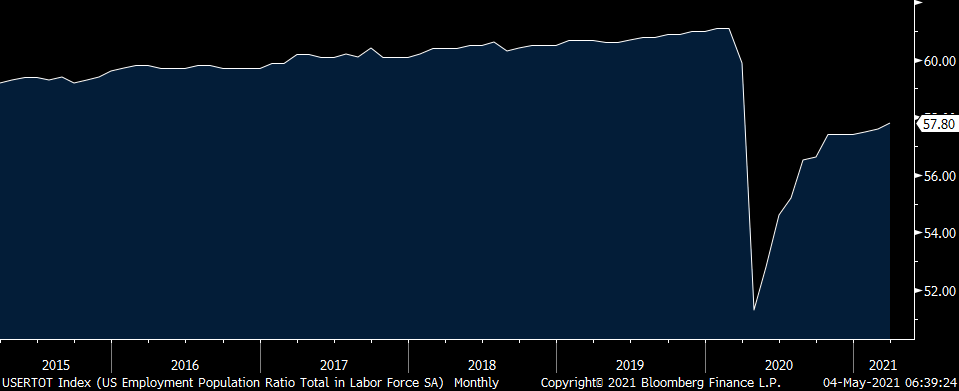

We finally got at least one Fed member’s explicit opinion on what ‘substantial progress’ means with respect to what would trigger a change in monetary policy. In an interview with CNBC yesterday, Richmond Fed President Barkin, a voting member, said he is watching the employment to population ratio and a reading above 60% from the March print of 57.8% would be ‘substantial progress’ towards their employment mandate in his view. In February 2020 it stood at 61.1%. My problem with his thinking is that no amount of easy money and QE can get someone to take a job if they don’t have the skills, are receiving generous unemployment benefits and don’t want to work until they expire, and/or have kids still learning from home. Instead Barkin should focus his attention on the amount of job openings as that is what the private economy can directly provide. Those openings stand at the highest level since January 2019. Either way, Barkin is not thinking about tapering QE anytime soon.

EMPLOYMENT TO POPULATION RATIO

JOB OPENINGS

The final tally of US auto sales for April was a solid 18.51mm, well more than the estimate of 17.6mm but with a dearth of inventory and likely a scramble to get what was available, I’m assuming this will be the best for a while. In their conference call today, the large German semi maker Infineon estimated that 2.5mm cars won’t be made in the 1st half of 2021 (1.5mm in Q1 and 1mm in Q2) because of the lack of semi chips.

The Reserve Bank of Australia kept policy unchanged as expected and I’m completely mystified by how dovish they remain even as they raised their GDP and employment forecasts. Australia has fully recaptured the jobs lost due to covid but the RBA still has rates just above zero and said they’ll stay there until 2024, has yield curve control out to three years (although they said they would review this in July) and continues with aggressive QE. How much more evidence does the world need that QE doesn’t give you higher inflation and you can’t print jobs? How much of a housing bubble does one create before responding? Yields in Australia were little changed in response but the Aussie $ is lower as are most currencies vs the dollar today. The ASX was higher by .6%.

The April UK manufacturing PMI was revised slightly higher to 60.9 from the initial print of 60.9 a few weeks ago. That’s up 2 pts from March and Markit said this: “Growth of output and new orders were both among the best seen over the past 7 years, leading to a solid increase in employment. The sector remained beset by supply chain delays and input shortages, however, which contributed to increased purchasing costs and record selling price inflation.” The revision is never market moving but the 10 yr gilt yield is near its highest since June 2019. With the pound lower, the FTSE 100 is up by 2/3 of a percent. The Bank of England meets on Thursday, and we’ll see what they say about the possibility of tapering sooner rather than later.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.

Peter is the Chief Investment Officer at Bleakley Advisory Group and is a CNBC contributor. Each day The Boock Report provides summaries and commentary on the macro data and news that matter, with analysis of what it all means and how it fits together.