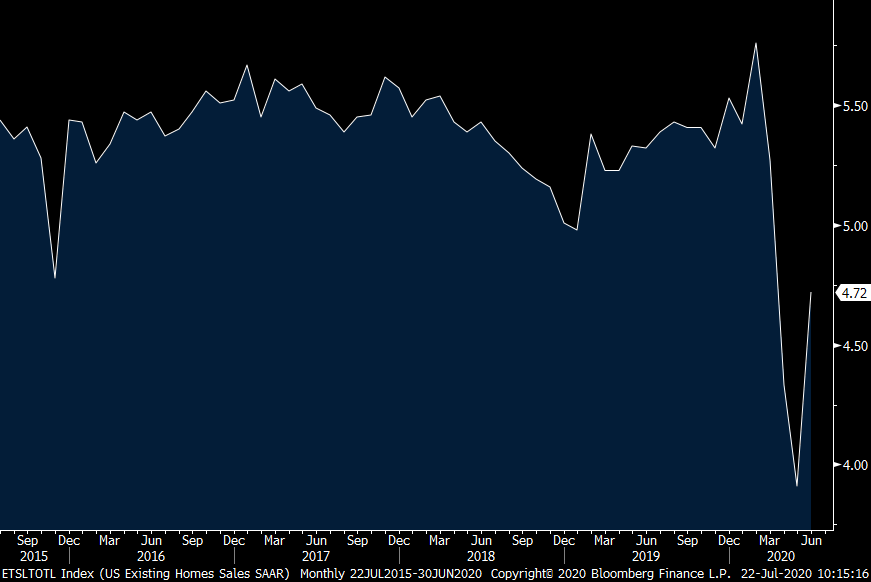

Existing home sales in June, reflecting many contract signings in the March thru May time frame, totaled 4.72mm, 30k less than expected but up from 3.91mm in May as things were only just reopening. This figured was 5.27mm in March and 5.76mm in February. As homes for sale didn’t keep up, months’ supply fell to 4.0 from 4.8 but that is where it was in April and above the 3 handle seen in Q1. Median prices rose 3.5% y/o/y and a needed come down after years of 5-6% price increases. First time buyers totaled 35% of sales vs 34% in May and 36% in April. That though is up from 32% in January and likely reflects more younger households leaving the cities for the burbs. Investors/2nd home buyers stepped away from the market as they only tallied 9% of sales vs 14% in May and vs 17% back in January.

The NAR said “Homebuyers considering a move to the suburbs is a growing possibility after a decade of urban downtown revival. Greater work-from-home options and flexibility will likely remain beyond the virus and any forthcoming vaccine.” And, “buyers were eager to purchase homes and properties that they had been eyeing during the shutdown.”

Bottom line, while this is a dated number as contracts were signed months ago, we know as seen in the weekly mortgage apps that the housing sector has been a bright spot. The question though is after this pent up demand for a backyard gets satiated is whether the pace of transactions settle in along with the trend of jobs and income. Also, the millennial demographic will be a huge swing factor in the coming years.

EXISTING HOME SALES

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.