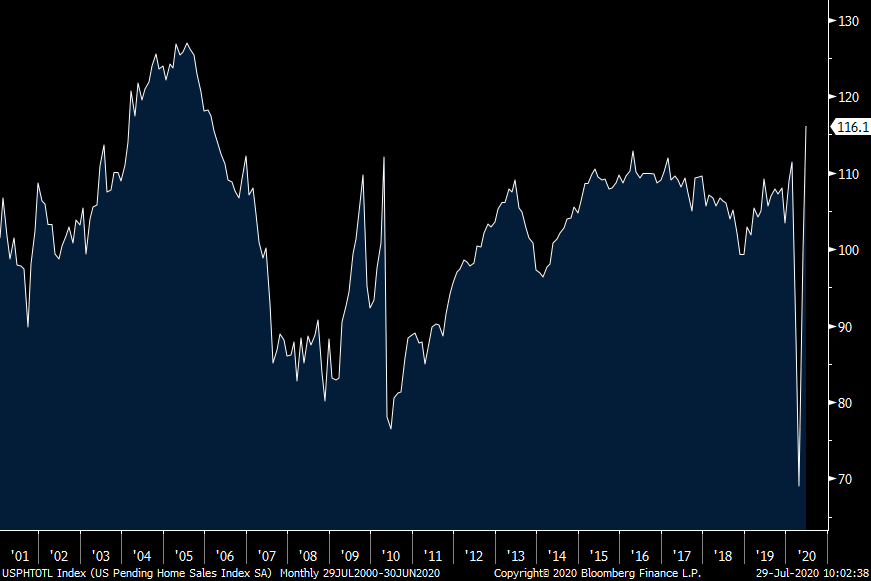

Pending home sales in June rose 16.6% m/o/m, a bit above the estimate of up 15% and follows the 44.3% spike in May as things reopened after 20%+ declines in March and April. This rebound takes the index to the highest level since 2006. The Northeast saw the best m/o/m gain but it is out West, down South and in the Midwest where the sales index is above where they were in February. The Northeast is a touch below.

The chief economist at the NAR said simply “Consumers are taking advantage of record low mortgage rates resulting from the Federal Reserve’s maximum liquidity monetary policy.” Also, to what we’re all seeing, “as house hunters seek homes away from bigger cities, properties that were once an afterthought for potential buyers are now growing in popularity.”

Bottom line, housing remains the standout bright spot in the economy right now. I’ll say again though that at some point, this pent up demand will be satiated and the industry will more follow the trends in employment and income for better or worse, along with the big demographic trends, aka the millennials.

PENDING HOME SALES INDEX

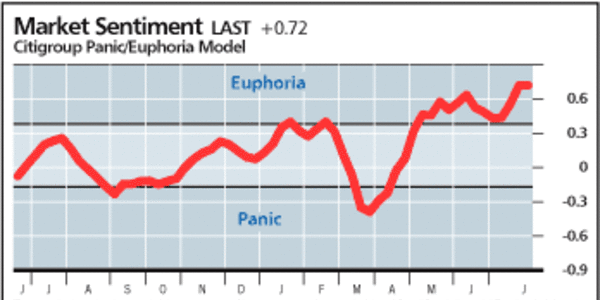

According to II, the Bull/Bear spread remained around 40. Bulls rose .6 pts to 57.3 while Bears were up by .2 pts to 17.5. The balance believe we’ll see a correction that they want to buy. I’d call this stretched but not extreme. A bull read above 60 would be extreme, thus close.

Add this to the Citi Panic/Euphoria index over the weekend which is at an extreme euphoric reading. The .72 read is almost double the line of .41 which enters into Euphoria.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.