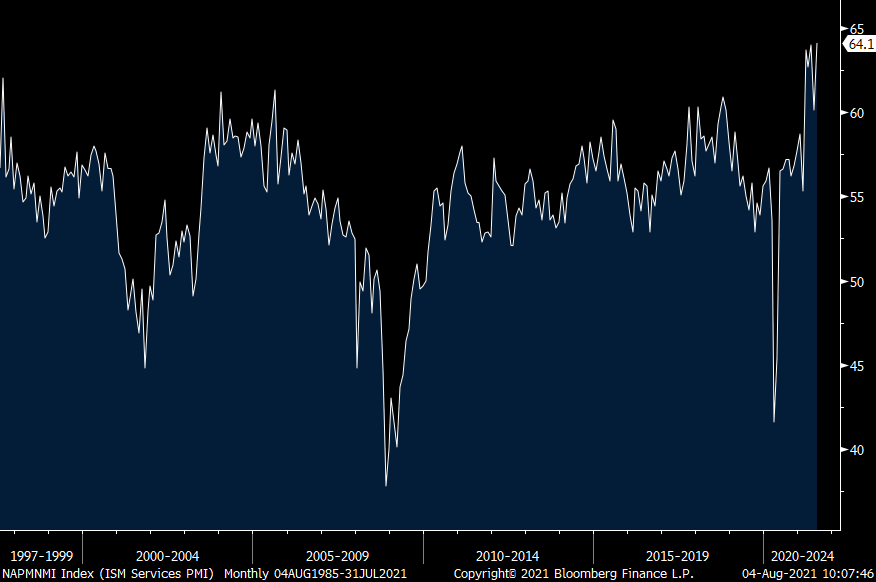

The ISM services index for July fell rose to 64.1 from 60.1, well better than the estimate of 60.5 and the highest on record. Markit on the other hand said its services PMI fell to 59.9 from 64.6 and that was the lowest since February. Markit includes more small and medium sized businesses.

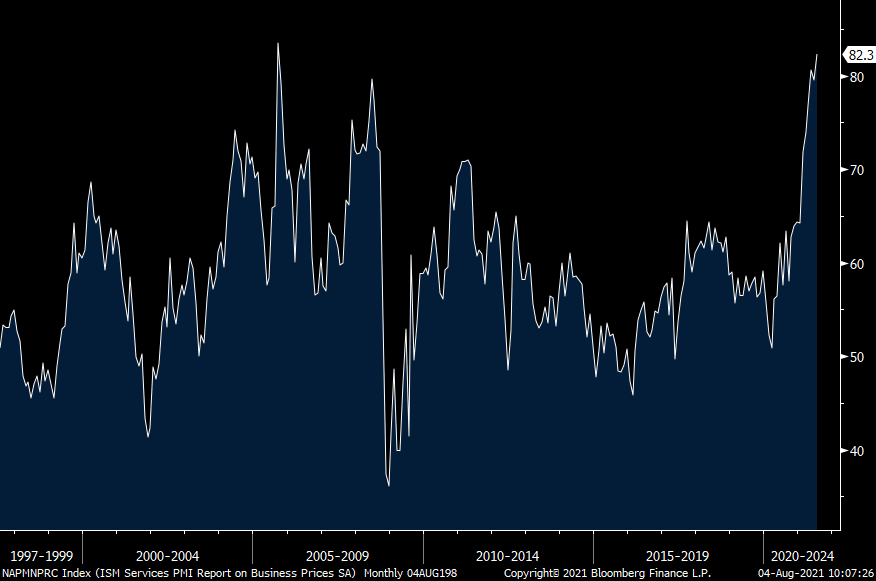

In ISM, new orders rose 1.6 pts m/o/m to 63.7 while backlogs slipped by 2.3 pts to a still high 63.5. Inventories fell by .7 pts to 49.2 and are below 50 for the 3rd month in the past 4. Employment got back some of what it lost last month, rising by 4.5 pts to 53.8 “even though the constrained labor pool continues to be an issue.” It was 55.3 in May. Export orders spiked by 15.1 pts to 65.8 but only some service industries report exports. Imports on the other hand fell by 6.6 pts after rising by almost 8 last month. Prices paid rose another 2.8 pts to 82.3, the highest since September 2005 as supplier deliveries rose (reflecting more constraints) to the highest since last April. ISM said “Materials shortages, inflation and logistics continue to negatively impact the continuity of supply.” These challenges were all over the quotes from different businesses in a variety of industries.

Of the 18 industries surveyed, 17 saw growth.

So we have a record high in this ISM report and this is what Markit said:

“The upturn softened to the slowest since February, but was much quicker than the series average. Contributing to the less marked upturn in output was a softer rise in new business. Nonetheless, domestic and foreign client demand remained historically strong.”

This is what they said on inflation, “input costs and output charges rose substantially despite their respective rates of inflation softening again from May’s historic highs…Service providers sought to pass on higher costs to their clients where possible in July.” With hiring, “efforts to ease pressure on capacity was hampered by reports of a shortage of suitable candidates.” As for the outlook, it remained “strongly upbeat in July” but “The degree of confidence dropped to a 5 month low, however, amid concerns about the strength of customer demand over the coming months.”

Net, net, the strength in services reflects a broad reopening but with the same challenges we are fully aware of with respect to shortages of materials, product and labor and now along with where Delta goes from here. With respect to Delta, I’m confident that we power thru towards some form of herd immunity and we’ll see what the next variant brings.

ISM SERVICES

PRICES PAID

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.