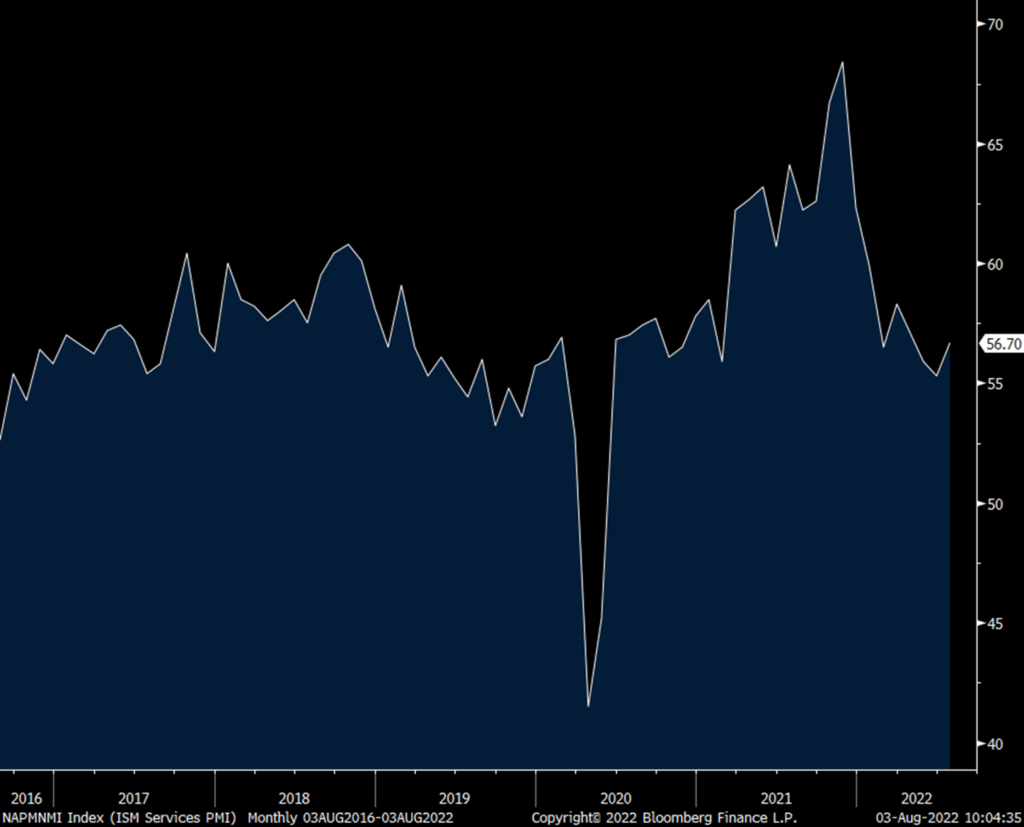

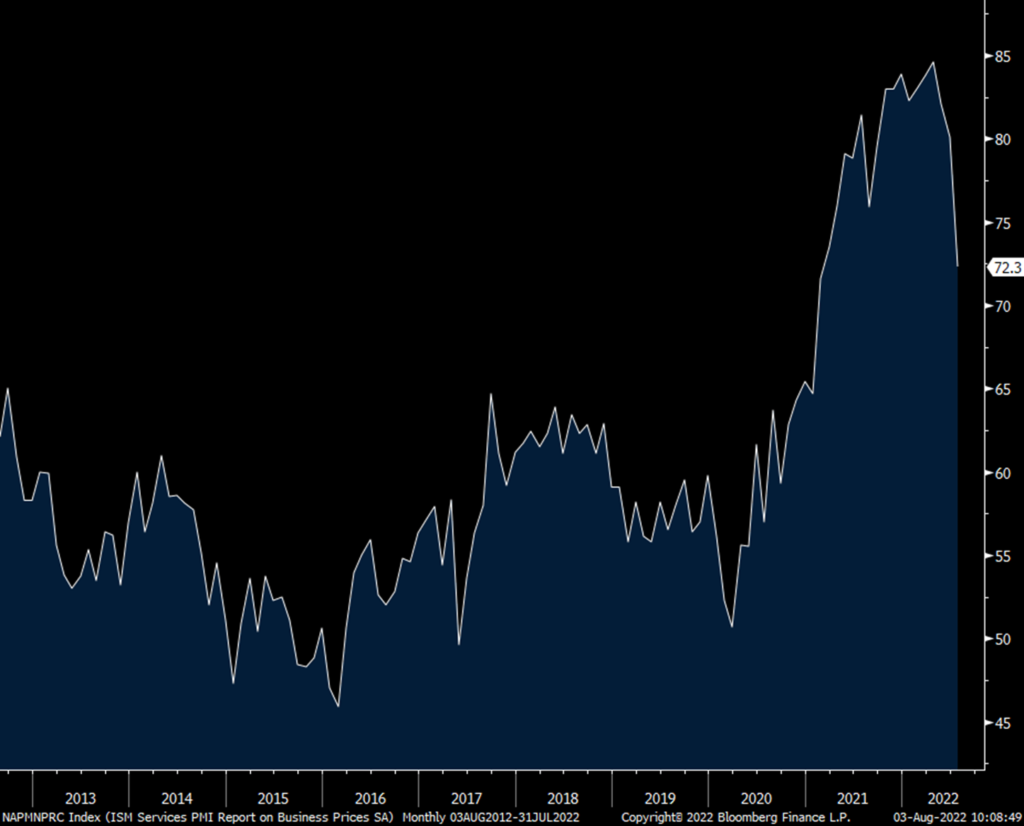

The July ISM services index rose to 56.7 from 55.3 and that was better than the estimate of 53.5. It compares with 55.9 in May and 57.1 in April. New orders rose 4.3 pts to 59.9, a 4 month high while backlogs slipped to 58.3. Inventories fell 2.5 pts to 45 and below 50 for a 2nd month. The high inventory rhetoric is more on the goods side. Ahead of Friday’s payroll report, employment was up 1.7 pts but below 50 for the 3rd month in the past 4 at 49.1. Much of this according to ISM has more to do with the supply of labor rather than the demand but we know the demand is slowing. Supplier deliveries eased further with a 4.1 pt drop and prices paid declined by 7.8 pts to 72.3, the lowest since February 2021. For perspective, the 10 yr average in prices paid is 60.2. Of note, for the first time in a while, not all 18 industries surveyed said they paid higher prices, 16 did.

While the headline number improved, the breadth of growth deteriorated as 13 industries of 18 asked saw growth vs 18 in June, 14 in May and 17 in the two months before that. Three industries saw a contraction, including retail and finance/insurance.

ISM highlighted the headline number in its summary but laid out the risks we’re well aware of, “Availability issues with overland trucking, a restricted labor pool, various material shortages and inflation continue to be impediments for the service sector.”

My bottom line, with the headline increase but the shrinking breadth of economic growth points to the growing mixed bag, but slowing trend of the US economy.

I also want to make something clear on the continued recession or no recession debate. Outside of the Covid mandatory shutdowns, a once in a lifetime event, there is not an economic switch that gets turned on and off all at once. There is a dimmer instead that calibrates up and down with different businesses and industries feeling differing flows of activity at differing times. When we have a slowdown, it’s sort of like a virus, to use that analogy, that doesn’t infect everyone all at once but percolates throughout over time. Here are some notable quotes that highlight this progression of events.

“Restaurant sales have softened the past few weeks (due to) post-holiday and seasonality factors, but we’re also hearing because of consumer pressures, particularly fuel and food prices. Staffing remains a challenge in some markets. [Accommodation & Food Services]

“Interest rates have significantly impacted the homebuilding market. Cancellation rates have increased, as homebuyers can no longer afford the monthly payment. Traffic to our communities is down. Inflation has sidelined many would-be buyers.” [Construction]

“Can feel the economy weakening. Clients are making appropriate moves in anticipation of a recession.” [Management of Companies & Support Services]

“Hiring demand remains robust in most industry sectors. Tech has had a slowdown in hiring and layoffs. It’s still a candidate’s market, as the number of job openings across all skill levels and positions remains far greater than the number of candidates for those roles.” [Professional, Scientific & Technical Services]

“(We are) in inventory reduction mode, attempting to match inventory levels to current lower sales trends.” [Retail Trade]

“Holding steady, but some headwinds are definitely ahead on the economic front. However, supply chain issues appear to be easing, though still not great.” [Utilities]

“Food service remains strong. Retail is softening as the mass is overly concerned about inventory and consumer spending.” [Wholesale Trade]

ISM Services

Prices paid

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.