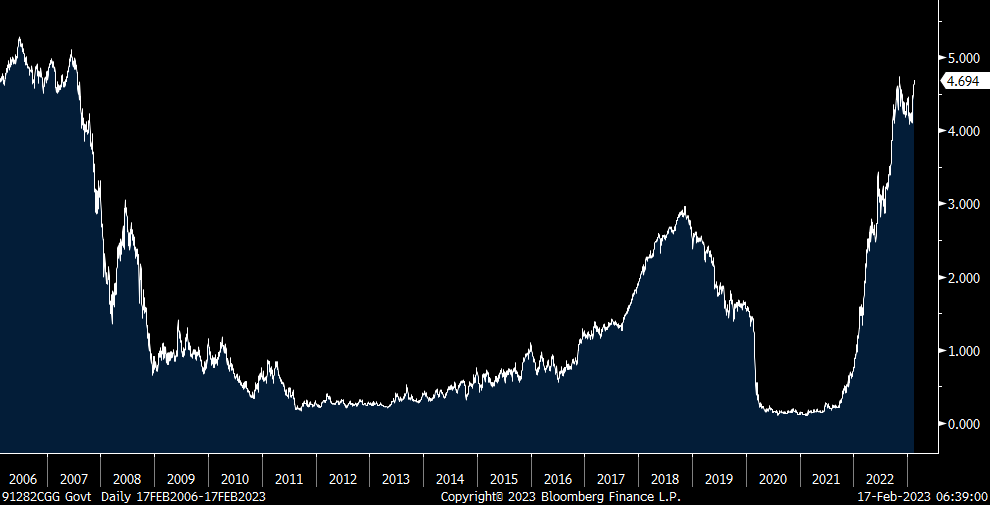

The 2 yr yield is now testing that 16 yr high that 6 month and 1 yr bills achieved this week. Clearing 4.72% would do so. At 4.68% currently, it’s up about 60 bps since the day before that January payroll report. While the comments yesterday from Fed president’s Mester and Bullard (who don’t vote this year) got notice that they each wanted a 50 bps hike at the previous FOMC meeting, we had more than enough guidance going into the last Fed hike from others that do vote that 25 bps was going to be the new norm and that won’t change. So, if the Fed is going to hike another 2-3 more times (with the 3rd being something new being partly priced in), it will be in 25 bps increments.

Again though, considering the 450 bps of hikes already done, another 50 or 75 bps really doesn’t matter at this point but it does hammer home this new rate world we’re in that some still seem to be in denial about. The Treasury market quickly took notice over the past two weeks but the stock market up until yesterday has been in LA LA land.

2 yr Yield

We know consumer product companies have been very aggressive in raising prices at the expense of volumes as we heard a lot about low elasticities. But there are limits to this strategy and at least Kraft Heinz believes they have reached it. After raising prices by a whopping 15% in 2022, the CEO on their earnings call Wednesday said “As we look to the rest of the year, we have no current plan to announce new pricing in North America, Europe, Latin America and most of Asia.” So at least from Kraft, their ‘inflation’ will be zero y/o/y in 2023 and that is what the Fed and markets care about, but the cost of living bar is still up sharply.

Under pressure too from falling real wages didn’t stop a better than expected UK retail sales figure for January. Ex auto fuel sales rose .4% m/o/m instead of falling by 2 tenths as forecasted. That though was partially offset by a 3 tenths downward revision to December. As seen in the US, January is a big discounting month and all those gift cards given in December are used.

This is not a market moving number but the bond selloff is global and yields in both Asia and Europe are notably higher too.

Germany said its January PPI rose 17.8% y/o/y, a crushing number but a slowdown from the 21.6% increase seen in December, the peak of 46% last August and it was down 1% m/o/m. Energy subsidies on top of the fall in energy prices has certainly helped to finally see some moderation. This also is not market moving and German inflation breakevens are unchanged. That said, we continue to get tough talk from most ECB central bankers. I say ‘most’ because some doves will always be doves that are not entirely comfortable with 50 bps rate hikes.

She should have been talking to US markets too but ECB council member Isabel Schnabel and a noted hawk said today “Markets are priced for perfection. They assume inflation is going to come down very quickly toward 2% and it is going to stay there, while the economy will do just fine. That would be a very good outcome, but there is a risk that inflation proves to be more persistent than is currently priced by financial markets.”

German PPI y/o/y

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.