I keep highlighting the high yield market as something very important to watch to see whether the valuation rethink seen in stocks spills over into economic worries in credit and thus giving us a form of asset price contagion. Well, it continues to soften. Yesterday the yield to worst for the Barclays/Bloomberg high yield index jumped 20 bps to 5.18%. It’s the 1st time above 5% since November 2020. Its spread to Treasuries widened by 18 bps to 330 bps, though still below where it was this past November.

For the lowest rung of high yield, the CCC category, its yield to worst rose 14 bps to 7.67%, the highest since December 2020. Its spread to Treasuries is back to 600 bps after getting there this past December. That was wider by 18 bps yesterday. With the possibility of 4-5 rate hikes this year, I don’t see anything attractive about this sector at current yields.

The other area of credit to keep your eye on is the leveraged loan space where massive amounts of money have piled into because of the floating rate nature of bank loans. Everyone wants to play Fed rate hikes and are in turn throwing out their credit risk analysis as this area has some of the junkiest credits, with many including private equity deals. The LSTA Leveraged Loan index hit a high one week ago and has since backed off.

JUNK YIELD to WORST

JUNK OAS

LSTA Leveraged Loan Index

Shifting to Asia, Taiwan’s manufacturing PMI fell a touch to 55.1 from 55.5. Over the past few years the world has learned how important Taiwan is, particularly Taiwan Semi to the global economy. Markit said “Robust client demand, particularly in overseas markets, supported a further solid increase in total work, while firms continued to add to their payrolls. However, shortages of inputs remained a key concern, and supplier delays weighed on growth of output and drove a further steep increase in backlogs of work. At the same time, companies reported further rapid rises in both input costs and output charges.” Taiwan Semi’s stocks hasn’t avoided the global correction as it’s down 7% year to date. The TAIEX itself is lower by 3%.

Vietnam too is now hugely important because of its growing manufacturing presence and prowess. It’s PMI rose to 53.7 from 52.5. Vietnam has backed away from its strict covid approach after learning its lesson last year. Markit said “Both output and new orders increased at sharper rates in the opening month of the year as customer demand continued to improve. In each case the rate of expansion was the sharpest in 9 months.” Export orders rose to the best since November 2018. Price pressures did ease but “a key factor behind rising input costs was higher charges for freight and international shipping.” I still like Vietnamese stocks. The Ho Chi Minh index was higher by .6% overnight and down just 1.3% year to date.

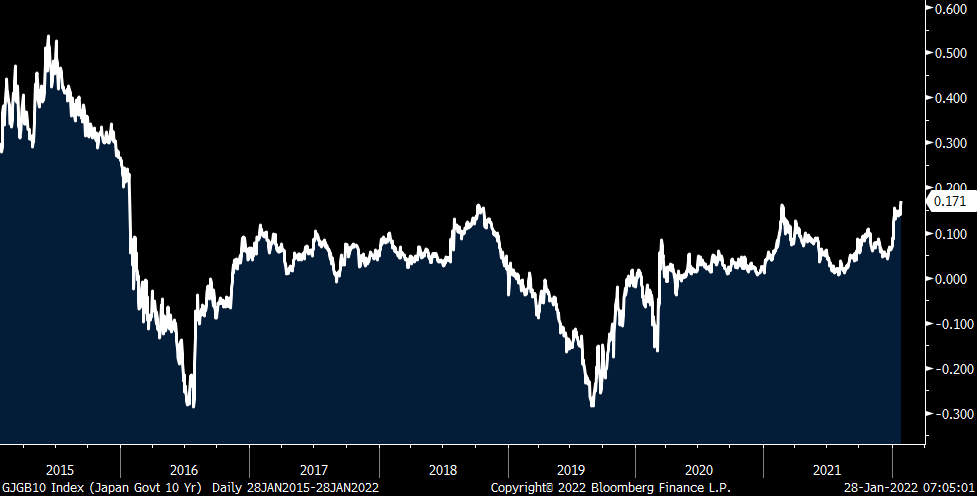

The January CPI in Tokyo was up .5% y/o/y headline but lower by .7% ex food and energy. Lower hotel prices because of omicron and a tough comparison last year along with lower mobile phone fees (which cycle out in April) were the factors. Higher energy and food prices, exaggerated by the weaker yen, is what kept the headline CPI positive and we’ll be adding back more than 100 bps after the cell phone fee situation reverses. The 10 yr inflation breakeven did slip almost 1 bp to .54%. It’s still of course low but just off the highest since May 2018. And, the 10 yr JGB yield rose another 1.2 bps to .17% and getting ever closer to the upper band of BoJ yield curve control. That is a 6 year high highlighting that the bond selloff is global.

Don’t expect though right now for the 10 yr JGB yield to get above .20% as BoJ Governor Kuroda today said “It’s too early and inappropriate to raise interest rates or steepen the yield curve by changing the yield curve control program now.”

10 yr JGB Yield

Germany’s economy shrunk by .7% q/o/q in Q4, worse than the forecast of a decline of .3%. Versus last year, it grew by 1.4%. A combination of omicron in December which hurt consumer consumption and continued supply problems infected the quarter. Likely too was the economic slowdown in China and who is such a big customer of Industrial Germany. Higher energy prices didn’t help either.

In contrast, the French economy expanded by .7% q/o/q and 5.4% y/o/y, above expectations helped by consumer spending. France powers much of its electricity needs via nuclear and thus is less susceptible to spiking natural gas prices. Germany really screwed up with their decision to shut its plants.

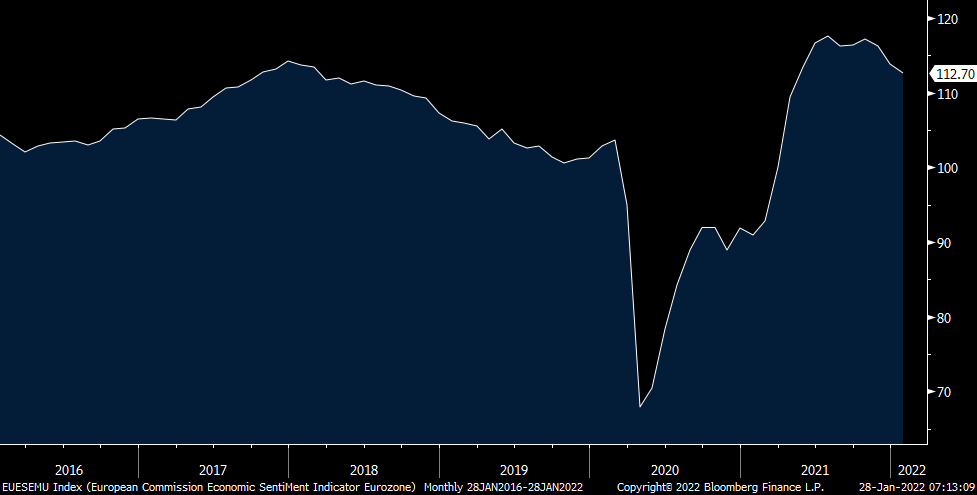

As for the economic situation in Europe in January, its Economic Confidence index fell to 112.7 from 113.8 and that was an unexpected fall relative to the estimate of 114.5. Both manufacturing and service components fell as did construction while consumer confidence was little changed and retail sales got back what it lost in December which was hurt by omicron. This is not market moving but we know Europe is dealing with rising inflation, particularly with higher energy prices along with higher labor costs for companies and the manufacturing industries are dealing with the same issues as the rest of us. As the ECB is so far behind the Fed in shifting policy, yesterday’s euro fall took it to the lowest since May 2020.

With respect to the DXY, the Daily Sentiment Index is now above 90 so watch for a reversal lower soon.

Eurozone Economic Confidence Index

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.