I finally got the II #s and Bulls rose 3 pts to 53.5 while Bears were little changed at 23.7 vs 23.8 last week. The Bull/Bear spread of 29.8 is the biggest since late February. Bottom line, any Bull read above 50 reflects extended sentiment while above 55 is stretched and a read higher than 60 is extreme. Thus, a level of complacency is setting in.

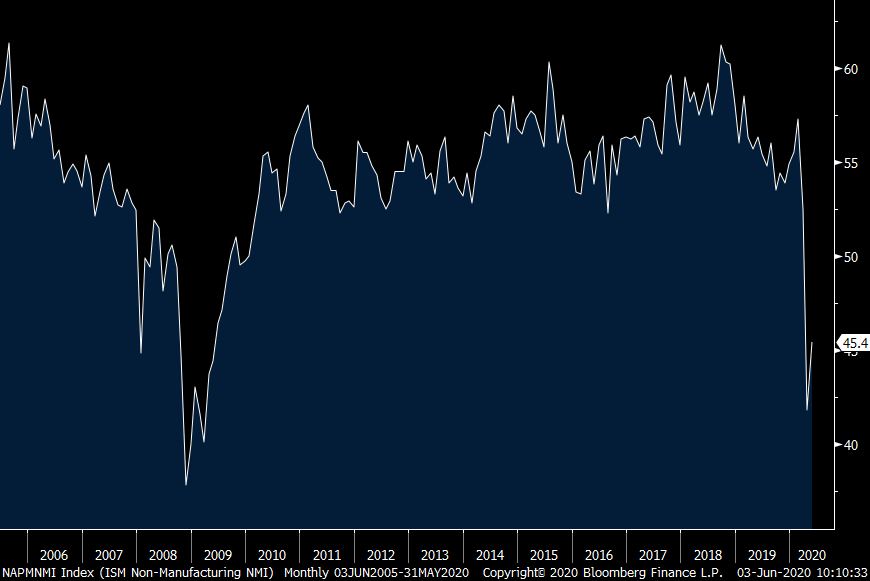

The May ISM services index rose to 45.4 from 41.8 in April. That was 1 pt above the estimate with 50 being the breakeven. Business Activity jumped by 15 pts after falling by 22 pts in the month prior but is still well below 50 at 41. Supplier Deliveries, which has kept this figure higher than it should have been because it reflected supply chain problems rather than a jump in demand, receded by 11.3 pts after a record high of 78.3 last month. New orders were up by 9 pts to 41.9 while backlogs fell a touch to 46.4. Employment was little changed at 31.8 from 30 in April and 47 in March with zero industries adding to payrolls, notwithstanding the reopenings. Inventories remained below 50 but a bit less so at 48. Prices paid, something I’m watching closely, rose .5 pt to 55.6, a 6 month high with 12 industries seeing higher prices vs 10 in April.

The breadth of expansion is still poor as just 4 industries saw growth vs 2 in April. 14 industries saw a contraction vs 16 last month.

The bottom line from ISM was simply “Respondents remain concerned about the ongoing impact of the coronavirus. Additionally, many of the respondents’ respective companies are hoping and/or planning for a resumption of business.”

My bottom line: show me August and September data when most things are reopened and then I’ll really pay attention. Certainly June and July figures should point to an upward trajectory as things reopen but August and September will tell us at what pace things are moving after those reopenings.

ISM MFR’g

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.