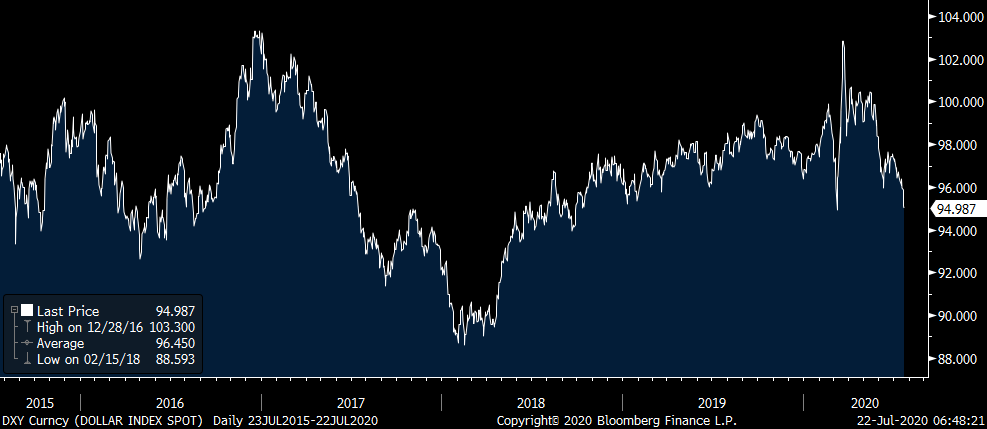

The rally in gold and silver, which I remain bullish on (particularly the latter), continues to be helped by the fall in real rates and the drop in the US dollar. The euro heavy dollar index is a stone’s throw from the weakest level since September 2018 while the 10 yr inflation breakeven is at the highest level since early March, rising another 2.7 bps yesterday to 1.47%. I continue to believe that inflation is coming, likely showing up in earnest in 2021. The rally in silver by the way is in itself inflationary as about half of the demand for it is as a raw material in a variety of industrial uses, particularly now on the renewable energy side including EV batteries. In the meantime, the 10 yr Treasury yield continues to flat line. The Fed thought they were helping ‘market functioning’ by implementing massive QE along with talk about YCC but instead they’ve killed the market, just as the ECB and BoJ did to their bond markets. What’s price discovery anymore? What clear signal is the corporate bond market telling us anymore when everyone thinks the Fed has placed a floor under pricing? There is none. Maybe Judy Shelton will inject some free market thinking back into that institution because free market it is no longer.

I hope I’m wrong about inflation because those that will directly suffer will be those who can least afford it, especially in the current tough economic environment we’re in. Also, if the dollar continues to weaken, that would further reduce the purchasing power of the American consumer, the dominant force in the US economy and will be itself inflationary as well.

10 yr REAL RATE

DXY

After last week’s 6.1% w/o/w decline in purchase applications to buy a home, they rose by 1.8% this week and are higher by 19.4% y/o/y as we know the residential housing market has been a bright spot in the economy. Refi’s with mortgage rates sitting at record lows rose 5.3% w/o/w and 122% y/o/y.

There was only slight improvement in the Japanese manufacturing and services composite index for July. It rose to 43.9 from 40.8 with no change in services while the manufacturing component was up by 2.5 pts to 42.6. Markit said “While the easing of emergency measures provided some relief, especially to the domestic sector, Japan’s growth continued to be adversely affected by subdued global trade flows and restrictions on travel. All of these factors continued to weigh heavily on demand, with total new orders falling further, dragged down by a substantial decline in new exports…Any hope of a robust recovery need to be tempered as business sentiment about the year ahead outlook remained pessimistic on balance.” No V bottom here but luckily Japanese companies have some of the best balance sheets in the world which makes their stocks attractive.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.