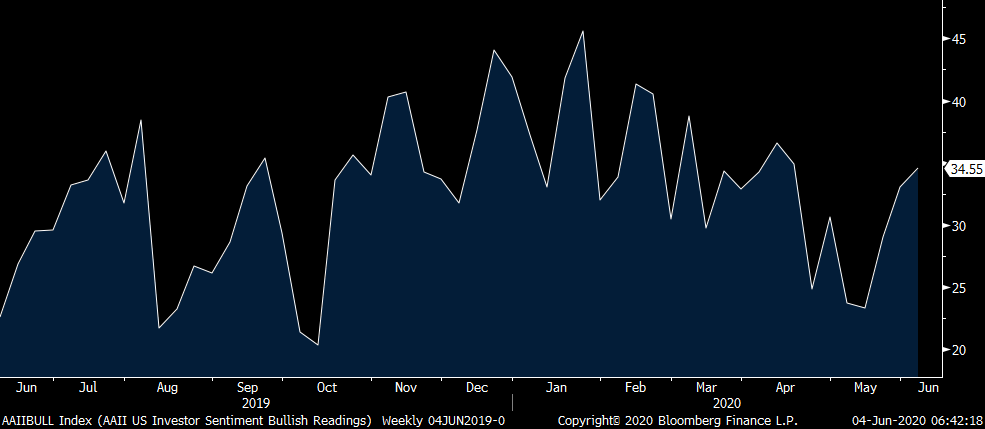

It was the individual investor that remained the biggest bear over the past month as bullish sentiment built elsewhere as markets recovered. Now even they are throwing in the towel on the bear side according to AAII although they still remain higher than the bulls. Bears fell for a 4th straight week, by 3.3 pts to 38.9 which is the least since February 20th. That print is now only just above the one year average of 35.7. Bulls rose for a 3rd week, by 1.5 pts to 34.6, the most since mid April. Bottom line, as bears are still more than bulls, the individual investor is still the last hold out on this rally but they are coming around to embracing it. From a contrarian standpoint, that is something worth noting as it begins to join the other stretched sentiment gauges as mood follows price.

AAII BEARS

AAII BULLS

While it will take time for sure to bring Vegas back to what it was, let’s all hope with today’s opening that it gets off to a good start.

I will say this about how ad hoc and sometimes the silly rationale for how the country is reopening with different states going about this in different ways, as a resident of NJ I’m disappointed that Las Vegas is opening today, Costco, Target and Walmart never closed and the NJ barber owner still has to wait 2 1/2 more weeks to open up their shop.

Expect to see the ‘Covid’ surcharge in some places as things reopen. FedEx said they are following in the foot steps of UPS in adding a fee to certain sized packages. A spokeswoman for FedEx said “As the impact of Covid-19 continues to generate a surge in residential deliveries and oversized items, the peak surcharges will help us manage the demand while maintaining strong levels of service for our customers.”

The ECB meets today and there is speculation that they would add to their Pandemic Emergency Purchase Program (PEPP) from the current size of 750b euros of which they’ve spent about 250b. As I don’t believe the cost of money or the amount of liquidity is the issue right now, I can’t give any good answer why this would be necessary. Also, at the current pace of buying it won’t run out until October. The euro is down today after a 7 day winning streak with sovereign yields mixed and stocks down.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.