Notable in the previous Q1 2022 fiscal yr earnings release from FedEx (full disclosure, it is owned by clients and myself) was their difficulty in hiring staff which resulted in sorting facilities and warehouses that didn’t have enough people and trucks and product had to be re-routed and that cost them almost a half a billion dollars in higher costs. In the just reported Q2 quarter last night, the COO said “I am pleased to share that we have made considerable traction in recruiting frontline positions. Last week, we exceeded 111,000 applications, the highest level in FedEx history. To put this in perspective, we had 52,000 applications the week of May 8. This has led to appropriate staffing levels of peak, including having more than 60,000 frontline team members since we last spoke in September.” Following this he said, “we anticipate cost pressures from constrained labor markets to partially subside in the 2nd half of the fiscal year.”

This all said, “The difficult labor market once again had the largest effect on our bottom line, representing an estimated $470 million in additional y/o/y costs.” Of this, $230mm was due to higher wage and purchase transportation rates and the balance lost to “network inefficiencies resulting from labor shortages.”

As for the ability of FedEx to take price with its customers, “Constrained capacity has continued to support a favorable pricing environment. We are maintaining a brisk pace for repricing contracts, ensuring a high surcharge and yield improvements.”

As the BoE did, yesterday the Norges bank in Norway raised rates by 25 bps to .50% and said another will likely come in March. That was followed by a 50 bps rate hike from the central bank in Mexico to 5.50%. Only a 25 bps increase was expected. They said the board “evaluated the magnitude and diversity of the shocks that have affected inflation and the factors that determine it, along with the risk of price formation becoming contaminated, and the challenges posed by the ongoing tightening of monetary and financial global conditions.” And today, the Bank of Russia hiked rates by another 100 bps to 8.5%. That is double the level it stood at in February 2021 and was at 6% in February 2020.

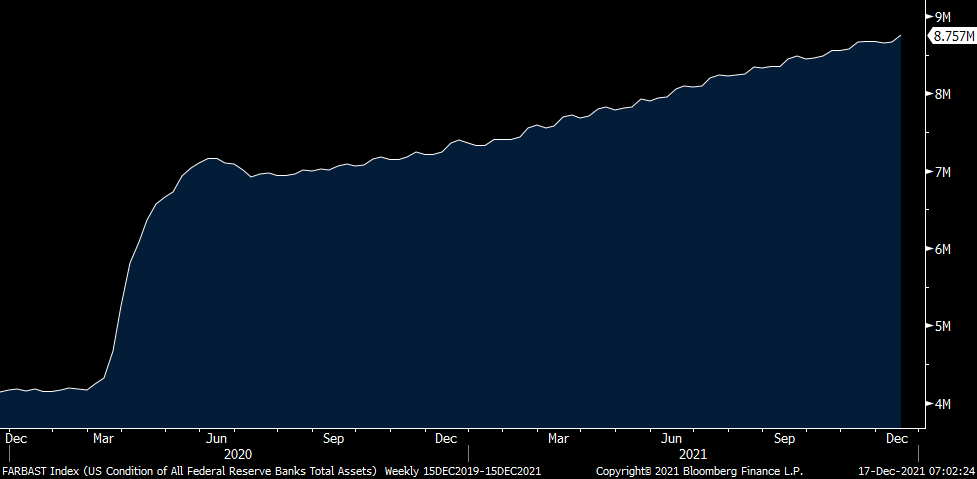

With respect to the Federal Reserve and their unserious and very delayed attempt to control inflation, their balance sheet increased by another $92b in the week ended Wednesday to a fresh record high of $8.76 Trillion.

FED’s BALANCE SHEET

The Bank of Japan will likely be the last central bank on the planet outside of the Swiss National Bank that will ease their foot off the monetary pedal. They of course kept rates unchanged but did cut back a bit their funding source for large companies while maintaining it for smaller ones to September. Beginning in April, they will trim their buying of commercial paper and corporate bonds to the pace they were doing pre Covid. This is what Governor Kuroda said and who has been trying for 2% inflation since 2012, “It’s true that inflation expectations have been rising a bit. There may be upside risks to the inflation outlook but the situation will be far from those in the US and Europe…We are not likely to make moves toward policy normalization like the US and European central banks.” Wholesale prices in Japan have been thru the roof but mostly because of a 50% drop in mobile phone fees, CPI has been kept very low. JGB yields were little changed in response while inflation breakevens slipped a touch. The yen is higher but has been following the price of crude oil while the Nikkei took it on the chin as did all markets.

Taiwan’s central bank kept rates unchanged as expected at 1.125% but that will soon change. The Governor said “Monetary policy is moderately loose now, but it will definitely move toward tightening next year.”

So 2022 will bring us a further global synchronization of some form of central bank monetary tightening.

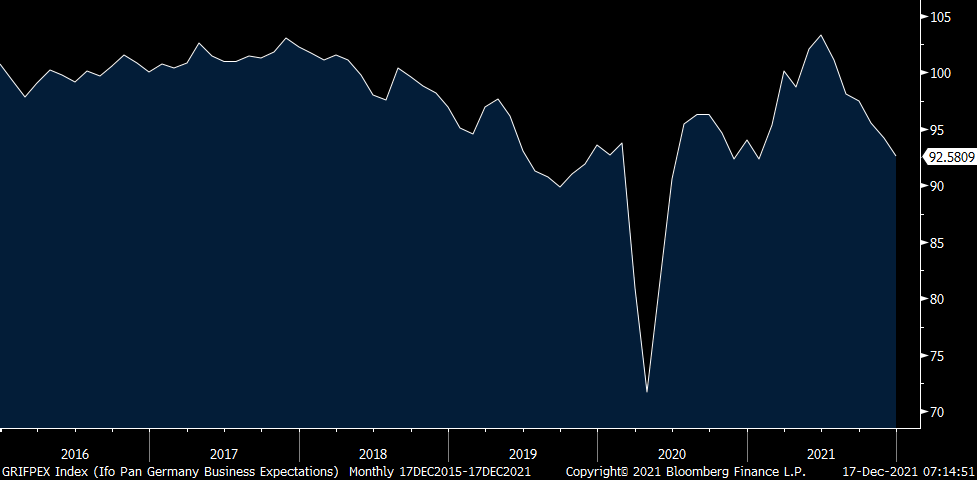

The German December IFO business confidence index fell to 92.6 from 94.2 with both components lower. That is the lowest since January. The IFO was succinct with its conclusion, “The German economy isn’t getting any presents this year.” Manufacturing outperformed services. With the former, “order books grew substantially. However, companies’ assessments of the current situation was somewhat worse. Supply bottlenecks for intermediate products and raw materials intensified once more.” It was in services that was more broadly weaker as “the business climate nosedived.” We can of course blame the Covid spike for that. Trade and construction also softened. German bund yields are down after yesterday’s ECB driven rise. The euro is down a touch.

IFO

Germany also reported its PPI for November and it was up .8% m/o/m after a 3.8% spike in October. While that was 6 tenths less than expected, it was still up 19.2% y/o/y after an 18.4% rise in October. Inflation breakevens are unchanged at 1.73%. The tension between the Bundesbank and the ECB will only intensify next year.

Lastly overseas, retail sales in November in the UK ex auto fuel was better than expected with a 1.1% m/o/m increase, 3 tenths more than expected and October was revised up by 4 tenths. With the wild spread of omicron we can assume December takes a hit. Even so, get ready for more rate hikes from the BoE in 2022. Speaking today was Huw Pill, the banks chief economist who said “What we saw yesterday was the bank’s response to a view which has been building through time, accumulating evidence, that underlying more domestically generated inflation here in the UK, probably centered around cost and wage pressures in a tight and tightening labor market are going to prove more persistent through time…The pressures we still see building domestically within the labor market, in services, prices, inflation and so forth, need to be addressed by somewhat tighter policy and a somewhat higher bank rate.” The 2 yr yield is little changed after a 3 day jump while the pound is giving back some of yesterday’s rally.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.