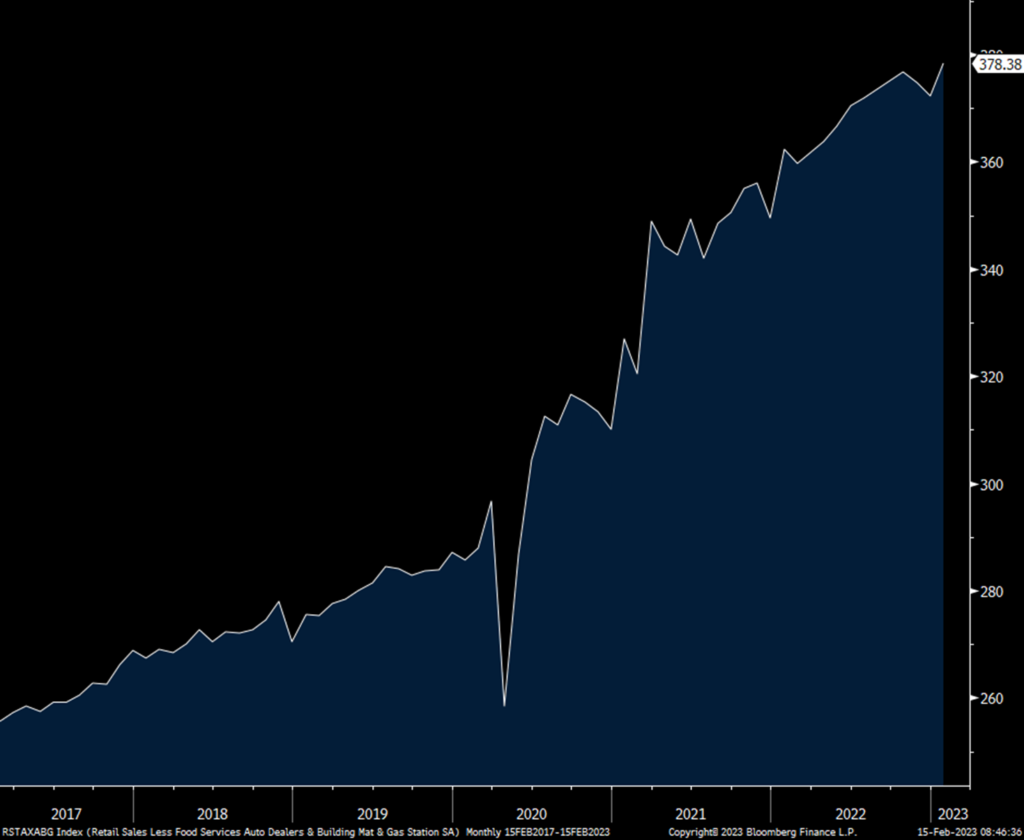

Core retail sales in January, the post holiday hangover and discount and returns filled month, was better than expected with a 1.7% m/o/m increase vs the estimate of 1%. The internals were quite interesting as department store sales jumped 17.5% m/o/m after 3 months of declines. Anyone care to chime in on why because I don’t know. Eating/drinking out saw a 7.5% m/o/m sales jump. Sales of electronics rose 3.5% m/o/m and that is the first increase since April 2022. Sales of furniture rose 4.4% m/o/m after declines seen in 3 out of the last 4 months. Online retail sales grew by 1.3% m/o/m but after dropping also in 3 out of the last 4 months. Clothing sales were up by 2.5% m/o/m following 3 straight months of declines. Building material sales rose by .3% m/o/m. Auto sales increased by 5.9% m/o/m after a drop in 3 out of the prior 4 months.

Bottom line, retail sales in January were certainly better than expected but comes after declines seen in the key November and December time frame. For core retail sales, they are up just .4% nominally since October in total. Yields jumped right after the report hit the tape with the 2 yr yield getting near 4.7% but it has since backed off to 4.63% as maybe people are wondering what’s going on too with department stores.

Core Retail Sales in nominal $ terms

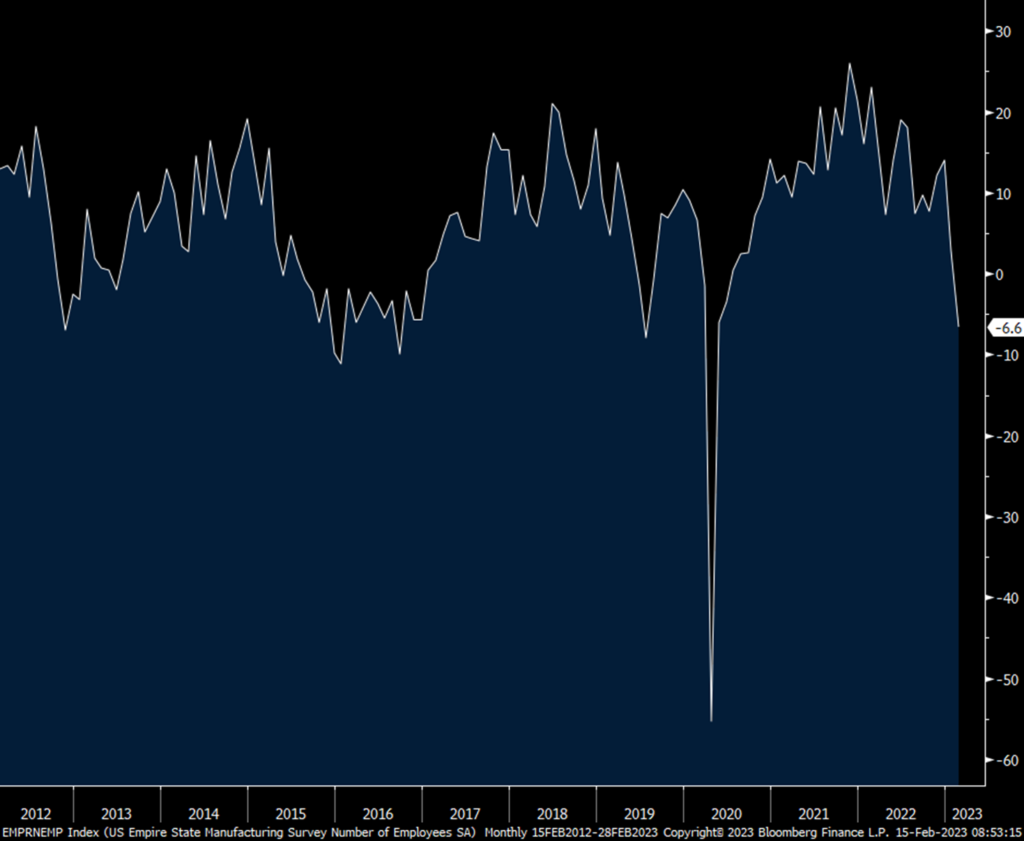

The February NY manufacturing index, the first February industrial number to be seen, rose to -5.8 from -32.9 and that was better than the estimate of -18. It is still below zero however for the 3rd straight month and 6th month in the past 7. New orders at -7.8 are below zero for the 4th straight month and compares with the 6 month average of -6.4. Backlogs are under zero for a 9th straight month at -9.2, just below the 6 month average. Inventories rose 1.9 pts to 6.4 which is 1 pt less than the half yr average. Delivery times improved again. Prices paid jumped 12 pts but after falling by 17 pts last month. Those received rose to a 6 month high, up 10 pts. Of note, the employment component went negative for the first time since 2016 if we don’t include covid. Also, the workweek fell deeper below zero at -12.1.

While the manufacturing sector is in a recession, and the first February region to report confirmed in the NY area it is continuing, there is optimism as the 6 month outlook improved to 14.7 from 8. Capital spending plans though did slip but is very volatile month to month. The Philly index comes tomorrow and expectations are for it to be in contraction again too.

NY Mfr’g

Employment

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.