Jay Powell has quite the juggling act to perform today. He needs to convince us that monetary policy of zero rates and huge QE (not currently as large as the panic behavior a yr ago but still 50% more than QE Infinity in 2013) that maybe was appropriate a year ago at the depths of the global economic shutdown but today we have the S&P 500 at a record high, 2mm+ vaccine shots getting done per day, a sharp economic rebound widely expected, 5 yr inflation expectations at a 13 yr high and a Treasury market that believes higher interest rates are appropriate. What makes Powell’s job even tougher is having to meet the other two mandates of keeping asset markets high and monetizing US Treasury issuance (indirectly). If he sounds less dovish he threatens the former and he can’t really taper as the latter needs him badly as DC spends more and more. Lastly, if they overstay their welcome with easing and feel the need to act to contain a rise in long term rates, they then sacrifice the value of the US dollar which in turn would raise inflation pressures further and hurt those least able to afford it.

With respect to the debt monetization unspoken mandate, this is what the WSJ editorial page said yesterday in case you missed it. “Jerome Powell lobbied publicly for months for more fiscal spending in the name of spurring the economy. Congratulations to the Federal Reserve Chairman, who has succeeded in catching the fiscal bus. Now his wish is Treasury Secretary Janet Yellen’s command as the Fed has to finance the vast fiscal deficits to come…But eventually there is a price for everything in economics, notwithstanding the assurances of modern-monetary theory. The test for the Fed will come in future months as the economy recovers. The market may demand higher interest rates, even as the Fed will want to keep them low to finance continuing fiscal deficits. The political pressure from the Biden Treasury and Congress will be enormous to keep rates low as far as the eye can see.” I say, good luck Mr. Powell.

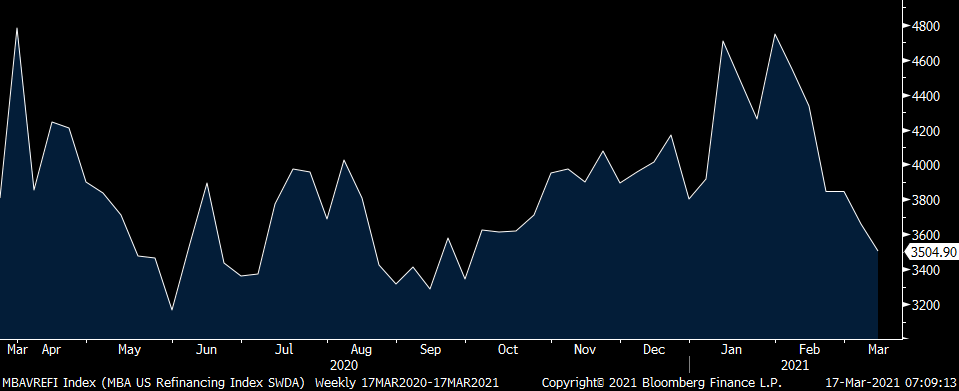

The average 30 yr mortgage rate rose another 2 bps on the week to 3.28%, up 40 bps over the past two months. Purchases did rise 1.8% w/o/w and 5.2% y/o/y as some fence sitters get off to lock in still historically low rates. Refi’s though fell 4.2% w/o/w and are down for the 5th week in 6 to the lowest level since early October. As comps are really tough, they are down 39% y/o/y.

REFI Index

Japan said its exports in February fell 4.5% y/o/y, more than the forecast of down 2% but with the Chinese new yr distorting the data, I’ll give it a pass as it is their largest trading partner. That said, exports to the US fell by 14% y/o/y. Imports up 11.8% y/o/y were as expected. Singapore said its exports in February jumped 8.2% y/o/y, well more than the estimate of down .7%. Taking out China, exports still rose 6.7% y/o/y if you look at January and February combined. Electronics and petrochemicals were the key exports. Neither of these data points were market moving as both the Nikkei and Singapore Straits were little changed overnight.

In Europe, the Eurozone February inflation stats were left unrevised with a headline gain of .9% y/o/y and a core rate higher by 1.1%. Inflation expectations in the region are little changed but after the recent move higher. The German 10 yr breakeven is up 10 bps in the past week. The 5 yr 5 yr euro inflation swap is up 7 bps over the past week to 1.50%.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.