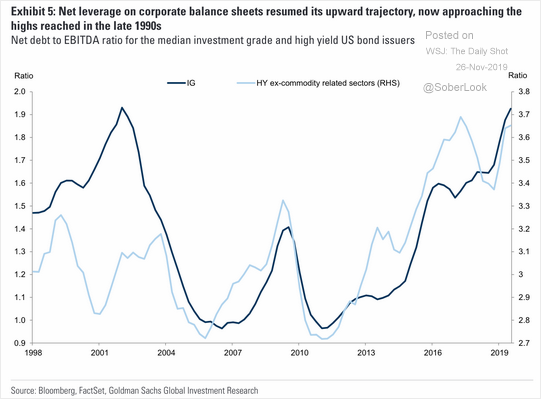

Yesterday after I heard Dallas Fed President Robert Kaplan again express his concern with the high levels of corporate debt I found this chart on the WSJ Daily Shot from Goldman Sachs highlighting the net debt to EBITDA ratios for the median IG and HY ex commodity related company. It’s a good visual to what extent corporate cash flows are being asked to service debt.

What we didn’t hear from Mr. Kaplan was that the Fed’s easy money policy, especially 10 years of it, is what encourages taking on excessive debt. And it incentivizes investors desperate for yield to lend the money. That’s the whole point of accommodative policy and we are just repeating in a different form what went on in the mid 2000’s. So instead of sobering up Corporate America, the Fed, via 75 bps of rate cuts this year, keeps inducing the financial system to take on more leverage. Charles Ponzi would be proud.

With the 10 yr yield down on the week as stocks go up every day, it’s a good time to visualize the two. Sometimes they correlate, sometimes they don’t.

SPX in orange, 10 yr yield in white

Bullish sentiment continues to increase, according to the weekly II survey, as the mood follows price. Bulls rose to 58.1 from 57.2 and that’s the most since October 3rd, 2018. Those expecting a Correction fell for the 11th time in the past 13 to 24.8 from 25.7 last week. Bears were unchanged at 17.1 and the Bull/Bear spread is now 41, the widest since mid July. Bottom line, the Bull side is now about 2 pts from what is considered very extreme while anything above 55 is considered stretched.

Skewed by seasonal adjustment issues around this time of the year, the MBA said mortgage apps rose 1.5% w/o/w. Purchases fell by 1.2% w/o/w while refi’s rose 4.2% w/o/w. Don’t bother looking at these stats vs last year again because the timing of Thanksgiving is different.

I’ve been a fan of the economic changes (most of them) that French President Macron has implemented since he was first elected and I do believe it continues to resonate with the French citizenry. Today they reported consumer confidence for November and it rose 2 pts m/o/m to the best level since June 2017 and the 2nd highest print since 2007. It’s not a market moving number however.

On the flip side, Italy remains challenged. Its consumer confidence index fell to the lowest level since July 2017. No explanation needed here. As for the Economic Sentiment index, it was little changed from October as the manufacturing component is at a 5 yr low.

Have a great thanksgiving, //www.youtube.com/watch?v=2DnSXo8Ve9M

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.