Here are a few of my thoughts on what Steve Mnuchin wrote to Jay Powell:

1)As Mnuchin is about to leave DC he wants to say ‘mission accomplished.’

2)With many of these facilities barely being used, he wants the money back to allocate to a possible fiscal deal.

3)Once a government program is created, it never really dies.

4)Good riddance to the Primary and Secondary Market Corporate Credit Facilities. It was a bridge too far to argue that buying the bonds of Apple and McDonald’s was needed as if there weren’t any private buyers for them. It was just the price the Fed didn’t like, along with US Treasuries back in March but markets adjust. It is the Volcker Rule that should be eliminated here so banks can make real markets again. I haven’t seen one comment from any Fed or Treasury member that this rule needs to be revisited.

5)The idea that the Fed needs to step into markets to improve market functioning misunderstands that Fed involvement in any market pollutes market functioning instead as it misprices risk which then misallocates capital, creates moral hazard and then a permanent market dependency with the end result being financial instability. How corporate bonds trade today will be most interesting.

6)The Main Street Lending Program sounds great on paper but what many small and medium sized businesses need right now is equity not more debt.

7)The Municipal Liquidity Facility was set up in early April to mostly help state and local governments who weren’t going to get tax payments because the tax deadline was extended.

8)To my point that these things never really go away, the Term Asset Backed Securities Loan Facility was just brought back to life after the housing/financial crisis and now is no longer needed again.

9)The facilities that will remain are focused on short term funding needs along with the PPP which we know has been a big help to many businesses.

The Fed is whining about the changes, but the Fed doesn’t seem to ever see any limits to what they can do and that is not what the original purpose of the 1913 Federal Reserve Act was. If it was up to them they would find a reason to buy baseball cards, art and vintage Ferrari’s if they felt the need to support the art and collectibles market.

The ECB Vice President Luis de Guindos said today that ‘Low profitability at European banks is a problem.’ As the ECB is mostly responsible for that, his comment is like giving someone a bottle of vodka to drink and after they do wonder why they can’t walk straight.

Shifting overseas, Japan’s manufacturing and services PMI for November slipped one point to 47 with both components down a touch. While things have stabilized in Japan, this is still contractionary behavior. Markit said “The Japanese private sector economy continued its struggle to gain recovery momentum midway through the 4th quarter…Demand conditions continued to weaken, with inflows of new business falling for a 10th month in a row, weighed down by a further drop in export orders.” As this is all pre vaccine, we assume 2021 will be much brighter.

Japan also reported its October inflation data and CPI ex food and energy fell .2% y/o/y vs the estimate of a .3% drop and vs flat in September. A key factor in the y/o/y decline was the comparison as last October included the VAT hike. Also, the core/core rate includes the travel discounts that have been implemented. To this, hotel prices fell 37% y/o/y and took away almost .5 percentage point from headline CPI. Either way, prices are little changed which is TRUE price stability. JGB yields were little changed with the 40 yr down 1 bp. The Nikkei after its impressive run was down by .4%.

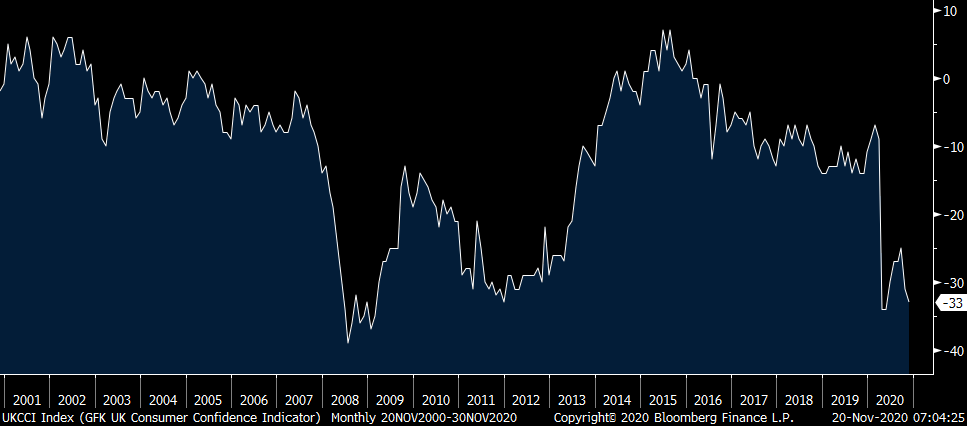

The only thing of note in Europe was October retail sales in the UK where ex fuel oil rose 1.3% m/o/m, above the estimate of no change but this was pre restrictions where some people stocked up on things. Also, November consumer confidence in the UK fell 2 pts to -33, about as expected but is near the lows seen in April. On December 2nd the selective restrictions expire and hopefully they do.

UK Consumer Confidence

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.