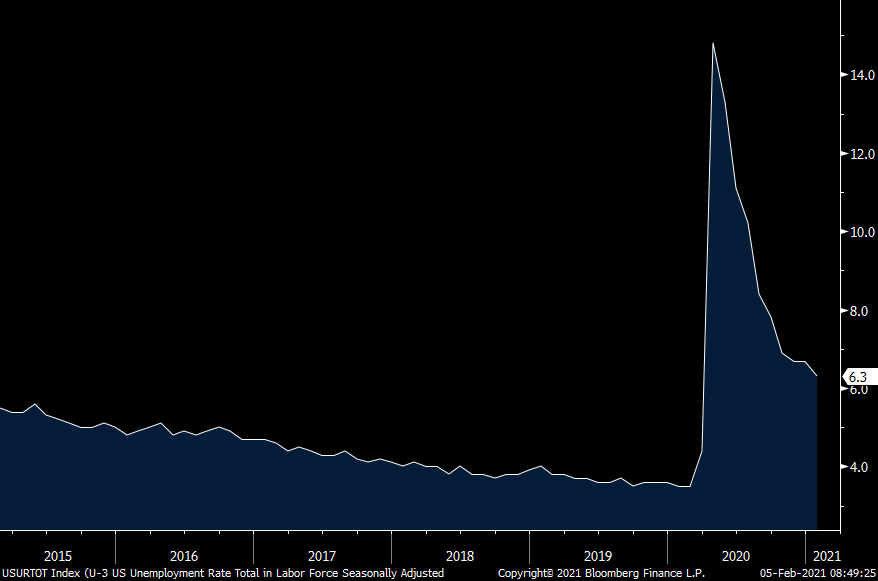

Payrolls in January grew by 49k, about half the estimate of 105k with the private sector contributing just 6k vs the forecast of 163k. Also of note, the two prior months were revised down by a combined 159k. Keeping the headline number above zero was the hiring in public education. The unemployment rate though dropped to just 6.3% as the household survey said 201k jobs were added while the size of the labor force fell by 406k. The more comprehensive U6 rate dropped by 6 tenths to 11.1%. The participation rate fell one tick to 61.4% while the employment to population ratio rose one tick to 57.5%. The diffusion index, which nets out the number of industries adding jobs relative to those shedding, fell below 50 at 48.1 from 61.9 in December.

Of note was the jump in average hours worked to 35 from 34.7 which then mitigates the need to hire if your existing work force is handling more load. Combine this with a .2% rise in average hourly earnings and out comes a 1.1% m/o/m increase in average weekly earnings and a 7.5% y/o/y jump. Helping too is the mix as the lower paying leisure/hospitality space is not as relevant with so many businesses in that industry closed or barely open.

Negatively, there was another rise in the long term unemployed, those still looking more than 27 weeks which now is above 4mm. Positively, there was a decline in those working part time due to economic reasons like not enough work to do or they can’t find full time spots.

Manufacturing shed 10k after a gain of 31k in December. Construction also lost jobs, by 3k after a 42k person increase in the month prior. Jobs were lost in retail and leisure/hospitality for obvious reasons. Temp jobs improved by 81k after a 64k gain in December. Transportation/warehouse lost 28k jobs after declining by 24k in the month prior but after seeing a rise of 124k in the month before that.

Bottom line, there was a lot of cross currents in this report with the weak establishment but good household survey. Wages are jumping as are hours worked for those working but it’s still tough for those longer term unemployed. Covid restrictions obviously impacted the leisure/hospitality and retail sectors while manufacturing and construction hiring took a breather. The only way to really get a clean look at the state of the labor market will have to come this summer when we have some form of herd immunity, if we do. Until then, the data will remain patchy but still pointing to an improvement overall.

On the headline miss, Treasury yields backed off their highs. The 10 yr was at 1.17% just before the release and now is at 1.15%. The 30 yr was 1.97% vs 1.94-.95%. The dollar is at the low of the day.

U3 Unemployment Rate

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.