United States

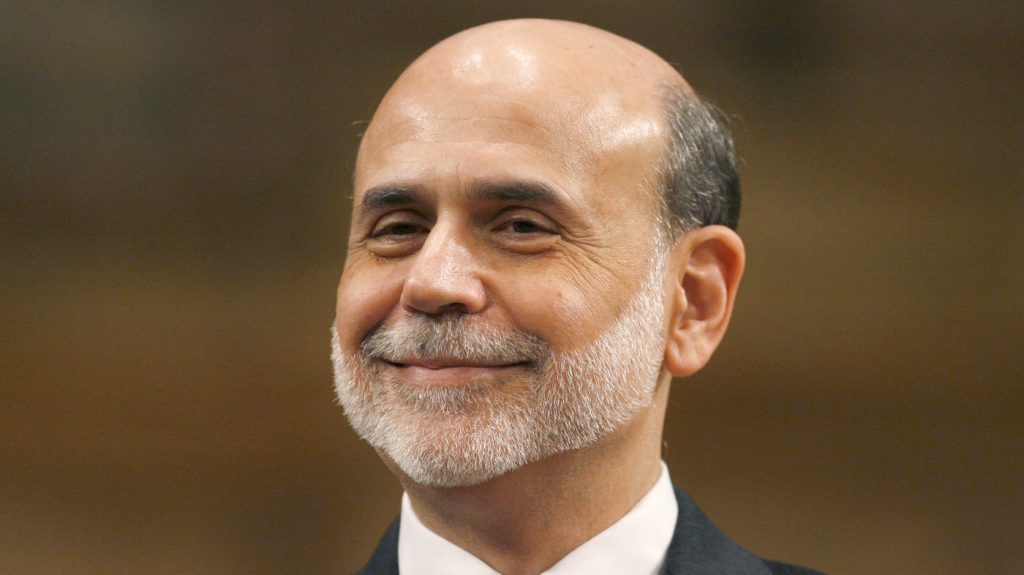

This week has a bit of everything that is important: politics (yes, the government will remain open but not one human I know in the markets was worried about any impact of a shutdown), monetary policy, a possible healthcare vote, a ton of economic data (April data in particular after a punk Q1) and a slew of more earnings. And most of the rest of the world is off today. Also of note today will be the CNBC interview with Ben Bernanke today, the King of Debt. Not because of his personal balance sheet but because of the enormous debt he all encouraged us to take on over the past 15 years. Yes, he saved the world in 2008 but he and Greenspan played with the matches in the 2000’s.

Ahead of this and two months after seeing a record net short position on the part of non commercial traders in the US 10 yr futures, longs are now at the highest since January 2008. See chart. I continue to believe the US 10 yr yield will predominantly trade in the 2.30-2.60% range until proven otherwise with the push and pull being the actual growth and inflation data keeping a lid on it on one side while on the other, we’ll see less central bank suppression this year across the curve and hopes for growth via tax cuts.

Asia

I keep highlighting the incoming data that has pointed to a turn for the better in global trade and we got more evidence that it continued into April. South Korea said its exports in April jumped 24.2% y/o/y, well more than the estimate of up 17%. Imports were higher by 16.6% which missed the forecast of an 18.7% rise. The trade surplus, to the dismay of President Trump, Secretary Ross, and Peter Navarro rose to $13.3b, the most since at least 1969 when data was kept. The exports were driven mostly by ships, semi’s, steel and auto’s. The Kospi was closed overnight while the Won is little changed. Assuming no bombs are dropped in the region, I continue to be bullish on the South Korean stock market due to a cheap valuation and the catalyst for change in the structure of the Chaebol’s which could lead to higher ROE’s, a valuation shift upward and higher dividends.

Over the weekend China reported its state sector weighted manufacturing and services PMI’s. The former fell to 51.2 from 51.8 and that was below the estimate of 51.7 and the lowest print since September. This index has basically fluctuated between 49 and 52 over the past 5 years which is essentially breakeven give or take. All the key components were down m/o/m with particular weakness in input and output prices in response to the sharp selloff in iron ore and steel prices. For services, which does include property, the PMI fell to 54 from 55.1 and that also matches the weakest read since September. New orders were barely above 50 while employment, export orders and backlogs all remained below it.

Bottom line, after a slight upside seen in Q1 growth, maybe the attempts in reigning in excessive leverage is beginning to bite in Q2. China remains on this hamster wheel of accumulating too much debt which is generating slowing growth at the same time Chinese authorities play the game every once in a while of trying to reign in leverage. As to this last point, a PBOC senior official said today: “China’s overall leverage is reasonable but rising at an alarming pace, especially in the financial sector” and “excessive economic stimulus is harmful for China and would lead to high leverage ratios.” I keep talking about some of the punch bowl being taken away by the Fed, ECB, and maybe the BoE and BoJ this year. Well, China is too taking away some of the juice. As markets there were closed, I’ll cite the response in copper which is down by 1/3 of a percent. At $2.60 per pound it’s off its high in February of $2.80 but is still 30% above the bear market low in January of last year and it was the supply side that drove the rally.

Europe

Lastly, in a poll released today by Opinionway, Emmanuel Macron has a 61% to 39% lead over Marine Le Pen. The euro is little changed just below $1.09 as this spread hasn’t changed much. I continue to like the euro here as pressure mounts on Draghi to announce another taper as early as next month.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.