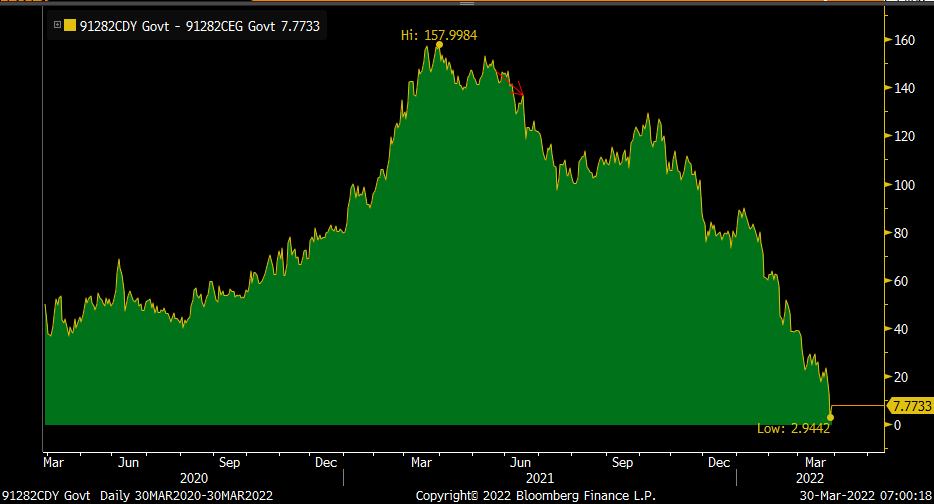

Thanks to my friend Luke Groman for pointing this out last week in his newsletter and take a look at the Austrian government 100 year bond issued a few years ago that matures on June 30th, 2120. Duration bites right now and there is no better example than this bond which is down 55% from its peak in December 2020. This is not a meme stock and not a high flying tech stock but a sovereign bond with an AA+ credit rating. The problem is the duration is so long and thanks to the enticement of the ECB at the time, the coupon is just .85%. Now if you’re going to live another 98 years or pass it on to your kids or grandkids or to the descendants of your investors, you’ll be fine because they can hold it to maturity and eventually get their principal back. But if you’re going to mark to market or you need the money now, sorry.

Austrian 100 yr bond price

This is an interesting stat I found on Twitter from Charlie Bilello who pointed out yesterday that “Apple’s 7.1% weight in the S&P 500 today is the largest weighting we’ve seen for any individual company going back to 1980.” The still heavy reliance on so few. //twitter.com/charliebilello/status/1508543547041005577

I’ll see the II investor sentiment data later but after touching 13 a few Monday’s ago, the CNN Fear/Greed closed at 54 yesterday which is considered Neutral. //www.cnn.com/markets/fear-and-greed

We’re all of course watching the yield curve and trying to discern the message but I want to repeat again, this is what always happens when the Fed tightens monetary policy as the ‘soft landing’ scenario is a rare occasion and the more debt that low rates have encouraged over the years and the high sensitivity our economy now has to changes in the cost of capital, it only reduces the odds of it happening again. Philly president Harker on CNBC yesterday did throw out a new line that the Fed is trying to achieve and that is a ‘Safe Landing.’ Trying to explain what that is he said the landing will be bumpy but they don’t want too much of an economic slowdown. We certainly all want that but we’ll see.

To my point that this is always what happens upon a change in Fed policy, the yield curve flattening really started in earnest on June 16th 2021, the date that Jay Powell told us that they are finally thinking about tapering its asset purchases (and thus taking out one of the ‘thinking’ terms used previously). The red arrow below is pointing to that day. The top in steepening was in mid March 2021, a few days after Powell said they are thinking about thinking about…

The now 4.80% average 30 yr mortgage rate led to another double digit decline in the pace of refi’s as the MBA said they declined by 14.9% w/o/w after falling by 14.4% last week. They are lower by 60% y/o/y. Purchases again though held in as they were up .6% w/o/w as fence sitters get off the fence. They are still down 10.1% y/o/y and after there are no more fence sitters, expect the pace of home purchases to slow as the affordability squeeze gets more pronounced. What buyers are also doing is shifting to ARM’s and their lower rates as ARMS as a % of total number of loans did tick up to 6.6% from 6.4% last week and vs 5.6% in the week prior.

Refi’s

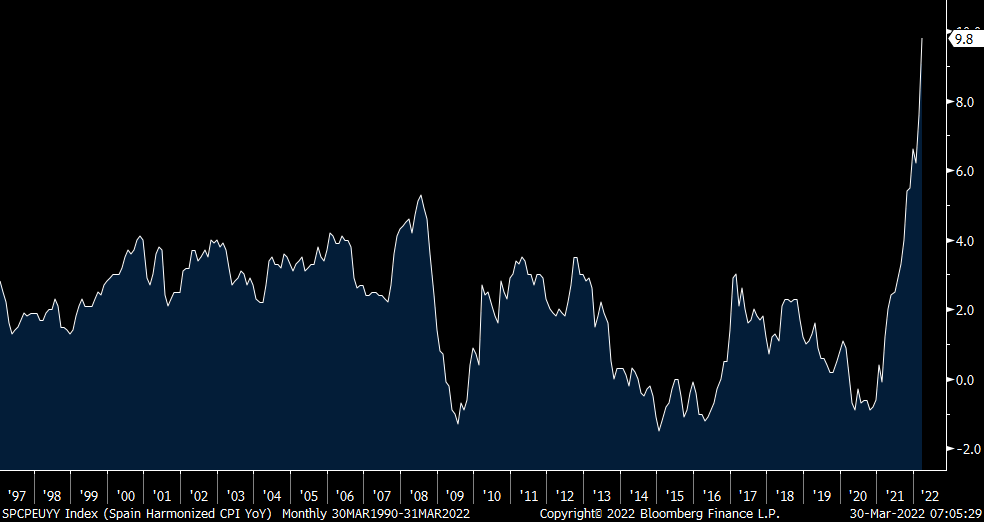

Ahead of the expected March CPI print at 8am est from Germany which is supposed to be up 6.8% y/o/y, Spain said its CPI was up 9.8% y/o/y in March, well more than the estimate of up 8.4%. Thanks to the spike in energy prices, the cost of living was higher by 3.9% in March alone. Christine Lagarde still is conducting QE and has negative rates and talked many times over the past year about transitory. In response, European bonds are selling off across the board with the Spanish 10 yr yield in particular up by 6 bps to 1.55%, the highest since November 2018. The global bond bubble continues to leak air.

Spanish CPI y/o/y

Also out of Europe was the March Economic Confidence index which fell to 108.5 from 113.9 but about as expected and certainly not surprising. Consumer confidence plunged to -18.7 from -8.8 and retail and manufacturing also softened. Thanks to the ‘let’s live with it’ approach to covid did help the services component which rose 1.5 pts m/o/m while construction was little changed. The euro is lifting and the dollar is weaker across the board.

Lastly, thanks to the BoJ buying for a 2nd day, the 10 yr JGB yield and longer term yields backed off and the yen is rallying after Kuroda met with the new PMI Kishida to try to talk down the connection between QE and the yen, however insincere that is.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.