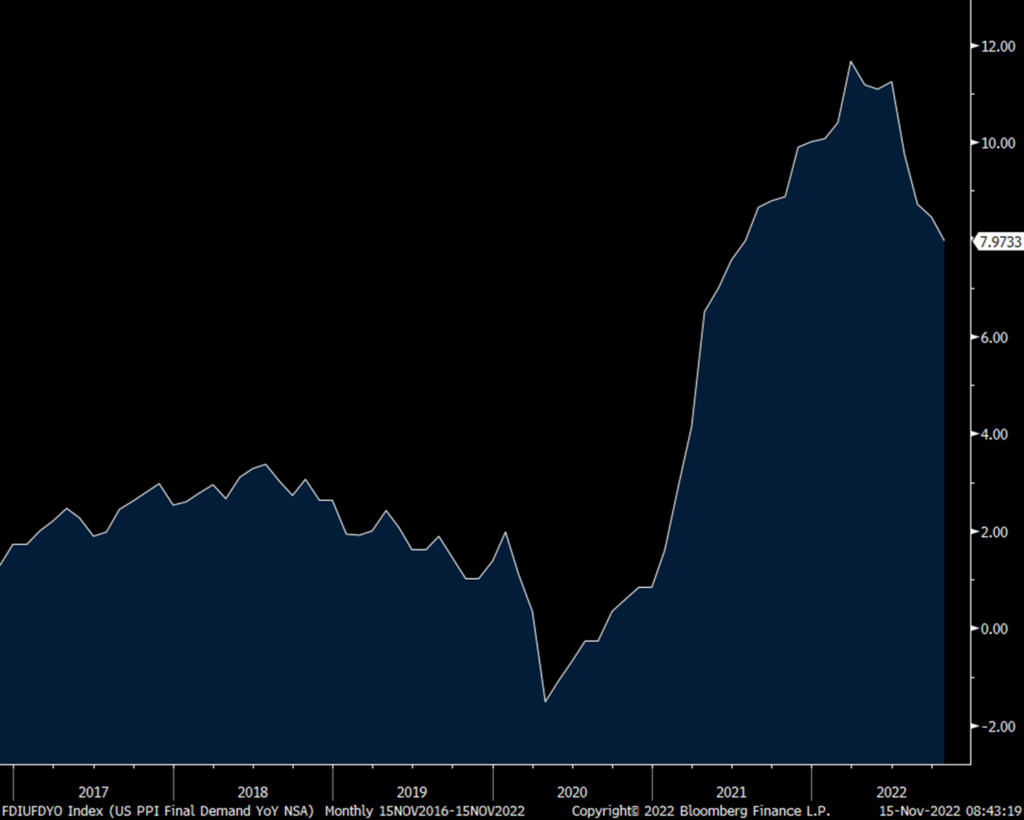

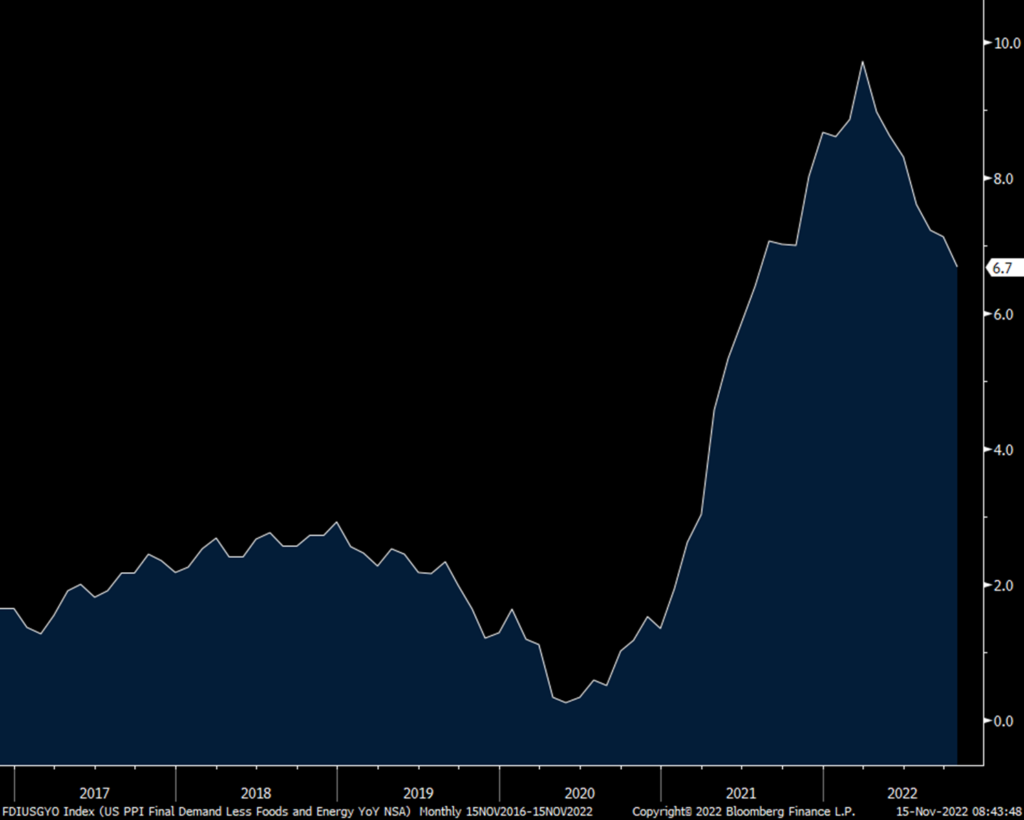

Headline PPI in October was up .2% m/o/m, half the estimate after a .2% increase in September which was revised down by 2 tenths. The core rate was unchanged m/o/m, 3 tenths less than expected and September was revised down by one tenth. If we also take out trade, prices were up .2% m/o/m, one tenth below the forecast and the prior month was also revised lower by one tenth. Versus last year, headline PPI was higher by 8%, 6.7% ex food and energy and 5.4% also taking out trade.

Goods prices rose .6% m/o/m with food up by .5% and energy higher by 2.7% m/o/m but taking both out saw goods prices down by one tenth. Core goods prices are up 6.6% y/o/y. Passenger car prices in particular dropped 1.5%.

Service prices fell one tenth m/o/m with trade lower by .5% and transportation/warehousing weakening by two tenths and lower for the 4th straight month (though still up 16% y/o/y). Service prices are up 6.3% y/o/y. Weighing on prices were declines in ‘portfolio management’, auto retailing (likely used cars) and equipment wholesaling.

Inflation in the pipeline, as measured by processed and unprocessed goods, at the core level both fell m/o/m and the robust y/o/y gains are moderating (partly due to very tough comps).

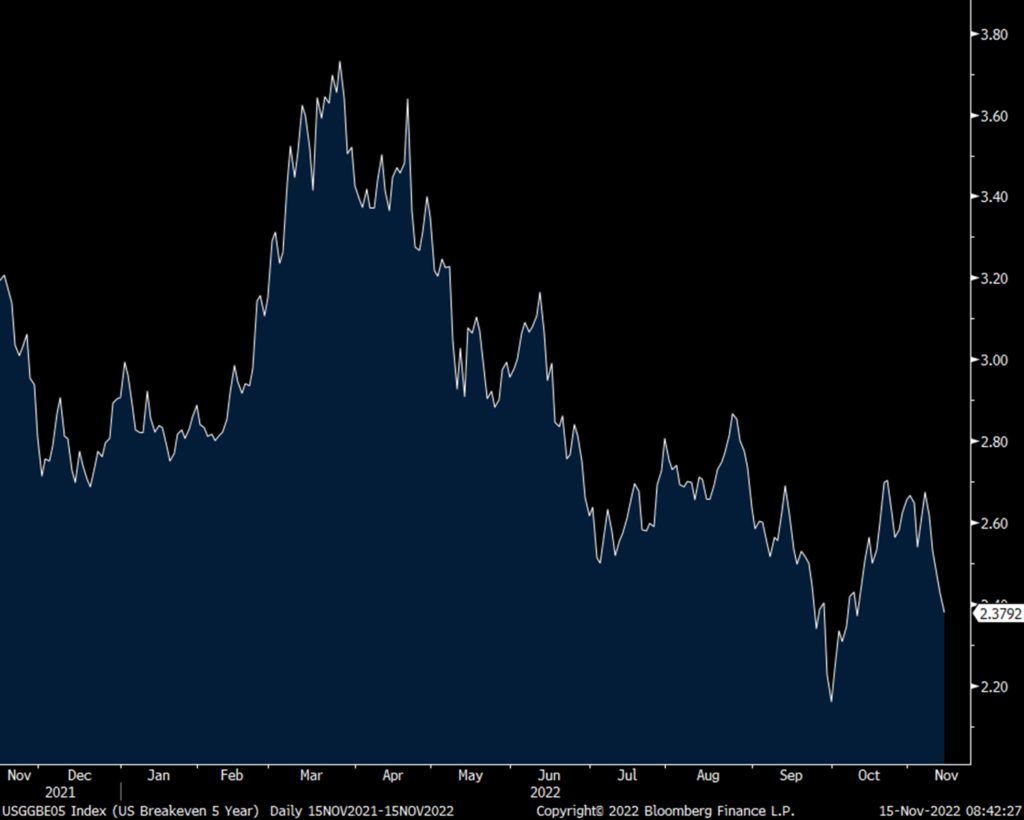

Bottom line, this data is further confirmation of the peak for now in inflation, evidence that we’ve been seeing for months. The question still unanswered is where does it settle out when all is said and done. Will CPI go back to the 1-2% pre covid level just like that or did something structural change and we’re going to have to get used to 3-4%. I’m in the latter camp as you know. Inflation breakevens are dipping in response. The 5 yr breakeven is down by 5 bps to 2.37% while the 10 yr is down by 3.5 bps to 2.34%.

Maybe my stated belief that the Fed will be done hiking after another 50 bps hike next month isn’t too far off. That said, wherever it ends up, it will stay there for a while and that is the next thing to get used to.

PPI y/o/y

Core PPI y/o/y

5 yr Inflation Breakeven

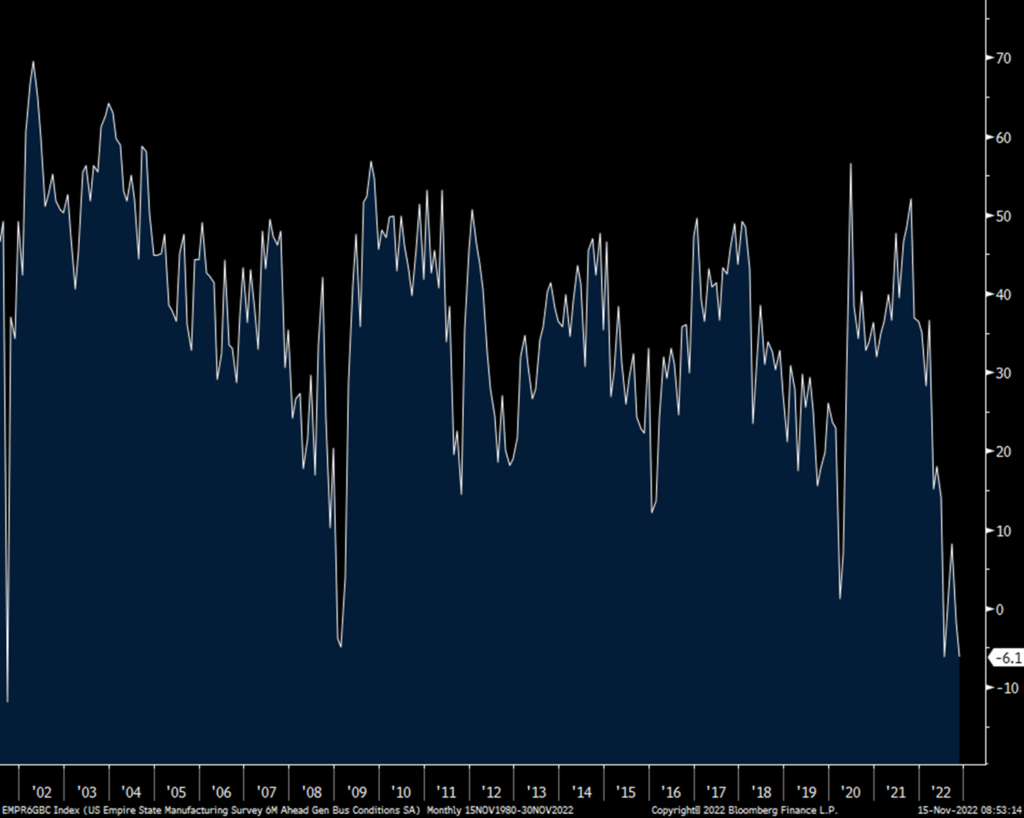

After 3 straight months of below zero prints, the November NY manufacturing index was +4.5, about 10 pts better than anticipated. The internals though were mixed as new orders fell back below zero and backlogs weakened further and is below zero for the 6th straight month. Inventories jumped by 12 pts to a 5 month high. Delivery constraints rebounded and prices paid and received bounced. Employment was a positive, rising to a 4 month high and the workweek was higher too.

A negative was the 6 month business outlook which fell to -6.1 and that is just .1 pt off the weakest since 2001. Capital spending plans softened with tech spending plans in particular at the lowest since June 2020.

Bottom line, after a string of negative prints, the NY survey saw some stabilization but with a lot of mixed messages and expectations of contraction in the coming 6 months.

NY Mfr’g

6 Month Business Outlook

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.