation ex energy y/o/y

Core Goods Prices y/o/y

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.