Last night at about 10pm est Reuters reported on comments from Chinese Premier Li Keqiang speaking at a news conference after the annual parliamentary session, ‘the Ukraine situation was “disconcerting” and that it is important to support Russian and Ukraine in ceasefire talks.’ About 8 hours later the IFX headline hits the tape that Putin told the Alexander Lukashenko, the head of Belarus, “There are certain positive developments, as far as negotiators from our side informed me.” As China is the only friend of Russia’s that matters right now, let’s hope one is stepping up its influence of the other.

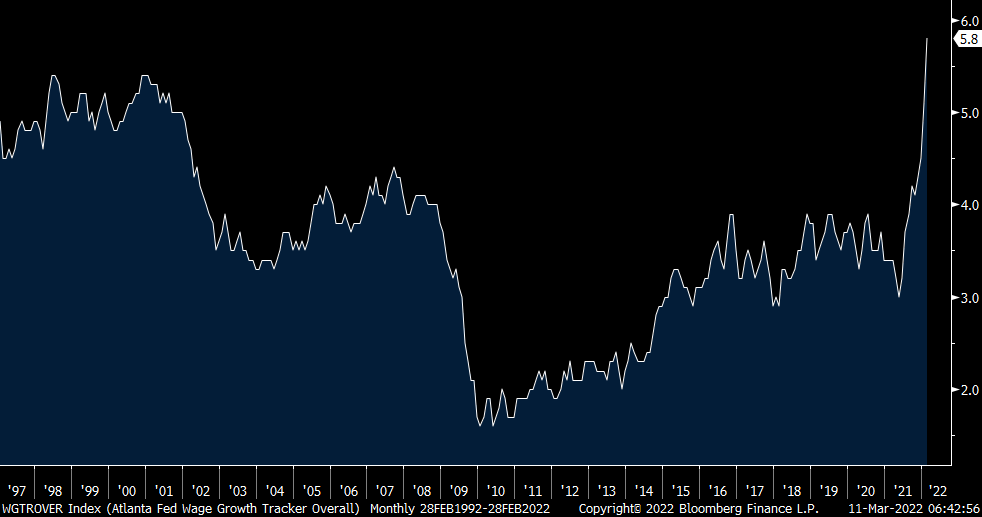

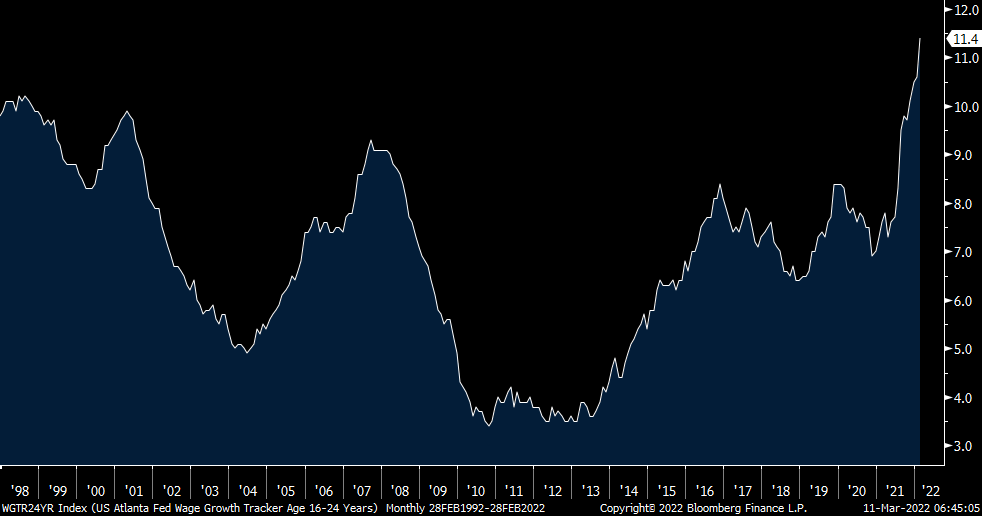

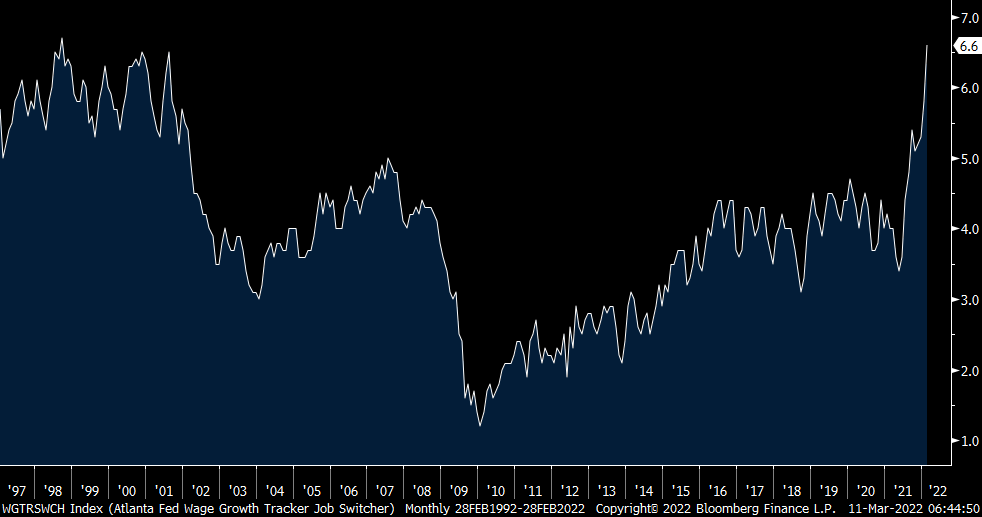

So yesterday morning we saw the 7.9% y/o/y CPI print and at days end the Atlanta Fed said its February Wage Growth Tracker rose 5.8% y/o/y. That’s the quickest pace since this data was first collected in 1997 but obviously not fast enough in the aggregate. If though you are aged 16-24 (the good ole days), you’re in better shape as wages are higher by 11.4% y/o/y. If you’re moving from one job to another, it’s higher by 6.6%, the most since 1998. If one is in the top tier of wage earners, wage growth is more modest, up just 3.2% y/o/y, though up from 2.9% in January. It’s quicker for the bottom tier as wages are now up 5.9% from 5.8% in January, and to a 20 yr high. Bottom line, a higher cost of living is a problem in itself but even more so when wages don’t keep up.

Atlanta Fed Wage Tracker

Atlanta Fed 16-24 Wage Growth

Atlanta Fed Job Switcher Wage Growth

It’s most like a pipe dream that the Chinese economy will grow at a 5.5% rate this year as 30% of their economy reliant on residential real estate continues to contract but they’ll give it their best shot optically, fiscally and monetarily it seems. Their February aggregate financing data came out this morning and we must combine it with January because of their holiday and it was lower than expected by about one trillion yuan. Money supply growth also slowed. When a sector of an economy, whether consumer or business wants to delever or is already choking on too much debt, no amount of fiscal or monetary stimulus will matter until that aversion to debt changes. Just ask the Japanese. H share stocks in Hong Kong continue to suffer with now worries about NY delisting but if one has a Hong Kong listing, the shares are really fungible. The A shares rallied by .4%. For both the sake of the Chinese economy, and the rest of the world that relies on Chinese growth, they need to get past Covid.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.