Listening to this whole democratization argument and we’re seeing this new age of individual investor empowerment, my message again is that this is not new. This was an E-Trade commercial from 1999, //www.youtube.com/watch?v=hm8_MFdFpeE. This one is from either 2007 or 2008, //www.youtube.com/watch?v=X4GZfvXx9Js.

For some reason the Reddit crowd is chattering about silver. There is this belief that for years the big banks, particularly JP Morgan, have been artificially suppressing its price when all I think their positioning reflected was the other side of their customers. There is not a large short position that I’m aware of but that said, it is my favorite asset. It holds a unique position of having half its demand from investment and jewelry as a precious metal and money and the other half as an industrial metal. That industrial usage is becoming more ‘new age’ as silver is a raw material needed for solar panels, wind turbines and electric vehicles. Also, according to the Silver Institute, “Almost every computer, mobile phone, automobile and appliance contains silver.” From a price perspective, it still is almost 50% below its 2011 peak. I’m not aware of ANY asset that is that far from its high and consider what’s happened since 2011. Central banks discovered negative rates and a level of QE that our minds could never have imagined and the growth in renewables is only accelerating.

Generic SILVER futures contract

If you didn’t see it, Germany reported January CPI yesterday that rose 1.6% y/o/y, well above the estimate of up .5% and vs -.7% in December. It is though being rationalized away because the sales tax rose and a carbon tax was initiated on some energy products. A minimum wage increase was also cited as a reason by the Statistics Office. Either way, investors are not looking past some of these factors as the 10 yr inflation breakeven is up 4 bps in two days to 1.05%, a one yr and not far from a 3 yr high. The German 10 yr bund yield is higher by almost 4.5 bps over the past two days. Also lifting yields was the unexpected drop in German unemployment in January of 41k vs the estimate of up 7.5k. Their unemployment rate held at 6%. Their job subsidization program has encouraged employers to hold on to their employees.

GERMAN 10 yr INFLATION BREAKEVEN

After some jawboning by some ECB members in order to lower the value of the euro by threatening more rate cuts, Governing Council member Gabriel Makhlouf today is saying that “Right now, today, I don’t think that’s warranted.” Although he didn’t rule it out and said they are watching the strength of the euro. If the ECB is now going to try to fight the FX markets, they will lose. Just ask the Swiss and the Japanese. Another unnamed ECB official said “Even if you see a much bigger appreciation, I would not infer that the unique answer to that is the interest rate.” The euro is higher in response. And now that inflation is possibly bottoming out in Europe, they have less of a need to ease further.

I mentioned Germany above but Spain too surprised to the upside. Headline CPI rose .6% y/o/y, well more than the estimate of a decline of .5%. Higher power prices and food and beverage prices led the way. The Spanish 10 yr is up 2.3 bps and the Spanish 10 yr inflation breakeven is 4.5 bps over the past two days. I pity the world’s bond markets if inflation actually starts to rise from here. The euro 5 yr 5 yr inflation swap is up 3.5 bps over the past two days to a one week high.

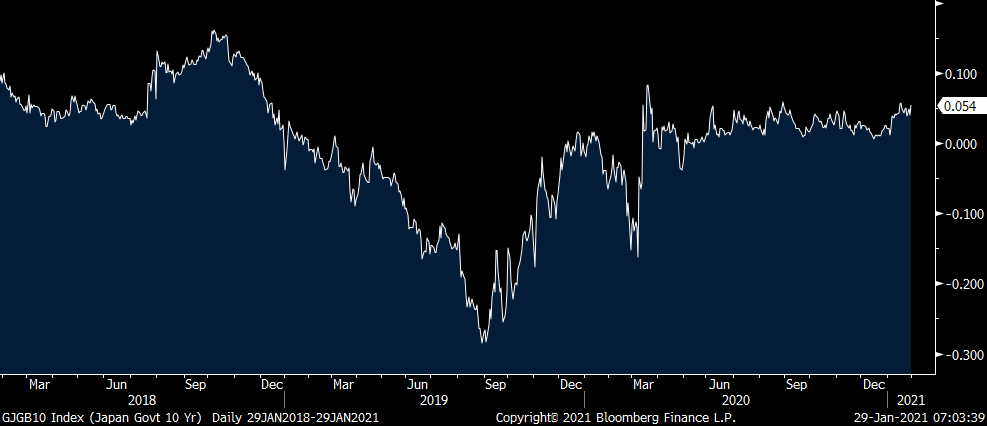

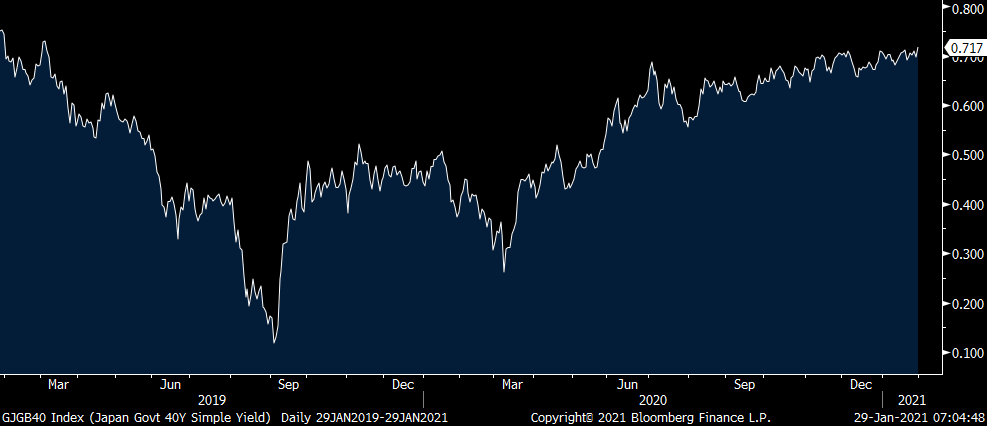

Speaking of rates, the Bank of Japan is seemingly more tolerant of a wider yield curve control spread in its 10 yr yield according to the minutes of their last meeting. There has become a growing realization that the lack of a yield curve has killed their banking system, particularly the regional banks and without banks, how will credit get to small and medium sized businesses? A BoJ member said “With our monetary easing steps to be prolonged, allowing the 10 yr government bond yield to move upward and downward to some extent will contribute to financial system stability.” In response, the 10 yr yield is up 1.5 bps, a big move for a yield of .054%. The is just below the highest since March 2020. The 40 yr yield, least manipulated by the BoJ, closed up 2 bps to the highest level since March 2019.

Also lifting JGB yields was the January Tokyo CPI report where prices ex food and energy rose .2% y/o/y, vs -.4% in December and vs the estimate of no change. The increase was led by housing, furniture, food, and recreation. Japan also reported no change to its December unemployment rate of 2.9% and the job to applicant ratio of 1.06. The estimates were 3% and 1.05 respectively.

10 yr JGB yield

40 yr JGB yield

We know Vietnam is becoming a manufacturing juggernaut, especially with changes in Chinese supply chains. They reported January exports up 50.5% y/o/y, almost double the estimate of up 29.5%. Imports jumped by 41% vs the forecast of up 30%. I remain bullish on Vietnamese stocks.

Taiwan said its economy grew by 4.9% y/o/y in Q4, above the estimate of up 3.6%. Hong Kong’s economy was lower by 3% y/o/y, more than the forecast of down 2.1%.

Germany’s economy declined by 2.9% y/o/y in Q4, a bit better than the forecast of down 3.2%. France’s Q4 GDP fell 5% y/o/y vs the estimate of down 7.6%. Spain’s contracted by 9.1% y/o/y vs expectations of down 10.8%.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.